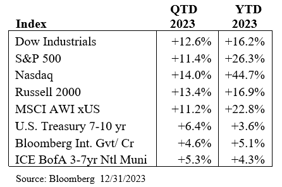

Global equities and bonds rose in the fourth quarter of 2023, capping a year of outsized gains in the former and avoiding another year of negative returns in the latter. The broad fourth quarter rally across risk assets was driven by a dramatic change in Federal Reserve tone from continued monetary tightening toward potential upcoming rate cuts on the back of continued disinflation and some signs of a pending slowdown in the U.S. economy. Although the fourth quarter saw a broadening out of gains, index returns were again paced by the “Magnificent Seven” group of large-cap technology stocks, led by artificial intelligence (AI) leader NVIDIA (NVDA). Indeed, for the year, roughly 60% of the S&P 500’s performance was attributable to this small cohort of companies. Small cap stocks rebounded sharply in the quarter with most of the year’s gains concentrated in the last three months of the year.

Global equities and bonds rose in the fourth quarter of 2023, capping a year of outsized gains in the former and avoiding another year of negative returns in the latter. The broad fourth quarter rally across risk assets was driven by a dramatic change in Federal Reserve tone from continued monetary tightening toward potential upcoming rate cuts on the back of continued disinflation and some signs of a pending slowdown in the U.S. economy. Although the fourth quarter saw a broadening out of gains, index returns were again paced by the “Magnificent Seven” group of large-cap technology stocks, led by artificial intelligence (AI) leader NVIDIA (NVDA). Indeed, for the year, roughly 60% of the S&P 500’s performance was attributable to this small cohort of companies. Small cap stocks rebounded sharply in the quarter with most of the year’s gains concentrated in the last three months of the year.

The U.S. economy continued to defy expectations in the fourth quarter and the Fed currently estimates that GDP grew by an estimated annualized 2.2%, powered by the twin pillars of consumer and government spending. The economy is still adding jobs at a robust pace and wage growth, while moderating is still historically high. Combined with the wealth effect from still rising home values and equity prices close to all-time highs, American consumers continued to feel comfortable opening their wallets.

The second half of 2023 was marked by rapidly receding inflation globally which prompted dramatic shifts in investor sentiment and, in the fourth quarter, a notable softening of central bank messaging in the U.S. and Europe. Clear signs of disinflation were a major contributor to U.S. fixed income’s strong fourth quarter performance as investors became convinced that this trend would prompt faster Fed rate cuts in 2024. Consumer price growth slowed to a 3.1% annual pace in November, while the Fed’s preferred PCE inflation measure also cooled more than expected. The Fed appeared to validate market views in December when policymakers increased the number of anticipated 2024 rate cuts compared to their prior update in September. Yields on both 2- and 10-year bonds dropped over 20 basis points in the largest one-day rally since March 2023. Market expectations now call for nearly 150 basis points of rate cuts in 2024, more than twice as much as Fed officials signaled in their latest quarterly forecast. We believe this could set the stage for investor disappointment and a retrenchment in yields should labor market strength and consumer resilience continue.

International markets also turned in strong performance during the quarter adding to their already impressive 2023 gains. The gains were broad-based, with particular strength in Europe, Japan and Latin America. Despite this, the valuation gap between U.S. and International equities widened further and now stands at 34.3%, the highest since 2003. The one exception was China, which continued to lag global markets in the fourth quarter. The much anticipated “bazooka” fiscal stimulus which investors had been hoping for all year did not materialize and its markets remained weighed down by the residential developer debt overhang, weak consumer spending and extremely negative investor sentiment.

We believe growth and inflation have both peaked and therefore continue to find bonds attractive at current levels. Starting yields, historically strongly correlated with forward returns, remain near their highest levels in 15 years, offering both attractive income and potential downside cushion should inflation flare up. The returns of high-quality bonds also tend to have lower volatility than stocks, providing investors with more stability against a range of economic scenarios. Nevertheless, we remain selective within the asset class, seeking higher quality, more liquid, and resilient investments. We continue to find value in defensive sectors as well as large systemically important banks with strong capital positions. Government guaranteed mortgage securities are also attractive at current levels. These assets offer their most attractive forward-looking return potential in 15 years along with a defensive profile that has historically performed well through economic downturns. As always, client cash flow needs should guide fixed income portfolio duration positioning with an anchoring towards neutral relative to the benchmark.

We expect muted U.S. equity market performance in 2024 as companies face pressure on multiple fronts: declining revenue growth as the economy slows, waning pricing power due to lower inflation and consumer pushback, still rising labor costs and higher interest rate expense from still elevated rates. While these pressures will be most acutely felt at smaller, less well-capitalized companies, it is difficult to envision significant market multiple expansion from the current 19.2 x forward earnings under these conditions.

Our global equity portfolio remains overweight large-cap domestic stocks relative to foreign stocks, but we have been slowly increasing our exposure to international markets in the relevant portfolios and expect to continue in 2024. We continue to favor high-quality style factors, stable growth, and a selective mix of cyclical value. Within our large-cap stock allocation, we prefer companies that can retain pricing power in a lower growth, lower inflation environment, have lower labor intensity to mitigate persistently high wage growth and lower levels of leverage and refinancing risk. We are sticking with our exposure to companies geared towards capital investment for future growth and the energy transition, though view the latter as at least partially at risk should there be a change in the U.S. administration.

|

Bruce Schoenfeld Principal Investment Analyst First American Trust |

Bruce is the Principal Investment Analyst responsible for investment research coverage of various asset classes and equity industry sectors. Bruce has more than 20 years of experience as an equity analyst and portfolio manager. He joined First American from 3P Associates, LLC, an investment and strategic management consulting firm he founded. He previously served as Director of Research at BlueStar Global Investors and as an analyst and portfolio manager focused on emerging markets for Delaware Investments, Artha Capital and Caisse de depot et placement du Quebec, Canada’s second largest pension fund.

Co-Authors: |

Jason Nerio SVP, Director of Investment Research & Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.