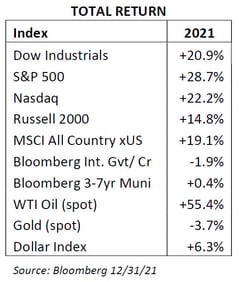

Equity markets rounded out a strong 2021 with an impressive fourth-quarter move. All three major market indices had gains of at least 8%, led by the S&P 500. The market move was even more impressive considering the environment. The fourth quarter started and ended with COVID Delta and Omicron variant infections, respectively. The market took an optimistic point of view as the less virulent Omicron variant became dominant and as the potential for the pandemic to transition to endemic becomes an increasing possibility. The markets also had to overcome the uncertainty of the Federal Reserve's plan to withdraw monetary stimulus. For now, it seems that Chairman Powell has satisfied market participants regarding taming inflationary pressures, which are currently running hot (November Y/Y CPI reading of 6.8%). Positive sentiment was fueled by economic data that was generally strong throughout the quarter, highlighted by impressive retail sales figures and a robust employment environment. Finally, the third-quarter earnings season was very encouraging, with most companies beating expectations. With everything taken into account, the Dow Jones Industrial Average, the S&P 500, and the NASDAQ clocked in YTD gains of 20.9%, 28.7%, and 22.2%, respectively. The 10-year Treasury yield moved two bps higher for the quarter and 59 bps for the year finishing at 1.51%. After drifting higher to start the quarter, 10-year Treasury yields fell nearly 20 basis points from a five-month high of 1.70% in late October, while yields on shorter-term rates rose sharply to their highest levels of the year. The moves drove a pronounced flattening in the Treasury curve, effectively eliminating the steepening trend seen earlier this year. The yield curve flattening came as investors assessed the economic recovery past its peak reopening impulse. Recent flattening comes as bond investors weigh recurring coronavirus outbreaks and rising prices against a Federal Reserve intent on tightening monetary policy more swiftly.

Equity markets rounded out a strong 2021 with an impressive fourth-quarter move. All three major market indices had gains of at least 8%, led by the S&P 500. The market move was even more impressive considering the environment. The fourth quarter started and ended with COVID Delta and Omicron variant infections, respectively. The market took an optimistic point of view as the less virulent Omicron variant became dominant and as the potential for the pandemic to transition to endemic becomes an increasing possibility. The markets also had to overcome the uncertainty of the Federal Reserve's plan to withdraw monetary stimulus. For now, it seems that Chairman Powell has satisfied market participants regarding taming inflationary pressures, which are currently running hot (November Y/Y CPI reading of 6.8%). Positive sentiment was fueled by economic data that was generally strong throughout the quarter, highlighted by impressive retail sales figures and a robust employment environment. Finally, the third-quarter earnings season was very encouraging, with most companies beating expectations. With everything taken into account, the Dow Jones Industrial Average, the S&P 500, and the NASDAQ clocked in YTD gains of 20.9%, 28.7%, and 22.2%, respectively. The 10-year Treasury yield moved two bps higher for the quarter and 59 bps for the year finishing at 1.51%. After drifting higher to start the quarter, 10-year Treasury yields fell nearly 20 basis points from a five-month high of 1.70% in late October, while yields on shorter-term rates rose sharply to their highest levels of the year. The moves drove a pronounced flattening in the Treasury curve, effectively eliminating the steepening trend seen earlier this year. The yield curve flattening came as investors assessed the economic recovery past its peak reopening impulse. Recent flattening comes as bond investors weigh recurring coronavirus outbreaks and rising prices against a Federal Reserve intent on tightening monetary policy more swiftly.

The outlook for 2022 reflects more modest capital market expectations, given the strong equity market performance over the past few years and generally low risk premiums. Markets have been supported by the extraordinary fiscal and monetary stimulus to offset the economic consequences of the pandemic. Last year we were positioned for a cyclical recovery, with over-weights in credit, small-cap, industrials, energy, and financials. Our base case outlook continues to see moderate market upside based on better than expected earnings growth, balanced with easing supply shocks and normalizing consumer spending habits. Record corporate cash flow and strong fundamentals should continue to drive capital investment, inventory restocking, and shareholder return activity. While there is potential for episodic flareups of COVID-19 variants, future economic disruptions are anticipated to be increasingly muted in the context of higher natural and vaccine acquired immunity, significantly lower mortality, and new antiviral treatments. Inflation trends remain cyclically elevated, although there is a compelling case to be made for inflation rotation rather than a broad-based acceleration in prices. The inflation outlook is for current above-trend inflation to moderate throughout 2022. In 2021, stimulus-induced consumer demand for goods combined with COVID-related labor disruptions stressed the supply chain's ability to keep up. Supply chain issues are expected to ease gradually throughout 2022, allowing for an inventory cycle to accelerate from historic lows. On the other hand, positive impacts from the robust fiscal and monetary policy support during the pandemic are primarily in the rearview mirror. Pandemic income support measures began to expire during the second half of 2021, and the Federal Reserve has signaled its intent to remove excess monetary policy accommodation. Hence, although our outlook remains positive, these changing policy conditions lead to a broader set of possible macroeconomic outcomes that may increase market volatility during the year. Additionally, to complicate matters, investors will need to navigate the mid-term political landscape amidst a divided and polarized public that will undoubtedly draw heightened media attention.

Investment implications are similarly complex given the vast array of economic outcomes and related policy responses. We expect markets to be more volatile because of this. While we take a long-term view, anticipated volatility in near-term market conditions will necessitate greater flexibility through portfolio rebalancing and positioning. Portfolio construction will need to balance the risk of current inflationary concerns and cyclical economic pressures with the shifts in fiscal and monetary policy response. Financial conditions will be a crucial barometer through the course of the year. We continue to favor credit exposures within fixed income given continued, although slowing economic growth. Within credit, the current narrow risk premium in the high yield category could be an underappreciated risk, given the potential for economic growth to slow during the year. Client cashflow needs should guide fixed income portfolio duration positioning with an anchoring towards neutral to the benchmark. Our global equity portfolio remains overweight large-cap domestic stocks, and our international allocation favors European exposure. We see late-cycle dynamics in the market favoring large-cap and high-quality style factors, and as a result, we are underweight small-caps. Within our large-cap stock allocation, we are positioned in a blend of both growth and value stocks. Our portfolio is skewed towards companies likely to benefit from further reopening in consumer services, cyclicals with pricing power, and technology leaders.

Written By: |

Jason Nerio Vice President, Director of Investment Research and Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.