Retail real estate remains a challenged asset class, although locations catering to experiential services so far appear to be more resilient than others. Even before the onset of the pandemic, the rise of eCommerce and the shift away from mall culture created an uncertain outlook for many types of retail locations. In this month’s X-Factor, let’s examine the current state of retail real estate and the challenges it faces.

“With pandemic-era excess savings falling, credit debt increasing, and inflation continuing to eat into consumers’ purchasing power, many of the tailwinds that supported robust post-pandemic retail sales growth appear to now be turning into headwinds.”

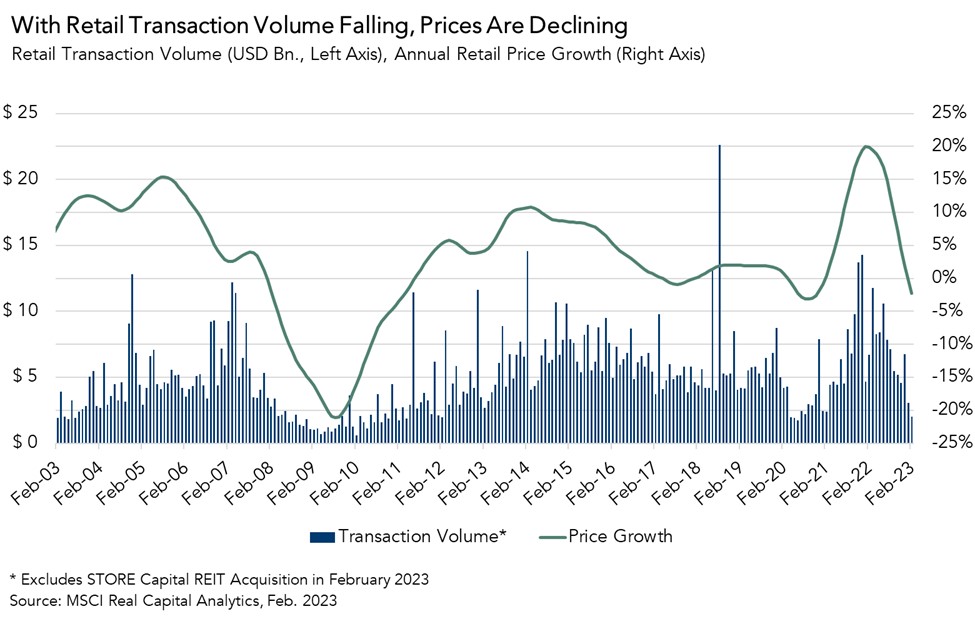

Muted Retail CRE Deal Activity Stifles Building Prices

Retail real estate transaction volume is slowing and, in turn, bringing prices down. In February, retail real estate transaction volume declined by 70 percent to $2.0 billion from $6.7 billion one year ago. As deal activity slowed, year-over-year prices declined in January for the first time in two years and fell further in February. Declining demand, measured by lower transaction volume, means buyers are lowering their valuations and, ultimately, the prices they are willing to pay for retail properties.

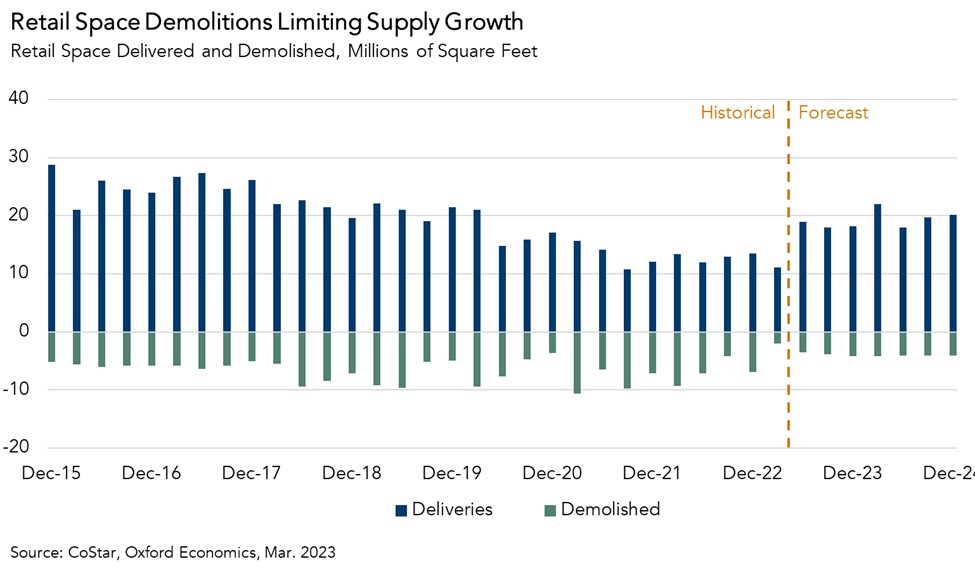

Limited New Retail CRE supply

Though prices are declining, a significant amount of retail space has been demolished, either due to obsolescence or conversions. There is also limited new construction of retail real estate currently underway. As a result, net deliveries (deliveries minus demolitions) are expected to remain relatively low in the near term, which should put a floor on how far retail real estate prices decline.

