It’s a popular myth – the millennial generation is destined to be a generation of renters – avocado toast, anyone? With student loan debt burdens, the scars of the Great Recession, and limited housing supply, the myth is rooted in some real challenges for millennials. However, despite these challenges, millennials are not only interested in homeownership, they are the primary reason that the homeownership rate increased over the past year.

“Are millennials destined to be a generation of renters? Consider that myth busted. Quite the opposite, actually – and they’re just getting started.”

Many millennials have prioritized furthering their education and thus delayed getting married and having children, which are critical lifestyle triggers to buying a first home. However, now the oldest millennials have made those lifestyle decisions and are entering the housing market. In fact, the data supports this trend – the homeownership rate among households headed by someone under age 35 increased the most of any age group in the fourth quarter of 2017, jumping from 34.7 percent a year earlier to 36 percent.

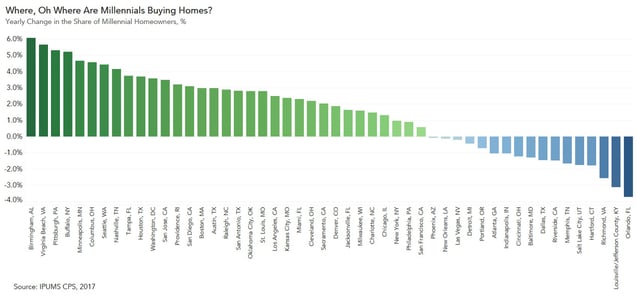

Millennial homeownership demand is rising nationally, but where are millennials buying? Using the top 50 largest cities from the 2017 U.S. Census Bureau Current Population Survey, we identified cities with the largest increases and decreases between 2016 and 2017 in the share of homeowners that are millennials.

The top 5 cities where millennial home buying increased the most:

- Birmingham, AL

- Virginia Beach, VA

- Pittsburgh, PA

- Buffalo, NY

- Minneapolis, MN

In the top market, Birmingham, the millennial homeownership share increased from 11.9 percent in 2016 to 18.0 percent in 2017. The top five markets experienced an average millennial homeownership share increase of 5.4 percent. Conversely, some markets have experienced falls in the share of millennial homeownership. The markets with the largest decreases are:

- Orlando, FL

- Louisville, KY

- Richmond, VA

- Hartford, CT

- Salt Lake City, UT

Orlando, the market with the largest drop, experienced a 3.7 percent fall in millennial homeownership share. The bottom five markets’ share of millennial homeowners fell an average of 2.6 percent in 2017.

Out of the 50 top markets, 33 of them experienced increases in the share of millennial homeowners, another indicator that exposes the myth of millennials being destined to rent. These results are consistent with findings that millennials are buying in cities large and small. So, are millennials destined to be a generation of renters? Consider that myth busted. Quite the opposite, actually – and they’re just getting started.

Odeta Kushi contributed to this blog post.