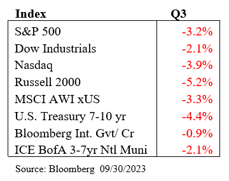

The second half of the year got off to a rocky start as equities suffered a broad decline in Q3-2023 as technology stocks came off the boil and market interest rates spiked. The market narrative shifted away from the much talked about “soft-landing” as continued economic strength and slowing disinflation forced investors to contemplate what Federal Reserve officials have been saying for some time, namely that interest rates will remain “higher for longer.” Markets also grappled with continued political dysfunction in the weeks leading up to the expiration of the 2023 Federal budget and though a government shutdown was averted, the deal reached by lawmakers merely extended the deadline for approving 2024 spending levels to mid-November.

The second half of the year got off to a rocky start as equities suffered a broad decline in Q3-2023 as technology stocks came off the boil and market interest rates spiked. The market narrative shifted away from the much talked about “soft-landing” as continued economic strength and slowing disinflation forced investors to contemplate what Federal Reserve officials have been saying for some time, namely that interest rates will remain “higher for longer.” Markets also grappled with continued political dysfunction in the weeks leading up to the expiration of the 2023 Federal budget and though a government shutdown was averted, the deal reached by lawmakers merely extended the deadline for approving 2024 spending levels to mid-November.

Energy stocks were by far the best performers during the quarter as oil prices surged from the low $75/bbl. range in early July to more than $90/bbl. Underlying the rise was extension of supply cuts by OPEC+ until the end of the year, low inventory levels and improved prospects for Chinese demand. Concern about weakening demand in key developed markets as a result of a potential economic slowdown in the U.S. then reversed some of the quarter’s gains, but recent geopolitical events in the Middle East appear to have put a floor under oil prices around their current level. Technology stocks finally faltered under some of these pressures, especially higher interest rates and lofty valuations, after having powered a 30% rise in Nasdaq in the first half of the year. Most of the so-called “Magnificent Seven” mega cap technology companies were not immune to selling pressure as investors took outsized profits and began to more realistically assess the Artificial Intelligence (AI) related hype that drove first half returns. Unsurprisingly, interest rate sensitive sectors such as Utilities and Real Estate lagged sharply in the third quarter. Investors often purchase shares in these sectors for their dividend yields which have become less attractive with 10-year Treasuries and some cash equivalents yielding close to 5%.

The Treasury market continued to struggle in the third quarter as stronger than expected economic data pushed yields higher. Bond investors were emboldened to start the quarter after yields fell in response to July’s consumer price index which reported compelling evidence that inflation may be cooling broadly. However, better-than-expected labor market data and consumer confidence surveys that handily beat expectations spurred debate among investors about possible economic reacceleration, raising concerns that inflation may flare back up and prompt the Federal Reserve to extend its rate hike campaign. Some Fed officials have talked down the need for another rate hike over the past several weeks, but even if the Fed doesn’t hike again, this doesn’t mean tightening is over as real yields will rise further amid cooling inflation and continued quantitative tightening.

In July, the Federal Reserve raised interest rates for the 11th time since March 2022, increasing its benchmark rate 25 basis points to a range of 5.25% - 5.50%, before “skipping” a rate hike in September. At the time, Fed policymakers cautioned that due to persistent inflation still well above its 2% target and continued strength in the labor market, it was likely to maintain high rates for longer than market expectations. It was only after September’s strong economic data, which helped push market interest rates sharply higher, that equity investors began to accept the Fed’s “higher-for-longer” narrative.

The jury is still out regarding the financial health of the American consumer. There have been conflicting analyses about how much excess cash remains from the pandemic era boost in savings, with an August San Francisco Fed report concluding that it has been fully depleted, while some sell-side analysts have suggested consumers still retain significant firepower. Regardless of which is correct, consumer spending data remained robust in the third quarter, with the most recent September data printing at almost twice market expectations. In addition, consumer credit metrics from the early reporting banks showed limited consumer credit deterioration. Given the lag between rate increases and their full impact on the economy, as well as commentary from various retailers, we expect pressures on the consumer to mount through the remainder of the year and into 2024.

