At first glance, converting old office buildings into apartments seems like an obvious solution to two pressing real estate challenges. There’s a national housing shortage of several millions of housing units, and office space is substantially underutilized due to the adoption of remote work. Declining office use is a significant risk to office owners - a recent report by Cushman and Wakefield estimated that up to 25 percent of current office stock could become obsolete by 2030.

Taken together, we need more housing and less office space, so turning old office buildings into multifamily properties seems like a great way to kill two birds with one stone. But, unfortunately, it’s not so simple.

“Converting offices into apartments, while beneficial, will only be a drop in the excess office-stock bucket.”

Easier Said Than Done

There are meaningful barriers to repurposing offices into apartments, which stem from the fact that space is used differently in these two types of buildings. For example, in an apartment building, each apartment needs a bathroom, whereas in an office building there may be only one or two restrooms per floor. Similarly, apartments need a kitchen, whereas in an office building there may be a single break room for an entire floor. Solving just these two basic problems could require a complete or at least substantial replumbing of the building, a costly endeavor.

Beyond the need for new rooms, office floor plates can be difficult to repurpose since they are often designed to maximize the use of interior space. In a typical office building, there may be a handful of rooms along the perimeter of each floor with windows, but the majority of workers sit inside this perimeter at cubicles or desks. Apartments, however, generally need windows. This is sometimes mandated by local law, but even where it’s not, windows are a desirable feature that renters seek in their apartment unit. Retrofitting an office building’s floor design to accommodate these sorts of upgrades can require meaningful, and expensive, structural work.

Of course, these aren’t the only roadblocks that can arise in a repurposing project – local zoning and permitting laws are another meaningful obstacle – but they are a sample of the challenges encountered when attempting to convert an office building into some other building type.

Repurposing Versus Ground-Up Development

Given the meaningful investment required to repurpose an office building for alternative use, it’s useful to compare the associated costs with the cost of new, ground-up development. While repurposing costs vary considerably depending on building quality and location, some estimates put office-to-multifamily conversions at between 15 to 25 percent cheaper than ground-up development. That’s certainly less expensive than a fresh build, but it implies that office owners may be forced to take significant discounts in a sale for a conversion project to be profitable.

Further, despite the emergence of new technologies that let developers better estimate the cost of conversions, such as 3-D digital modeling, opening up the walls of a building is always risky. You never know what you’ll find that might require additional capital to repair. Working at only a 20 percent discount to ground-up development leaves a narrow margin that a few surprise cost overruns could easily erase.

A Drop in the Office Stock Bucket

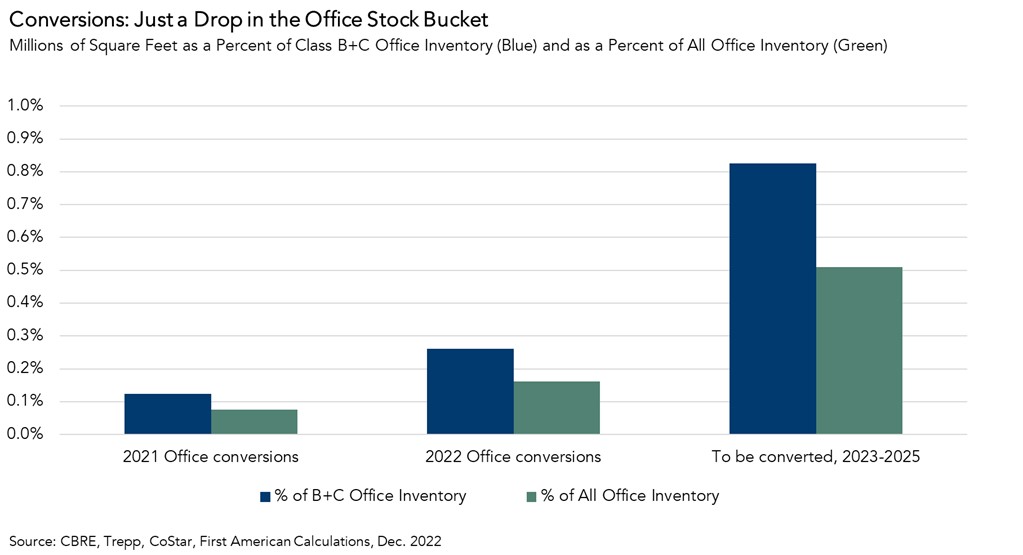

The expense and uncertainty in office-to-multifamily conversions make it unlikely that they will remove a substantial portion of existing, obsolescing office stock in the next several years. Though office conversions are currently happening at a faster pace than pre-pandemic, only about 43 million square feet of office space is expected to be converted by 2025. This is equivalent to 0.5 percent of all existing office inventory, or approximately 0.8 percent of lower quality Class B and C office stock, which comprise the majority of office buildings that are conversion candidates.

Office conversions can be profitable, but a number of challenges must be overcome to make these deals pencil out. These substantial challenges are likely to limit the reduction in obsolete office stock, despite the decline in demand for office space resulting from the rise of remote and hybrid work. Converting offices into apartments, while beneficial, will only be a drop in the excess office-stock bucket.