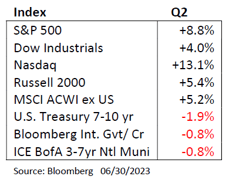

Following a solid start to the year in Q1, equities produced broad-based gains in Q2-2023, resulting in a very strong first half of 2023 performance for the asset class, particularly considering the environment. Stocks were surprisingly resilient in the face of March’s mini banking crisis, additional Federal Reserve rate increases and cautious investor sentiment. Resiliency turned to strength as the quarter progressed and a more optimistic narrative gained traction amongst investors. With inflation metrics easing throughout the quarter, investors reasoned that the end of the Fed’s hiking cycle was likely near, while at the same time better than feared economic data releases pointed to rising potential that the US economy could stick a soft landing. Gains were once again paced by the technology sector as cost-cutting efforts that began in late 2022 bolstered big tech earnings results while longer term tech prospects increased on the monetization potential of Artificial Intelligence (AI). Banking sector turmoil subsided with the orderly takeover of First Republic Bank by J.P. Morgan (JPM) and the Fed’s provision of significant backstop funding to wobbly regional, small- and mid-cap financial institutions. Growth continued to outperform value, led by the narrow group of tech mega caps, though there were increased signs of improving market breadth toward quarter end.

Following a solid start to the year in Q1, equities produced broad-based gains in Q2-2023, resulting in a very strong first half of 2023 performance for the asset class, particularly considering the environment. Stocks were surprisingly resilient in the face of March’s mini banking crisis, additional Federal Reserve rate increases and cautious investor sentiment. Resiliency turned to strength as the quarter progressed and a more optimistic narrative gained traction amongst investors. With inflation metrics easing throughout the quarter, investors reasoned that the end of the Fed’s hiking cycle was likely near, while at the same time better than feared economic data releases pointed to rising potential that the US economy could stick a soft landing. Gains were once again paced by the technology sector as cost-cutting efforts that began in late 2022 bolstered big tech earnings results while longer term tech prospects increased on the monetization potential of Artificial Intelligence (AI). Banking sector turmoil subsided with the orderly takeover of First Republic Bank by J.P. Morgan (JPM) and the Fed’s provision of significant backstop funding to wobbly regional, small- and mid-cap financial institutions. Growth continued to outperform value, led by the narrow group of tech mega caps, though there were increased signs of improving market breadth toward quarter end.

The Treasury market capped off the quarter on a weaker note as stronger than expected economic data pushed yields higher. After three bank failures in March, the Fed’s senior loan officer survey reported further tightening of bank lending standards and a sharp decline in loan demand. Anticipating a recession, Treasury investors initially pushed yields lower during the quarter but yields rose again as economic data released throughout the quarter confirmed that consumption is not falling as fast as expected and that core inflation remains sticky. Selling was most pronounced in shorter term Treasuries with yields on two-year notes rising 123 basis points from a low of 3.64% in early April. The moves drove a deeper inversion in the yield curve (the difference between yields on 2-year notes and 10-year bonds) to minus 106 basis points, close to a 40-year high. An inverted yield curve has historically presaged economic recessions.

The Federal Reserve raised interest rates for the 10th straight time in May, increasing its benchmark rate 25 basis points to 5.25%. In doing so, Fed officials cited progress in moderating inflation but reiterated that additional rate hikes would be needed to bring key measures down to its 2.0% target and that no rate cuts were envisioned during 2023. In June, as expected, the Fed “skipped” another rate increase but actually increased its year-end rate forecast to 5.6%, well ahead of market expectations of 5.1% at the time of the announcement. The statement reflected stronger than expected economic growth and persistent inflation, with year-end estimates for core inflation revised 30 basis points higher to 3.9% while its estimate of the unemployment rate was lowered by 40 basis points to 4.1%. The latter reflects one of the key conundrums facing the Fed as employment data over the quarter has been consistently stronger than expected.

A second conundrum is the surprising strength of the economy in spite of a cumulative 500 basis points of rate increases since March 2022. The elevated benchmark rate has dramatically increased borrowing costs for the government, companies, and consumers and at the same time pushed lending institutions to further tighten lending standards. Nevertheless, the Fed’s estimate of Q2-2023 GDP growth of 2.4% calls for acceleration versus the first quarter’s actual 2.0% growth rate. The economic data released during the quarter continued to highlight the “two-speed” characteristics on which we have previously commented, with better-than-expected employment numbers, housing market strength and a resilient consumer overshadowing broad manufacturing weakness. Consumer confidence stands at the highest level in 18 months, strongly influenced by downward trending, and better-than-expected consumer (CPI) and producer (PPI) data. The personal consumption expenditures (PCE) index eased to 3.8% y/y in May, a significant drop from 4.3% a month earlier. The increase was the lowest since April 2021, and nearly half of the 7% peak rate in June 2022. However, manufacturing activity continues to contract with manufacturing PMI readings stuck below 50. In addition, the Conference Board’s Leading Economic Index declined for the 13th consecutive month, falling 0.6%, highlighting a worsening economic outlook and the trade deficit widened reflecting weakening demand abroad for U.S. products. We note that tighter monetary policy takes roughly 18 months before reaching maximum impact on the economy, which suggests economic growth will face increasing downward pressure over the next several quarters.

