Several commercial real estate (CRE) fundamentals continued to soften in October. It was the second consecutive month where prices for multifamily, retail, and central business district (CBD) office sectors all declined on a month-over-month basis, though prices remain higher for all asset classes compared to October 2021.

Read More ›CRE X-Factor: Where is Commercial Real Estate Deal Activity Heading in 2023?

Will Slower Apartment Leasing Activity Lead to Rising Multifamily Cap Rates?

Surging mortgage rates have suppressed demand for home purchases by reducing affordability, which has prevented many renters from transitioning to homeownership. As a result, rental demand has remained strong and real estate investor interest in multifamily properties has remained high. Multifamily transaction volume broke records in 2021, and ...

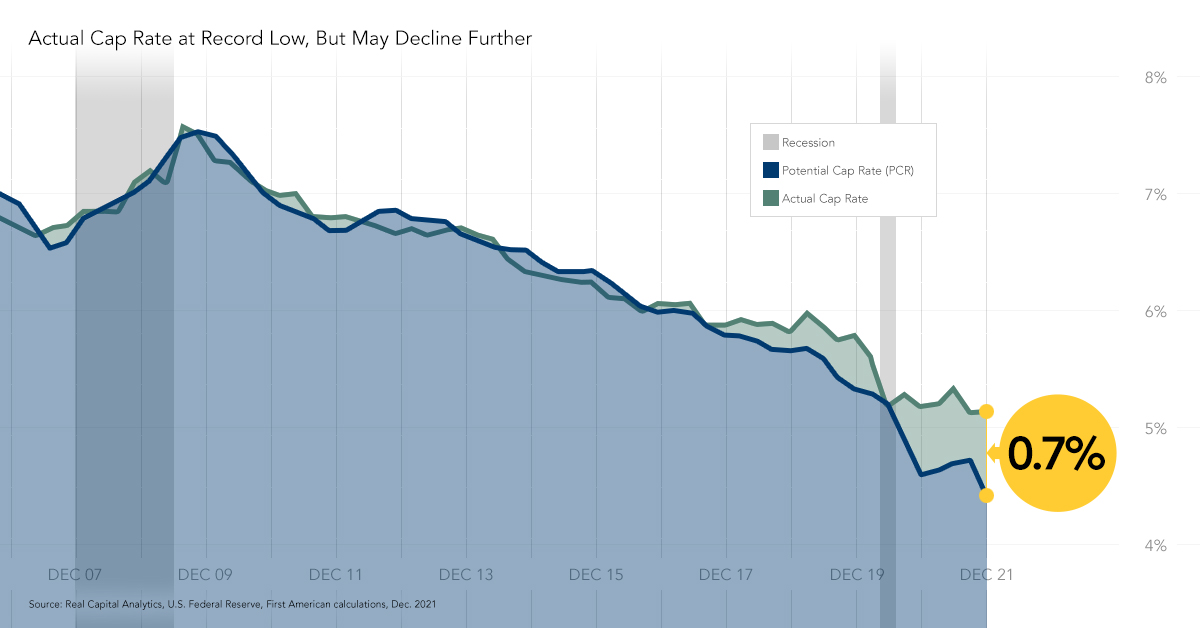

Read More ›Commercial Real Estate Interest Rates Potential Cap Rate Model

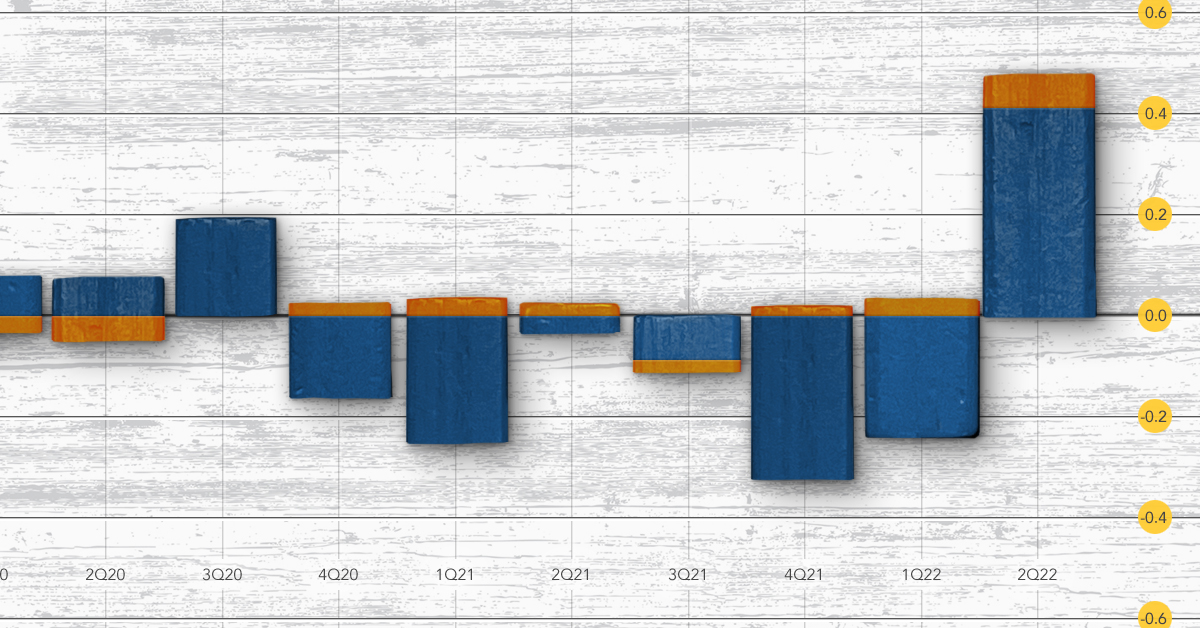

How Will Rising Interest Rates Impact Cap Rates?

When inflation first began to surge in 2021, many believed it would be transitory. Inflation has remained stubbornly high, however, prompting the Federal Reserve to tighten monetary policy. In response, the yield on the 10-Year Treasury note has more than doubled, from 1.5 percent at the end of last year to nearly 3.5 percent in mid-June. The ...

Read More ›Commercial Real Estate Interest Rates Potential Cap Rate Model

Commercial Real Estate Prices Still Have Room to Run

In the initial stages of the pandemic, some sectors of the commercial real estate market suffered. As people shifted to working from home – avoiding travel, visiting retail stores, and dining in restaurants – prices for hotels, retail properties, office buildings and other property types where people traditionally gathered declined. However, as ...

Read More ›Commercial Real Estate Interest Rates Potential Cap Rate Model