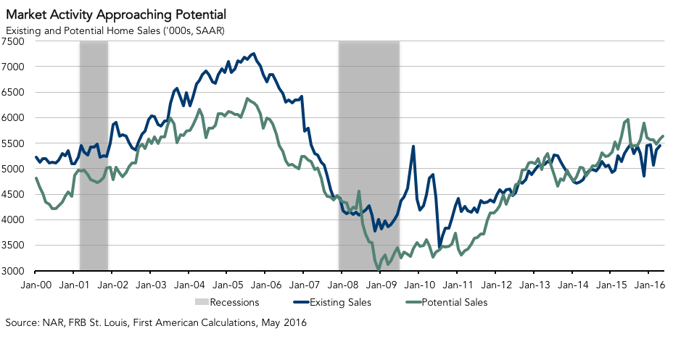

For the month of May, First American’s proprietary Potential Home Sales model showed that the market for existing-home sales is underperforming its potential by 2.8 percent or by an estimated 156,000 seasonally adjusted, annualized rate (SAAR) of sales. While still underperforming, this is an improvement over last month’s underperformance gap of 4.1 percent or 232,000 (SAAR) sales. The Potential Home Sales model provides a gauge on whether existing-home sales are under or over their long-run potential level based on current market fundamentals. In May, the market potential for existing-home sales grew by 0.9 percent compared to April, an increase of 51,000 (SAAR) sales, and decreased by 4.8 percent compared to a year ago.

This month, potential existing-home sales reached 5.63 million (SAAR). This is an 86.6 percent increase from the market potential low point reached in December 2008*, but is down 567,000 (SAAR) or 10.1 percent from the pre-recession peak of market potential, which occurred in July 2005.

Analysis: Market Closer to Hitting Potential in Era of Brexit Uncertainty

According to the National Association of Realtors (NAR), existing-home sales rose for the second consecutive month in April, to 5.45 million (SAAR), from an upwardly revised 5.36 million (SAAR) sales in March. The 1.7 percent month-over-month increase and impressive 6.0 percent annual increase was driven by broad growth across the country, except in the west where buying activity, hampered by large price gains and tight supply caused sales to fall 3.4 percent year-over-year.

"In the coming months, global uncertainty due to events like 'Brexit' or other forms of geo-political unrest may have more influence on mortgage rates than any actions taken by the Fed."

While nationally the inventory of homes for sale still remains at historically depressed levels, the supply continues to increase, rising to a 4.7-month supply in April, up from a downwardly revised 4.4-month supply in March. The tight supply continues to put upward pressure on house prices, which rose 5.8 percent year-over-year on a seasonally adjusted nominal basis according to the First American Real House Price Index. However, the current low-rate environment continues to provide relief to potential homebuyers in the form of increased leverage and home-buying power.

The average rate for a 30-year fixed rate mortgage fell to 3.6 percent in May, the lowest it has been since May 2013. The era of low rates seems likely to continue for some time, even in the face of potential rate hikes from the Federal Reserve later this year. This is due in part to pressure on the 10-year Treasury bond, as record levels of foreign demand continue to drive down yields. In fact, according to the Wall Street Journal, demand for 10-year government bonds from foreign buyers reached 73.6 percent on June 8. This "flight-to-saftety" drove yields down to 1.7 percent from 2.5 percent a year ago. This week, the yield on the 10-year Treasury-note tumbled further to 1.59 percent after the June meeting of the Federal Open Market Committee (FOMC) and the committee’s decision not to raise the Federal Funds Rate. This leaves fewer opportunities this year for a rate hike, although, as I wrote in my blog post last week, this will have little impact on the health of the housing market and housing affordability. In fact, FOMC decisions are currently non-event events for the housing market. In the coming months, global uncertainty due to events like “Brexit” or other forms of geo-political unrest may have more influence on mortgage rates than any actions taken by the Fed.

On the domestic front, credit availability continued to tighten as the Mortgage Bankers Association (MBA) reported a third consecutive monthly drop in its Mortgage Credit Availability Index (MCAI). In May, the overall index decreased by 0.8 percent, indicating further tightening of lending standards among mortgage originators. The declines were most apparent in the Jumbo and FHA/VA markets, which experienced a 1.3 percent and 1.0 percent decline respectively.

Relief may be in sight. The decline in credit availability in the FHA/VA market may not continue as United States Department of Housing and Urban Development Secretary Castro announced earlier this month the imminent implementation of rules meant to increase the availability of credit specifically targeting condo and co-op sales. This could be a boon to first-time homebuyers who often use both condos and FHA loans as a way to enter the housing market.

Next Potential Home Sales release: July 19, 2016 for June data

About the Potential Home Sales Model

First American’s proprietary Potential Home Sales model provides a gauge on whether existing-homes sales are under or over long-run potential based on current market circumstances. The model’s potential home sales seasonally adjusted annualized rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops, are outperforming or underperforming based on current market fundamentals. The Potential Home Sales model estimates the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of actual existing-home sales above the level of potential home sales indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model will be published prior to the National Association of Realtors’ Existing-Home Sales report each month.