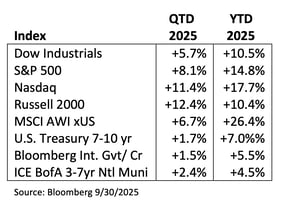

U.S. equity and financial markets delivered strong performance in Q3-2025, buoyed by renewed optimism about monetary easing, solid corporate earnings, and AI-related enthusiasm on the back of massive data center and semiconductor investment. The performance was impressive considering markets overcame a series of underlying risks, including persistent inflationary pressures from tariffs, and stretched valuations among large cap technology companies. For the quarter, the S&P 500 rose 8.1%, Nasdaq rose 11.4%, and the Dow rose 5.7%. The small cap Russell 2000 surged 12.4%, bringing that index into positive territory for the year. The yield on 10-year U.S. Treasury bonds fell 8 bps to 4.15%. The dollar recouped some its year-to-date decline, rising 0.9% relative to other major currencies, and gold soared to record highs.

U.S. equity and financial markets delivered strong performance in Q3-2025, buoyed by renewed optimism about monetary easing, solid corporate earnings, and AI-related enthusiasm on the back of massive data center and semiconductor investment. The performance was impressive considering markets overcame a series of underlying risks, including persistent inflationary pressures from tariffs, and stretched valuations among large cap technology companies. For the quarter, the S&P 500 rose 8.1%, Nasdaq rose 11.4%, and the Dow rose 5.7%. The small cap Russell 2000 surged 12.4%, bringing that index into positive territory for the year. The yield on 10-year U.S. Treasury bonds fell 8 bps to 4.15%. The dollar recouped some its year-to-date decline, rising 0.9% relative to other major currencies, and gold soared to record highs.

The macro backdrop in the third quarter was mixed but supportive of risk assets overall. After a weak start to 2025, the U.S. economy showed strong signs of resilience, and momentum continued into the third quarter, with the latest U.S. Federal Reserve estimate, released in mid-October, projecting 3.9% annualized growth for the quarter. Inflation remained a thorny issue throughout the quarter. The tariff regime has begun to show through in core goods prices, and services inflation has proved stickier than expected. In August, the headline U.S. PCE index, the Fed’s preferred inflation gauge, rose 0.2% sequentially, leaving the annualized reading at 2.7% and the key core index up 2.9% year-on-year. This, along with weekly jobless claims which in September rose to their highest since 2021, and the downward revision of data through March 2025, by roughly 900,000 jobs, was enough to prompt the resumption of rate cuts by the Federal Reserve which lowered its key rate by 25 bps in September.

U.S. trade policy remained volatile and unpredictable during the quarter, with new tariffs announced on heavy trucks and furniture. Although tensions with China eased in September, the trade war escalated post-quarter end with tit-for-tat port restrictions, key industry export controls, and the U.S. threat of an additional 100% tariff on China if it did not ease rare earth metal export restrictions.

Within equities, the reversion to dominance of the growth, momentum and high beta style factors which began after the April market selloff continued. Growth broadened beyond a small set of mega cap technology favorites to include a wider roster of software and semiconductor companies, primarily driven by continued hype around all things AI. At the other extreme, the low volatility and quality factor styles underperformed. The consumer staples sector was the only sector that ended in the red, with a loss of 2.4%, clear evidence of the market’s shift away from defensives. The value factor, while participating in the rally, underperformed growth narrowly. Small-cap stocks also enjoyed a sharp resurgence. With risk appetite elevated and hopes for imminent Fed policy easing, investor interest rotated toward more cyclical, domestic-oriented names. The Russell 2000 index rallied 12.4% over the quarter, outpacing its large-cap peers for the first time since Q4-2023 and hitting fresh highs.

Q2-2025 corporate earnings were stronger than expected, and once again propelled by Mega-Cap Technology companies. AI-leader NVIDIA (NVDA) reassured investors regarding the strength and durability of the AI boom with strong results. Other AI-centric companies, including chip designer Broadcom (AVGO) and software giant Microsoft also posted solid second quarter results driven by AI demand. Apple (AAPL) benefitted from unexpectedly high iPhone demand that powered its second quarter results.

