“One of these things is not like the other,” is an adage we learn as children to teach us how to identify outliers. This phrase maintains its relevance as adults, especially in the age of “big” data. This week’s release of the First American Real Estate Sentiment Index (RESI) is one such example of its use.

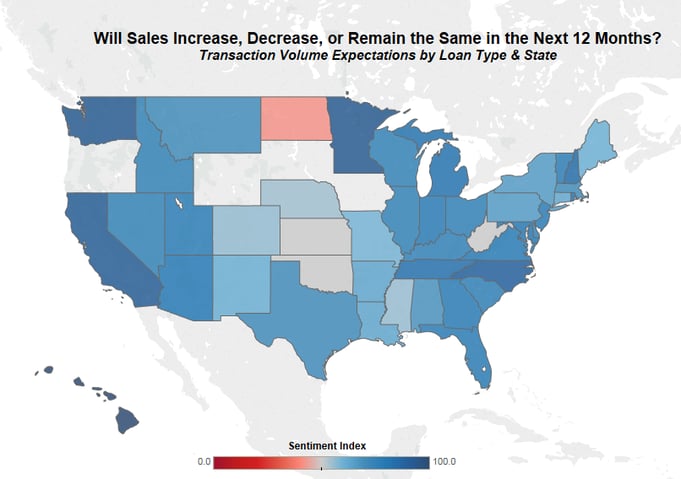

Among all the states where we measure the sentiment of title agents, there is only one state that is pessimistic about the future of residential sales demand – North Dakota. Title agents in every other surveyed state in the union are optimistic that residential buyers will increase sales in the coming year. Why is it that title agents in North Dakota believe that transaction volumes will decrease in the coming year?

Enter, the rise and fall of the energy boom in towns like Williston and Watford City. With the rise of oil prices in 2006, widespread hydraulic fracturing became economically feasible, populations boomed and housing demand increased dramatically. North Dakota was in the midst of an “oil rush” bringing oil workers, as well as a construction boom. Dwellings were built, but couldn’t keep up with the demand for housing. According to the FHFA expanded price index for North Dakota, since the beginning of the boom in 2006 until the end of 2014 home prices increased by 69 percent. During 2012 and 2013, prices averaged an annualized growth rate of 9.5 percent. Fracking was supposed to be an economic base for the economy of North Dakota, and a sustainable one at that.

"Among all the states where we measure the sentiment of title agents, there is only one state that is pessimistic about the future of residential sales demand – North Dakota."

However, with the fall of oil prices, the oil industry in North Dakota is shrinking quickly, more than 4,000 workers lost their jobs in the first quarter of 2015 alone. Many of the housing projects have been abandoned, and even commercial developments are being abandoned, including a new Menards home-improvement store with more than 200,000 square feet and two $40 million apartment complexes.

These empty dwellings are real world symbols of a level of pessimism expressed by survey respondents about the future of housing in North Dakota unlikely seen in years. In the map, our most recent sentiment index for residential sales by state clearly shows the outlier. North Dakota is the only state with negative sentiment about the future of home sales. The region is facing a six-year low drilling-rig count of 74, bringing with it housing vacancy rates as high as 70 percent. People agree that, even if oil prices climb once more, the workers will still return to their out-of-state homes when the boom inevitably comes to an end. This adds to the rising pessimism regarding residential transaction volumes. Sometimes outliers are more than just different from the rest of the group, sometimes they tell a story.