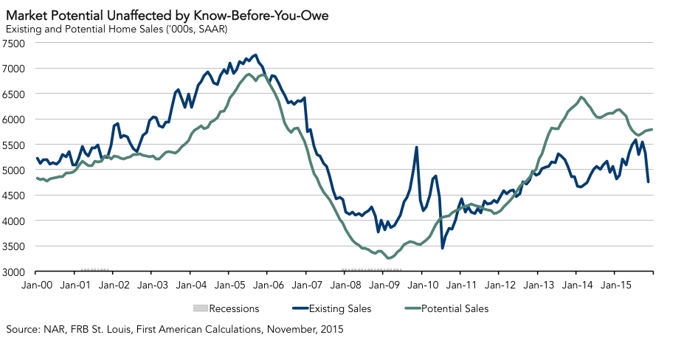

For the month of December, First American’s proprietary Potential Home Sales model (previously called the Existing-Home Sales Capacity model) showed that the market potential for existing-home sales increased by 0.5 percent compared to November and decreased by 5.1 percent compared to a year ago. The Potential Home Sales model provides a gauge on whether existing-home sales are under or over their long-run potential level based on current market fundamentals.

"While actual existing-home sales adjust to regulatory requirements, our model of market potential remained very stable month-over-month," says Chief Economist Mark Fleming

According to the model, the seasonally adjusted, annualized rate (SAAR) of potential existing-home sales is up 78.1 percent from the low point reached in February 2009*. The rate of potential home sales in the model increased by 26,000 (SAAR) in December. The potential home sales rate is down 631,000 (SAAR) from the most recent peak in February 2014.

The model’s current underperformance gap is an estimated 902,000 (SAAR), which is significantly less than the sales potential gap of 1.8 million existing-home sales in February 2014.

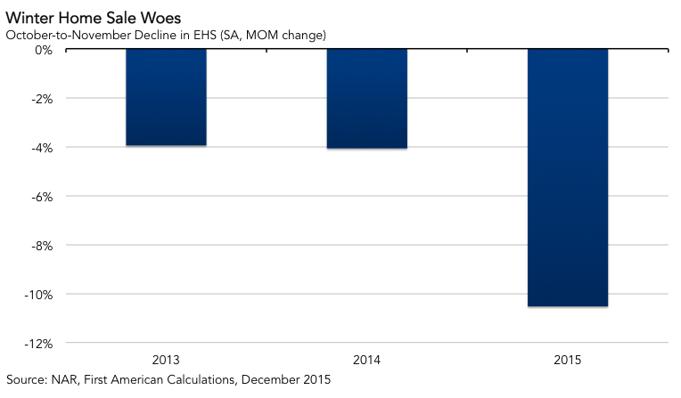

Analysis: Winter Home Sales Woes

Last month, the National Association of Realtors (NAR) reported a significant drop in existing-home sales from 5.32 million (SAAR) in October to 4.76 million (SAAR) in November, a decline of 10.5 percent month over month. This significant month-over-month drop also implied a year-over-year decline of 3.8 percent. This is not the first time that we have seen a significant decline in existing-home sales between October and November. In fact, the figure below shows that this is the third year in a row this has occurred. What’s unique about the decline this time is the increased magnitude of the month-over-month drop. In addition to the winter home sales woes we have seen in the past two years, the additional decline is being attributed to delayed closings caused by the implementation of the Know-Before-You-Owe rule. Pending Home Sales, which measures contract signings and is a leading indicator of actual sales in the subsequent month, strongly indicates that existing-home sales will rebound in December as the delayed closing of signed contracts in November come to fruition in December.

While actual existing-home sales adjust to regulatory requirements, our model of market potential remained very stable month-over-month and indicates that the market has the potential, given fundamental market conditions, for significantly more sales activity than is currently observed. After all the trepidation about the impact of an increase in the Federal Fund Rate announced last month by the Federal Reserve, long-term mortgage rates started the year below 4 percent. Rates are expected to remain below 5 percent through the end of this year, even as the Fed is likely to further increase their short-term Federal Fund rate. The modest forecasted mortgage rate increase over the course of the year will not significantly reduce the purchasing power of borrowers financing their home purchases.

In addition, the slow expected increases in mortgage rates, steady modest growth in incomes, increasing household formation, and slowing price appreciation all indicate that market potential in 2016 is likely to remain in the 5.5 to 6 million (SAAR) existing-home sales range. In fact, price growth in particular is expected to slow from a rate of 6 percent year-over-year at the end of 2015 to a rate of approximately 3.5 percent year-over-year at the end of 2016. The decline in the pace of appreciation is a positive for first-time homebuyers, as it further reduces the gap between housing asset growth and income growth – a gap that cannot be indefinitely sustained as rates increase.

Regulatory shock aside, the existing-home market should benefit in 2016 from an environment marked by continued low rates, strong purchasing power, slowing price appreciation and continued economic improvement. The winter home sales woes of late last year are not an indication of any structural change in market potential, but a temporary shock that will be quickly forgotten.

Next Potential Home Sales release: February 18, 2016 for January data

*Previous Potential Home Sales releases referred to November 2011 as the low point of sales. The model used to generate existing-home sales potential has been enhanced to more accurately reflect the dynamic relationships between sales, prices, interest rates and the user-cost of housing, resulting in a model that more accurately reflects past conditions.

About the Potential Home Sales Model

First American’s proprietary Potential Home Sales model (previously called the Existing-Home Sales Capacity model) provides a gauge on whether existing-homes sales are under or over long-run potential based on current market circumstances. The model’s potential home sales seasonally adjusted annualized rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops, are outperforming or underperforming based on current market fundamentals. The Potential Home Sales model estimates the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of actual existing-home sales above the level of potential home sales indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model will be published prior to the National Association of Realtors’ Existing-Home Sales report each month.