Global equities and bonds rose in the fourth quarter of 2022, closing out the worst year in more than a decade. The fourth quarter rally across risk assets was driven by sentiment that inflation has peaked and is decelerating, and thus the Fed's historic tightening campaign may soon be coming to an end. The rebound in markets was also supported by third-quarter earnings that were better than feared across several sectors, including Financials, Industrials and some select retailers. However, large-cap tech continued to disappoint, and poor results from Amazon (AMZN), Meta (META), and Alphabet (GOOGL), among others, continued to drive Nasdaq underperformance during the quarter. All the while, the Fed's messaging has remained consistently hawkish in the face of the market's more recent sanguine interpretation, as the Fed raised rates an additional 50 bps at the December FOMC meeting and forecasted further rate hikes to come. Markets struggled for the remainder of the quarter, post the December FOMC meeting, capping the challenging year for capital markets.

2022 was a year of stubbornly high inflation, while global growth slowed on a fading reopening boost, waning fiscal support, and monetary tightening. Geopolitics further aggravated investor anxieties with the Russian invasion of Ukraine, the most significant conflict in Europe since World War II. The tragic war in Ukraine triggered a global food and energy crisis with substantial impacts across Europe. Finally, China's Zero-Covid policy strained global supply chains and goods trade during the year.

In the U.S., intense inflation pressures not seen in nearly four decades led the Federal Reserve to orchestrate its most aggressive rate hiking campaign in history. High inflation and the end of pandemic-related transfer payments weighed on real disposable income in 2022. However, strong wage growth and significant accumulated post-covid excess savings from transfer payments continued to underpin real consumer spending. As a result, domestic economic growth remained more resilient than expected and furthered concerns that inflation may be slow to moderate. In December, the FOMC increased the Fed Funds rate to a targeted range of 4.25% to 4.5% and gave their projection for a peak Fed funds rate over 5%. Fed officials also signaled that they would slow the pace of their policy tightening, given inflation peaked in the summer and has decelerated since then. However, the Fed warned that a strong labor market and wage inflation threatened to unanchor inflation expectations, in which case additional rate hikes will be warranted.

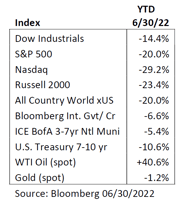

As a result of the difficult macro backdrop, asset markets struggled mightily in 2022. For the fifth time in the last 100 years, both U.S. Treasuries and the S&P 500 finished in the red. Geopolitical turmoil in Europe, and a rapid hawkish transition from the global central bank community, weighed on equity and bond markets globally. The U.S. Treasury market saw yields rise across the curve, with the 10-year bond peaking at 4.25% after starting the year near 1.5%. The S&P and Nasdaq saw double-digit declines as investors accounted for the higher interest rate environment and prospects for slower economic growth. High valuation stocks fell the most due to the interest rate sensitivity of their longer duration earnings and cashflow prospects. Fading tailwinds and tightening financial conditions made for a more challenging earnings backdrop in 2022 that will likely continue in 2023. Corporate sentiment and guidance for the fourth quarter earnings season should set the stage for 2023 in January.

The U.S. economy is expected to grow at a sub-optimal pace in 2023 while inflation continues to slow from elevated levels. However, uncertainty remains concerning inflation stickiness given a host of potential exogenous shocks (energy supply disruptions, friction among major powers, deglobalization and nearshoring, restructuring of supply chains, tight labor market, etc.). Thus, the timing of the Fed's transition from hiking rates to a pause and an eventual pivot to lower rates is unclear. The Fed's current outlook calls for further rate increases and a 5-5.25% terminal rate. Meanwhile, the fixed income markets have priced in a dovish divergent path, as concerns that the pace and magnitude of the 2022 rate hike cycle will ultimately overwhelm U.S. economic growth prospects this year.

Financial conditions are a helpful signal to define the ongoing progress of tightening policy conditions and market risk signals as rates become more restrictive. Thus far, financial conditions are up from extremely low levels a year ago; however, they do not yet signal much market stress. Given the swift change in interest rate policy over the last 12 months and the lagged impact on the economy of rate hikes, it would be reasonable to expect a significant slowdown (or even contraction) in aggregate economic growth in 2023 and, consequently, labor market weakness. Wage growth is currently running at a 4.5%-5% Y/Y growth rate, and wage growth moderation would be welcome, given the Fed's concerns about inflation. However, the flip side is that consumers will likely be under increasing financial pressure as most post-COVID excess savings are exhausted, and the asset market decline drives a negative wealth effect. Weakening growth also increases the likelihood that corporates meaningfully cut discretionary spending and capital investments, further pressuring economic growth prospects. Indicative of downside growth concerns implied by markets is the shape of the U.S. Treasury yield curve, which is inverted. An inverted yield curve has historically been a precursor to a recession, although timing can vary by months and quarters.

In our opinion, there is a wider than normal dispersion of potential market outcomes given the broad range of probable economic and inflation paths. We expect market volatility to stay elevated. Increased flexibility through portfolio rebalancing and positioning will help navigate anticipated volatile market conditions. Portfolio construction will balance the cyclical economic pressures with shifts in monetary policy. After significant repricing last year, fixed income represents a better portfolio value for the first time in several years. We favor high-grade corporate credit exposures within fixed income given continued, although slowing, economic growth. The high-yield category continues to represent an underappreciated risk due to its low-risk premium, given the potential for economic weakness during the year. Client cash flow needs will dictate fixed income portfolio duration positioning, anchoring towards neutral to slightly longer than the benchmark. Our global equity portfolio remains overweight large-cap domestic stocks relative to foreign stocks. We see late-cycle dynamics in the U.S. market and favor high-quality style factors, stable growth, and a selective mix of cyclical value. Within our large-cap stock allocation, we prefer companies with strong pricing power or expense pass-throughs and lower labor intensity to mitigate the risks of a persistent inflationary environment. The portfolio is also tilted towards companies geared towards capital investment for future growth and the energy transition. From a global perspective, the recent decline in the U.S. dollar is creating a favorable tailwind for international markets. Continental European economies likely need to negotiate a recession and geopolitical tail risks, but Eurozone has never been this attractively priced vs. the U.S.. Similarly, prospects for Asian markets are likely to improve as China moves away from the Zero-COVID policy to reopen its economy, extending regional benefits to neighboring economies.

Written By:

|

Jason Nerio Vice President, Director of Investment Research and Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

|

Bruce Schoenfeld, CAIA Principal Investment Analyst First American Trust |

Bruce Schoenfeld is the Principal Investment Analyst responsible for investment research coverage of various asset classes and equity industry sectors at First American Trust. Mr. Schoenfeld has more than 20 years of experience as an equity analyst and portfolio manager.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.