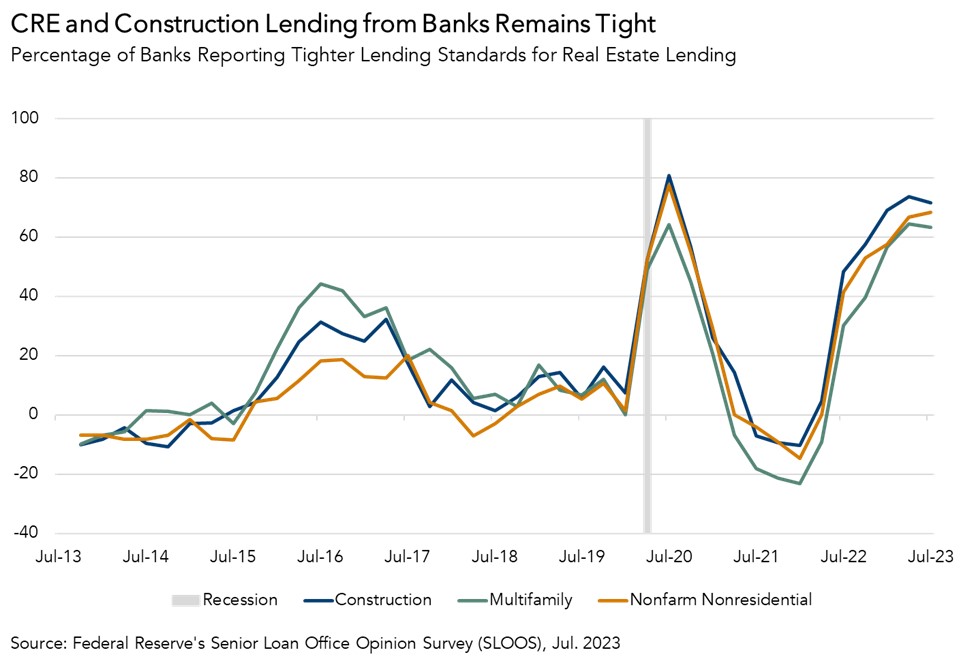

With interest rates well above recent lows and commercial property prices declining, commercial real estate (CRE) credit remains tight. How tight, exactly, is one of the questions that the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) attempts to answer.

The SLOOS is a quarterly survey that asks bank loan officers whether lending standards tightened, loosened, or remained unchanged over the last quarter. Specific questions are geared towards gauging lending standards and loan demand for different types of loans, such as construction, non-farm non-residential, and multifamily properties.

“Taken together, it appears that the SLOOS goose findings are flying once again, but unlike in early 2020, bank loan officers don’t expect lending standards to loosen significantly in the near future.”

The SLOOS Goose Findings Fly Again, Approach Early Pandemic Peak

The latest release of the SLOOS from July indicates that lending standards for all types of CRE loans continued to tighten in the second quarter of 2023. The percentage of banks reporting tighter lending standards picked up for all types of loans, but this figure was highest for construction loans at 72 percent.

Most banks reported lending conditions tightening for existing property loans as well, 68 percent for non-farm non-residential properties and 63 percent for multifamily properties. This is a complete shift in lending standard trends compared with two years ago, when interest rates were low and banks were reporting looser, rather than tighter standards.

This is not the first time in recent history that lending standards tightened so dramatically. CRE lending standards also tightened during the pandemic recession in early 2020, but they loosened quickly thereafter. In 2020, a majority of banks reported tightening lending standards for three consecutive quarters for construction and non-farm nonresidential loans, but only for one quarter for multifamily loans.

Now, however, a majority of bank loan officers have reported tightening lending standards for four straight quarters for construction and non-farm non-residential loans, and three straight quarters for multifamily loans.

You’re Special, Just Like Everyone Else

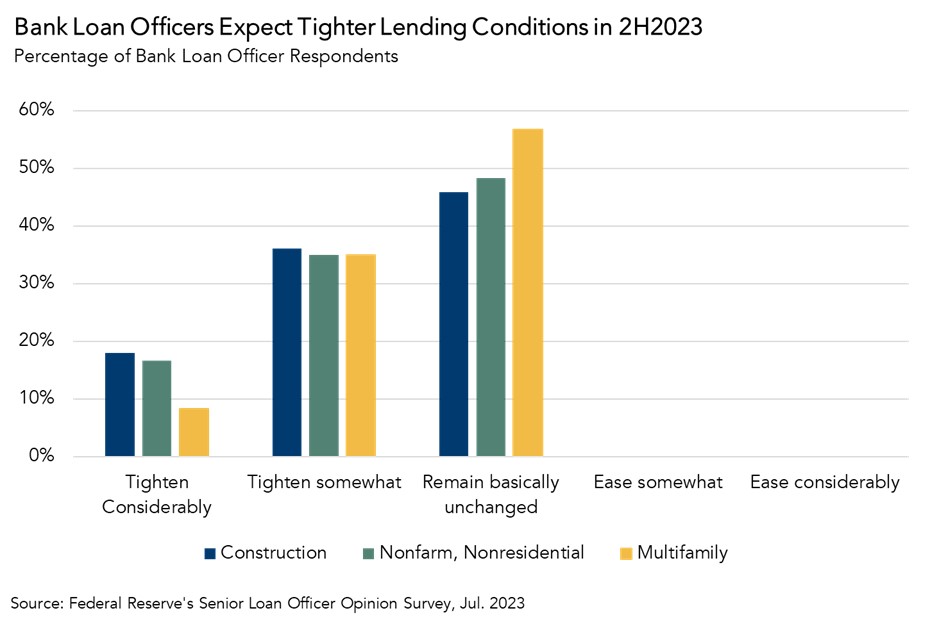

In each July release of the SLOOS, the Federal Reserve asks two special questions. This July, one of those questions was how bank loan officers expect lending standards to trend in the second half of 2023. No bank loan officers anticipate loosening lending standards in the second half of the year. About half anticipate lending standards to remain unchanged, while the other half expects either “somewhat tighter” or “considerably tighter” lending standards in the second half of this year.

Another special question in this quarter’s survey was a follow-up, asking why bank loan officers are expecting tighter lending conditions. Most loan officers reported a “less favorable or more uncertain economic outlook” as being “very important” (53 percent), followed by an expected deterioration in credit quality of CRE loans (26 percent), increased bank funding costs (21 percent), and concerns about future regulatory changes (18 percent).

Taken together, it appears that the SLOOS goose findings are flying once again, but unlike in early 2020, bank loan officers don’t expect lending standards to loosen significantly in the near future.