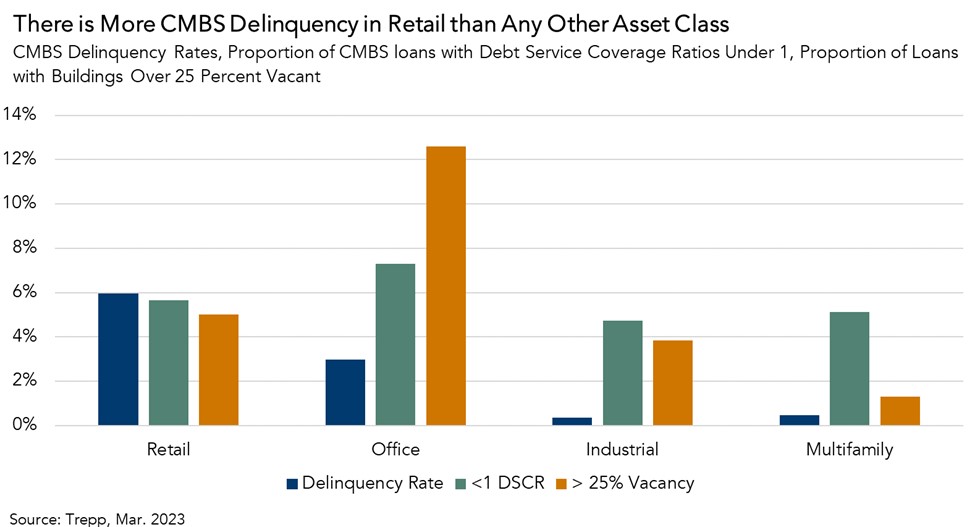

Retail CMBS Delinquency Remains Higher than Other Asset Classes

Retail properties currently display a greater incidence of distress than any other asset class, with delinquency rates at 6 percent. The seeds of retail’s distress were sown in the middle of the last decade. According to data from Trepp, most of the currently delinquent retail CMBS loans were originated between 2013 and 2017, with regional shopping malls accounting for more distress than other sub-asset classes within the broader retail category.

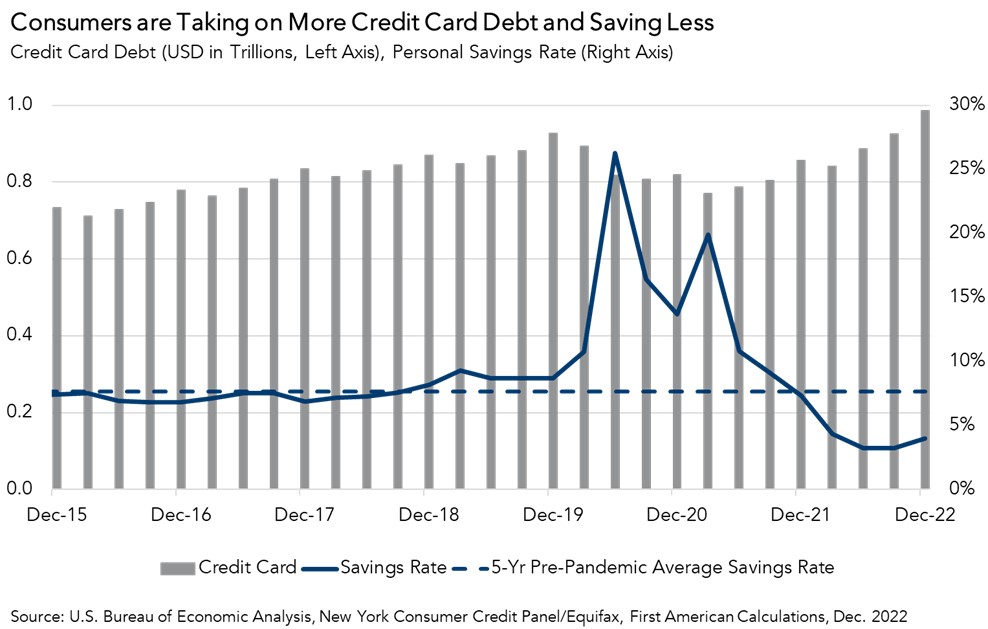

Excess Savings from Pandemic Steadily Dwindling

During the first two years of the pandemic, Americans stockpiled a large amount of savings, stashing away cash at rates far in excess of the average savings rate for the five years preceding the pandemic. While estimates vary, the Federal Reserve estimated that approximately $2.3 trillion in excess savings were accumulated in 2020 and 2021, which has buoyed consumer spending since then. However, since early 2022, the national consumer savings rate dipped back below the pre-pandemic average, indicating that excess savings are gradually fading. Less than half of these savings remain, with a recent report from J.P. Morgan estimating that about $900 billion in excess savings remained outstanding as of December 2022. Over this same period, as consumers depleted these savings, credit card debt increased, hitting nearly $1 trillion in December 2022.

The combination of declining savings and increasing debt will leave consumers with less money to spend, which will likely dampen retail spending, and therefore impact retail stores, later this year.

So, What’s the X-Factor?

As pandemic-era quarantine measures ended, and people had the opportunity to once again get out and about, retail spending surged. However, with pandemic-era excess savings falling, credit debt increasing, and inflation continuing to eat into consumers’ purchasing power, many of the tailwinds that supported robust post-pandemic retail sales growth appear to now be turning into headwinds. This, as well as general macroeconomic uncertainty, has reduced demand to own retail locations and led to declining prices for retail properties. With retail CMBS distress already high, these consumer headwinds will present challenges for retail real estate throughout 2023.