Nonetheless, the overriding market narrative for the second quarter, which has continued into the third quarter, is that of a successfully executed soft-landing with continued disinflation and moderately higher unemployment allowing the Fed to end this rate hiking cycle. This sets up a “goldilocks” backdrop for markets. Corporate earnings are expected to have troughed in the second quarter with a 9% year-on-year decline and a 0.3% decline in revenues. Forecasts show strong improvement in the second half of the year and final 2023 earnings essentially unchanged from 2022. There are several reasons why we view this as overoptimistic. Most notably, disinflation will likely forestall additional, or in the case of some industries and companies erode, the price increases and margin expansion that supported earnings over the past two years. In addition, a sustained period of higher interest rates should ultimately crimp consumer demand, thereby pressuring corporate revenues. The resumption of student loan payments will further stress some consumer balance sheets and continue to eat away at the pandemic era “money mountain” which by some estimates will be fully depleted by the end of the year. Signs of increasing consumer caution have been evident in recent earnings and commentary from a range of Consumer Staples and Consumer Discretionary companies, and we expect this trend to accelerate in coming quarters.

There is also risk that markets may be too sanguine about the inflation outlook as base effects will make year-on-year comparison more difficult beginning with the July data release at the end of August. Monthly consumer price inflation (CPI) peaked at 1.2% in June 2022 and declined to 0.0% in July 2022. Therefore, if CPI remains flat month-on-month from July, CPI will decline from an annualized 4.0% in May to 2.9% in June and will be unchanged in July. However, if CPI increases 0.2% month-on-month going forward, the June annualized increase will be 3.1% and will increase to 3.4% in July. Any increase in headline CPI will make it harder for the Fed to the call an end to rate increases. A weaker US dollar will only add to inflationary pressures as commodity prices – particularly energy – tend to rise as the dollar falls.

We expect market volatility to increase as these forces become more evident in the data. Portfolio positioning should remain flexible and adjust accordingly to anticipated changes in the macroeconomic outlook and sector and style factor impacts. Within equities we remain defensively positioned, though we did increase exposure to the technology sector during the quarter. The portfolio is skewed toward high quality style factors, stable growth, and a selective mix of cyclical value. We prefer companies that can retain pricing power in a disinflationary environment without sacrificing margins and that have a track record of delivering returns through a full economic cycle. From a thematic perspective, we favor companies that will benefit from the green transition via their technology, products or by building the necessary infrastructure.

Fixed-income markets have gone through massive repricing in the last 16 months. Yields are the highest seen in over a decade and are increasingly attractive. We remain cautious in fixed income credit, seeking higher quality, more liquid, and resilient investments. We continue to favor high grade corporate credit with a bias toward quality businesses within sectors that we believe are more resilient to late cycle dynamics. The recent banking sector stress reinforces our cautious approach toward lower rated credit. An area of opportunity we think is in U.S. agency mortgage-backed securities with historically wide spreads and no credit risk. Client cash flow needs should guide fixed income portfolio duration positioning with an anchoring towards neutral relative to the benchmark.

In international markets, the biggest disappointment of the second quarter was the poor performance of China as the government failed to provide broad fiscal and monetary surplus to bolster the much weaker than expected Covid reopening. The Chinese economy is burdened by a significant residential real estate overhang and highly leveraged developers that continue to stress its regional banks and governments. Consumer confidence has been severely dented as real estate is the preferred store of value and thus far consumers have not engaged in the type of post-Covid spending spree seen in the US and elsewhere. These factors, as well as the high level of economic and geopolitical tensions with the US, have increased negative sentiment toward Chinese assets. Stimulus measures to date have been small and narrowly targeted though recent official announcements suggest this may change soon. Given its important role in the global economy, we are closely monitoring events in China for evidence of this. While we remain underweight international equities relative to the benchmark in our global portfolios, we see room for increasing allocations in select regions, particularly Japan due to low valuations and rapidly increasing returns at the company level. Emerging markets are also looking more attractive as they will benefit from the weaker dollar and declining inflation that will allow many central banks to begin cutting interest rates regardless of the path of US monetary policy.

Author:

|

Bruce Schoenfeld Principal Investment Analyst First American Trust |

Bruce is the Principal Investment Analyst responsible for investment research coverage of various asset classes and equity industry sectors. Bruce has more than 20 years of experience as an equity analyst and portfolio manager. He joined First American from 3P Associates, LLC, an investment and strategic management consulting firm he founded. He previously served as Director of Research at BlueStar Global Investors and as an analyst and portfolio manager focused on emerging markets for Delaware Investments, Artha Capital and Caisse de depot et placement du Quebec, Canada’s second largest pension fund.

Co-Authors: |

Jason Nerio Vice President, Director of Investment Research and Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.