When considering innovation in the context of the title insurance industry, the evolution of data capture and data management techniques has been an instrumental part of the industry’s growth over the last several decades.

“Through the application of data and new technologies, like artificial intelligence and machine learning, alongside experienced and highly trained underwriters, First American is further enhancing the company’s abilities to identify real estate transactions that show signs of fraud risk.”

For example, let’s consider how title plants and supplemental databases have evolved. Highly trained title search and underwriting professionals rely on title plants, a collection of land title and public record documents and information organized geographically, to research issues that may impact the title to a property. This title search process is one of the first steps in the process of issuing title insurance on a real estate transaction.

Evolution of Title Plant Technology Accelerates Real Estate Transactions

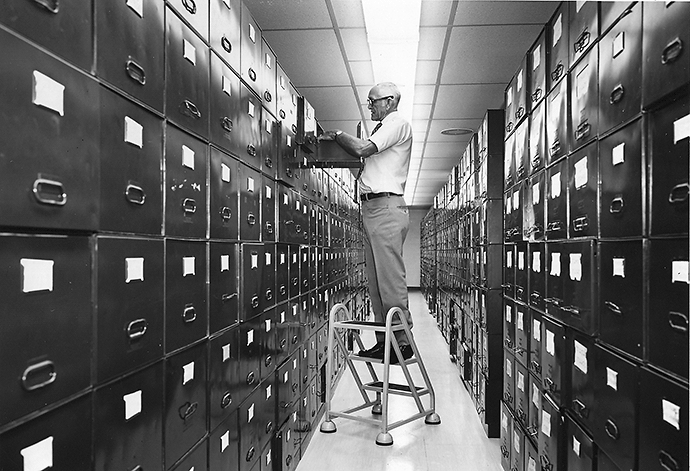

Title plants and the data and technologies that support them have evolved rapidly in the last 25-30 years. It wasn’t that long ago that title plants were primarily indexed paper files that required manual searching by title professionals.

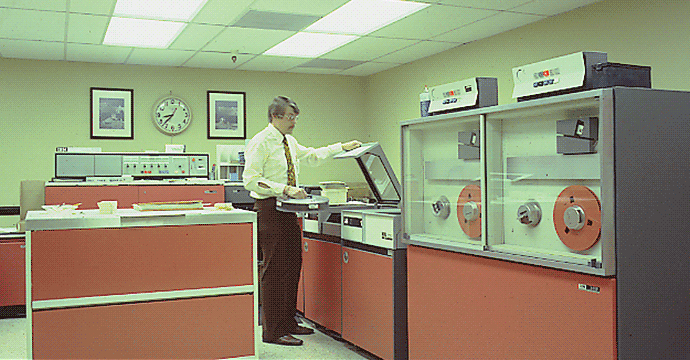

Eventually, they transitioned to electronic databases, but these early electronic databases were limited in the amount of data they could store because of the cost of manually creating digital records from original public record documents and information. These early electronic title plants typically only contained enough information about a property, or a person linked to a property, to help a prudent title examiner quickly identify and pull the appropriate public record documents needed to conduct a thorough title search.

Advances in optical character recognition (OCR) technology, which converts images of typed or handwritten text into digitally-encoded text, helped accelerate the evolution of title plants. As OCR technology continued to improve, the opportunities to efficiently capture data from public records significantly increased and, in turn, helped expand the amount of data available in title plants.

First American and other title companies have invested heavily in converting public records documents into searchable digital document images to help reduce the time needed for title searches and accelerate real estate transactions. Title plants and other supporting databases now include vastly more data and use sophisticated tools to make information about properties, historical transactions and the people associated with those transactions more easily accessible. For example, DataTree by First American boasts the industry’s largest database of property and homeowner information, spanning 100 percent of U.S. housing stock and including nearly 7 billion recorded document images.

Next Wave of Innovation Powering New Ways to Fight Fraud

Another wave of innovation in title production is on the way and First American is committed to applying state-of-the-art technologies to increase efficiency, security and reduce risk to improve the experience of buying and selling real estate. Enhancements in OCR technology, combined with breakthroughs in artificial intelligence and machine learning, are helping create new capabilities that will benefit all the parties involved in real estate transactions.

Consider the fight against fraud in real estate, which is a significant and growing threat to consumers and real estate professionals. According to the FBI, real estate scams cost Americans $150 million in 2018. Fraud prevention is a top priority for everyone in the real estate and mortgage finance industries and First American is applying advances in technology to help combat fraud.

Through the application of data and new technologies, like artificial intelligence and machine learning, alongside experienced and highly trained underwriters, First American is further enhancing the company’s abilities to identify real estate transactions that show signs of fraud risk. Based on analytics and the judgement of our underwriters, transactions can be flagged for different types of fraud risk, including identity theft, elder abuse and entity hijacking, among others.

Once flagged, we can apply different processes to these potentially higher risk transactions to help protect our customers against fraud. For example, a transaction involving the sale of a non-owner-occupied property that also shows no mortgage balance might be flagged for further evaluation by a First American underwriter. If deemed to be a possible fraud risk, First American will contact the property owner to confirm the property owner did indeed initiate the sale of the property. These additional steps have already prevented the unauthorized sale of many properties and the potential loss of millions of dollars.

These are exciting times for the title insurance and settlement services industry. This snapshot into how title plant innovation at First American is improving the process of buying and selling real estate is just one of the many innovations poised to benefit consumers and real estate professionals. More innovation stories are coming soon, so be sure to subscribe to the First American Innovation Center for the latest.

Dianna Serio is senior vice president of enterprise data strategy with First American’s Database Solutions division.