The flipside of the “everything AI” rally, though, began to surface during the quarter as investors began to question the sheer scale of investment flowing into the industry and the ultimate return on those investments. The sums are staggering. For example, privately held OpenAI has announced outlays approaching $1.5T trillion, equivalent to more than 3.5% of U.S. GDP, and roughly 25% of all nonresidential private investment, despite having a revenue base that is a small fraction of that. The tension lies in discerning whether AI will eventually drive sustainable productivity and earnings growth that will render such aggressive investment justified, or conversely, that companies are engaging in speculative behavior that will overshoot, creating the need for a painful capacity digestion period. The participation of NVDA in xAI’s funding, for example, along with other creative financing arrangements, has drawn additional scrutiny over the “circularity” of investment and valuation flows within the AI space.

In sum, Q2-2025 was a quarter of powerful recovery and reaffirmation of growth narratives. U.S. equities broadly gained, underpinned by strong earnings, reopening of yield curve expectations, and the pervasive appeal of AI and technology. Macro challenges persist, though, in the form of stubbornly high inflation, trade and geopolitical uncertainty, and the ongoing U.S. government shutdown. Internationally, the picture is cautiously constructive but threatened by regional vulnerabilities in China, Europe, and geopolitical policy uncertainty.

Entering the fourth quarter, the expectation of additional Fed easing along with what we believe will be a better than expected Q3 earnings season should continue to support equities. We also believe the economy will remain resilient, although vulnerable to tariff surprises, with particular attention paid to how negotiations with China play out. Due to rich valuations, the stock market is susceptible to negative headlines, however, keep in mind that the market has consistently scaled the wall of worry, particularly recently, and barring an unforeseen shock, we suspect the market will grind higher as we enter the most seasonally positive performance months of the year.

Global equity indexes posted solid gains, particularly in Asia and emerging markets, in large part driven by continued AI and tech strength, as well as continued monetary easing from major central banks. A weaker U.S. dollar over parts of the quarter lent support to emerging market returns. We expect these trends to continue in the fourth quarter and into next year.

High-quality fixed income remains compelling as the Fed resumed its rate-cutting cycle amid the potential for moderating growth, easing inflation, and weaker employment data. The Fed’s September rate reduction marked a dovish shift toward a more neutral policy stance, and additional gradual cuts are expected into year-end. Even as yields have eased slightly from their highs, they remain near multi-decade peaks, offering attractive income potential and the prospect for capital appreciation as monetary policy turns more supportive. At the same time, cash yields are beginning to fade, further enhancing the relative appeal of high-quality bonds. In this environment of elevated uncertainty but improving fundamentals, we continue to emphasize liquidity, quality, and resilience. U.S. government-guaranteed mortgage securities (Agency MBS) remain particularly attractive, with spreads over Treasuries still wide by historical standards, offering a liquid and higher-quality alternative to corporate credit. Credit markets, meanwhile, provide selective opportunities but limited compensation for risk, as spreads hover near historical lows. Our focus remains on disciplined sector and security selection, emphasizing relative value and downside protection. We also see potential in high-quality structured credit tied to stronger consumers, and in select global markets where inflation has normalized and monetary easing is further advanced. A weaker dollar and diverging central bank paths enhance the case for international diversification, which historically has improved volatility-adjusted returns relative to U.S.-only exposure. Portfolio duration should continue to align with client cash flow needs, anchored near neutral levels. In today’s landscape of still-elevated yields and a gradual easing cycle, intermediate maturities—between 5-10 years—offer particularly appealing total return potential and portfolio stability.

In this environment, we believe that discipline, diversification, and a quality bias across asset classes are key. While the market continues to wrestle with an evolving macroeconomic and policy landscape, attractive opportunities remain for patient, risk-aware investors with a long-term horizon.

Author:

|

Bruce Schoenfeld, CAIA® Principal Investment Analyst First American Trust |

Bruce is the Principal Investment Analyst responsible for investment research coverage of various asset classes and equity industry sectors. Bruce has more than 27 years of experience as an equity analyst and portfolio manager. He joined First American from 3P Associates, LLC, an investment and strategic management consulting firm he founded. He previously served as Director of Research at BlueStar Global Investors and as an analyst and portfolio manager focused on emerging markets for Delaware Investments, Artha Capital and Caisse de depot et placement du Quebec, Canada’s second largest pension fund.

Co-Authors: |

Jason Nerio SVP, Director of Investment Research & Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 28 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $2 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst® (CFA®) Charterholder and has more than 29 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 20+ years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.