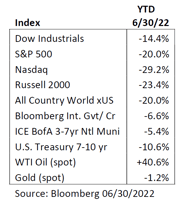

The first half of 2022 was the worst stretch for markets in almost 50 years, with a significant sell-off in stocks and bonds. All major asset classes are down for the year except commodities, although signs of commodity weakness are also beginning to materialize. Despite year-to-date losses, most asset classes are still higher than pre-pandemic levels. Importantly, longer-term asset class returns help to balance perspectives in volatile times. Over the last 3, 5, and 10 years, stocks have returned over 10% on average, including the difficult start to the year.

For the quarter, the large-cap S&P 500 fell 16.1%, the blue-chip Dow Jones Industrial Average was lower by 10.8%, the tech-laden NASDAQ dropped 22.3%, and the small-cap Russell 2000 fell 17.2%. Equity sector performance was dismal across the board, although there was a late-cycle defensive tone with Staples (-4.6%), Utilities (-5.1%), and Energy (-5.3%) outperforming while Consumer Discretionary (-26.2%), Communication Services (-20.7%), and Technology (-20.2%) led to the downside.

A relatively calm geopolitical climate, low interest rates, and below-average inflation helped buoy stocks and bonds over the years. However, market conditions have experienced significant change recently as inflation is at a 40-year high, the Fed is expected to implement its fastest pace of interest rate hikes since 1994, and NATO has been pushed closest to a warring stance in decades with Russia’s invasion of Ukraine. Global markets are also dealing with the strengthening U.S. dollar, which rose 9% in the first half against a basket of world currencies, including the Japanese yen, which is at its weakest level against the dollar since 1998, and the Euro, which is approaching parity versus the dollar for the first time in 20 years. The complexities and uncertainties of this challenging investment backdrop have been compounded by COVID-19 lockdowns in China, oil/gas and food price shocks, supply chain woes, and a burgeoning energy crisis in Europe.

Against this complex and volatile investment landscape, perhaps the biggest question on U.S. investor minds is whether the Fed can deliver a soft economic landing as they battle inflation through an aggressive rate hike schedule and balance sheet reduction. While the job market remains solid, on balance, economic data points are pointing to a U.S. economy that is slowing. High inflation (May CPI +8.6% Y/Y; 40 year high) is eroding consumer purchasing power and is pressuring corporate profit margins. Additionally, persistent supply chain issues are compounding inflationary pressures and causing companies to have difficulties filling customer orders and managing inventories. The Federal Reserve, which was late in identifying the extent of the inflation problem, is now determined to fight it despite potential economic consequences, and thus odds of a possible Fed policy mistake are on the rise. The Fed raised its benchmark policy rate 125 basis points during the June quarter and projected a notably more aggressive path for the federal funds rate following its June FOMC meeting. Investor concerns are reflected in a flattening U.S. Treasury yield curve, as measured by the difference between the 10-year less the 2-year Treasury note yield, which is approaching inversion. While an inverted yield curve has preceded all recessions, not all yield curve inversions have presaged a recession. Therefore, any signs that both inflation and/or inflation expectations are moderating should be a strong market catalyst, particularly if those signals come before too much economic damage is done.

As discussed in our 2022 outlook, several headwinds tempered our expectations for capital market performance. Since the pandemic started, markets were supported by extraordinary fiscal and monetary stimulus programs that offset the economic shock. The 2022 environment would be quite the opposite, with inflation being the primary near-term risk to capital markets. The Fed was behind the curve on inflation and would position to remove accommodation through rate hikes and balance sheet contraction. Given the degree to which the Fed was behind the curve on inflation, their policy path adjustment became more aggressive. Removing accommodation will increase financing costs, tighten financial conditions, and ultimately slow economic growth. The risk remains that Fed policy tightening overshoots and sends the economy into recession. In short, while we expected 2022 would be a bumpier ride, we certainly did not expect one of the most difficult first half of the year performances that global markets have ever seen.

Looking forward, we expect market volatility until there is increasing evidence that inflation is being reined in without significant economic repercussions. Despite awful equity market returns, earnings expectations for 2022 have remained resilient at 10.7% Y/Y expected growth. Therefore, the equity market correction to date has been driven almost solely by a valuation adjustment (higher discount rate pressuring the current value of future earnings/cash flows). Market valuations are therefore much more attractive today versus the beginning of the year but remain slightly elevated from a historical perspective. Economic slowing presents downside risk to earnings revisions; therefore, further downside market adjustments remain possible if the Fed hawkishly overshoots. The prevailing risks consequently call for conservatism in near-term market return expectations; however, longer-term market return potential is improving.

Anticipated volatility in market conditions will necessitate greater flexibility through portfolio rebalancing and positioning. Portfolio construction will need to balance the risk of current inflationary concerns and cyclical economic pressures with the shifts in fiscal and monetary policy response. Financial conditions will be a crucial barometer through the course of the year. We continue to favor high-grade corporate credit exposures within fixed income given continued, although slowing, economic growth. Within credit, risk premiums in the high yield category have been widening out but not yet opportunistically, in our opinion, given the potential for further economic slowing during the year. Client cash flow needs continue to guide fixed income portfolio duration positioning with an anchoring towards short to neutral relative to the benchmark. Our global equity portfolio remains overweight large-cap domestic stocks relative to international. We see late-cycle dynamics in the market favoring large-cap and high-quality style factors, and as a result, we are underweight small-caps. Within our large-cap stock allocation, we prefer companies with strong pricing power or expense pass-throughs and lower labor intensity to mitigate the risks of a persistent inflationary environment. The portfolio is also tilted towards consumer services companies likely to benefit from further reopening.

In difficult times, investors are well served to depend on their investment plan that balances long-term goals, objectives, and risk tolerances. The best-suited asset allocation mix aligns with the goals, objectives, and risk tolerances to weather the episodic periods of volatility. As part of the plan, periodic rebalancing may be needed to increase or decrease allocations when weightings drift out of alignment from the target. In closing, history and research have demonstrated that investors who commit to a long-term asset allocation policy that embraces diversification and risk controls are likely better equipped to take advantage of the market’s volatility to reach their long-term investment goals.

|

Jason Nerio Vice President, Director of Investment Research and Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.