Another theme we are monitoring is the wider use of GLP-1 diabetes and obesity drugs, not just for the impact on the drugs’ manufacturers and their competitors within the pharmaceuticals sector, but their impact on other industries including pharmacy benefit managers and health care insurers, medical technology companies, insurers within the financial sector, and the food and beverage industries. The potential for changed consumer eating habits has already been flagged as a risk for food and beverage companies, as well as for some food retailers and restaurants, though management teams have almost universally said it is too early to reach firm conclusions regarding financial implications for their businesses. We expect this topic to be in focus in Q4-2023 and 2024 but believe we are well-positioned with significant overweights to the key GLP-1 manufacturers and an underweight to Consumer Staples.

We expect choppy equity markets to continue through the fourth quarter as investors consider the path of interest rates, which are close to breaking key upside resistance levels on the back of strong economic data and no discernible labor market stress. Geopolitical risk has risen dramatically in the wake of events in the Middle East and we envision sharp market moves – both up and down – based on daily events, which will also impact the oil and energy markets. Another likely down-to-the-wire drama regarding the 2024 budget also increases the potential for sharp spikes in volatility. However, very weak investor sentiment and positioning, as evidenced by extreme readings in certain market technical metrics, as well as typically strong seasonal factors, could serve as a positive countervailing force on markets. Earlier this year we made several portfolio adjustments, most notably in the technology sector, to more equally balance our generally defensive positioning. Overall, we continue to overweight companies that can retain pricing power and margins in an increasing challenging external environment and the portfolio is skewed toward high-quality and stable growth style factors.

We believe growth and inflation have peaked and that risk assets are underpricing downside growth scenarios which supports a positive outlook for fixed income returns. Starting yield levels, historically strongly correlated with forward returns, are the highest in more than a decade, with high-quality corporate bonds yielding between six and seven percent. The returns of high-quality corporate bonds tend to have lower volatility than stocks, providing investors with more of a cushion against uncertainty. Nevertheless, we remain selective within the asset class, seeking higher quality, more liquid, and resilient investments. We continue to find value in defensive sectors as well as large systemically important banks with strong capital positions. Government guaranteed mortgage securities are also attractive at current levels. These assets now offer their most attractive forward-looking return potential in 15 years along with a defensive profile that has historically performed well through economic downturns. As always, client cash flow needs should guide fixed income portfolio duration positioning with an anchoring towards neutral relative to the benchmark.

Internationally, China’s economy is finally showing signs of stability though this has not yet been reflected in asset markets. We are encouraged by the increase in scope and size of recently announced stimulus measures, including the latest injection of $40B into its financial system, the largest since 2020. The economy is still plagued by a massive real estate overhang that has seen several of the largest developers default which most deeply affects local government lenders. To partially mitigate this, state-owned banks have been ordered to roll over existing local government debt with long-term loans at lower rates. The Eurozone economy continues to be challenged by weak manufacturing activity and is close to stall speed, with particular weakness in Germany. Nevertheless, the European Central Bank has continued to raise rates in the face of stubbornly high core and services inflation and though it is also prepared to pause rate hikes in the fourth quarter, there have been no signs of a willingness to cut interest rates for the time being. Eurozone weakness will negatively affect the earnings of many S&P 500 companies which we expect to show up in Q3/Q4-2023 earnings results. Recent dollar strength will also become a headwind to multinational domestic company revenue and earnings. We remain underweight international equities, although the asset class is screening as attractively valued relative to domestic markets.

|

Bruce Schoenfeld Principal Investment Analyst First American Trust |

Bruce is the Principal Investment Analyst responsible for investment research coverage of various asset classes and equity industry sectors. Bruce has more than 20 years of experience as an equity analyst and portfolio manager. He joined First American from 3P Associates, LLC, an investment and strategic management consulting firm he founded. He previously served as Director of Research at BlueStar Global Investors and as an analyst and portfolio manager focused on emerging markets for Delaware Investments, Artha Capital and Caisse de depot et placement du Quebec, Canada’s second largest pension fund.

Co-Authors: |

Jason Nerio SVP, Director of Investment Research & Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.