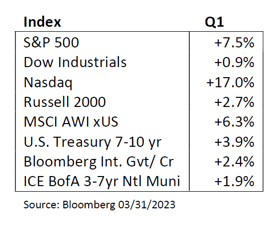

Global markets produced gains for the first quarter despite a turbulent March end. All three major market indices advanced with improving sentiment toward tech stocks, especially large-cap names, in the face of additional Federal Reserve tightening and a mini-financial panic prompted by the collapse of Silicon Valley Bank. Market volatility raced higher in early March with the failure of two regional banks, a forced takeover of Credit Suisse, and a flight of deposits from smaller institutions. The S&P Bank index fell nearly 19% in March. The government backstopped the deposits of SVB and Signature Bank, and setup a special lending facility for other banks, helping to stem the crisis. Technology stocks were the big winners during the quarter as investors rotated out of cyclically sensitive sectors, including Financials and Energy. Growth outperformed value in the quarter, while defensives lagged despite the banking crisis. Semiconductors, a subsector of Technology and an important bellwether for global growth, delivered strong performance during the quarter. However, gold, a safe-haven asset, is giving conflicting signals as it closed the quarter near its highs after rising nearly 10% in March amidst the banking upheaval.

Global markets produced gains for the first quarter despite a turbulent March end. All three major market indices advanced with improving sentiment toward tech stocks, especially large-cap names, in the face of additional Federal Reserve tightening and a mini-financial panic prompted by the collapse of Silicon Valley Bank. Market volatility raced higher in early March with the failure of two regional banks, a forced takeover of Credit Suisse, and a flight of deposits from smaller institutions. The S&P Bank index fell nearly 19% in March. The government backstopped the deposits of SVB and Signature Bank, and setup a special lending facility for other banks, helping to stem the crisis. Technology stocks were the big winners during the quarter as investors rotated out of cyclically sensitive sectors, including Financials and Energy. Growth outperformed value in the quarter, while defensives lagged despite the banking crisis. Semiconductors, a subsector of Technology and an important bellwether for global growth, delivered strong performance during the quarter. However, gold, a safe-haven asset, is giving conflicting signals as it closed the quarter near its highs after rising nearly 10% in March amidst the banking upheaval.

The Treasury market capped off a volatile first quarter on a higher note. Following the best start to the year in three decades, Treasuries surrendered gains in February after the Federal Reserve’s preferred inflation gauge, the core PCE price index, reflected a firming of monthly price increases. That raised concern that the preceding string of disinflationary readings may be short-lived. However, the backup in yields was not sustained after the banking turmoil in early March reduced risk appetite in markets. Yields on two-year Treasuries tumbled 115 basis points from a high of 5.08%, which put the rate on pace for its most significant monthly drop since 2008. Yields on 10-year notes fell less, dropping 80 basis points from a high point of 4.08%. The moves helped re-steepen a 110 basis point inversion in the yield curve, a level last seen during the early 80s when inflation was running in the low teens.

While acknowledging the stress within the banking system, the Federal Open Market Committee softened its language around the potential for future tightening, even as it delivered another quarter-point hike. During the quarter, the FOMC lifted the Federal Funds Rate from 4.75% to 5%, marking the ninth increase this year and hitting the highest level since 2007. The committee’s post-meeting policy statement removed language stating that “ongoing increases” in the rate would be appropriate, hinting that the Fed may be nearly finished raising rates. In their statement of economic projections, Fed officials forecasted the Federal Funds Rate would end the year at 5.1%, 75 basis points higher than currently implied by futures pricing. The Fed’s favorite inflation gauge, the PCE index, rose 4.6% excluding food and energy, slightly below expectations of 4.7%. In recent months, Fed Chairman Jerome Powell has stated several times that he is looking for a decline in core inflation for confirmation that underlying inflation pressures are easing.

Economic data for the quarter were mixed, reflecting a two-speed economy where labor and consumption remain resilient, yet manufacturing and housing weakness persisted. Jobless claims were generally below 200,000, signaling limited labor weakness, while nonfarm payrolls averaged over 300,000 per month over the last 90 days. Personal spending slowed month on month in February, though it grew 7.6% from the prior year, driven by solid wage gains and a post-pandemic excess savings buffer. The ISM Services and Manufacturing Purchasing Manager Indexes showed weakening trends, with new orders down on softening demand. New and existing home sales fell by nearly 20%, and new home construction was down by over 18% as the 12-month rise in interest rates crimped demand.

As we head into the second quarter, there are significant uncertainties as the economy confronts expanding headwinds. Economic data points to a U.S. economy that is slowing as it works through the Fed’s aggressive rate hike schedule of the last 12 months. At the top of investors’ minds is whether the Fed can achieve a soft economic landing as they navigate slowing growth with moderating inflation. The impact of the Fed’s tightening campaign will play out with long and variable lags, and the massively inverted yield curve is representative of the potential future pressure on the economy. The recent banking sector stress is also symptomatic of the later stages of an aggressive monetary policy tightening cycle. The March bank panic saw deposits decline by $300 billion, a historic contraction in bank deposits, which are 85% of M2. Impacts from the recent stress in the banking sector are likely to continue to materialize over the year as tighter lending standards and higher credit costs reduce credit availability, consequently slowing economic growth. Even before current events, banks were tightening lending standards on commercial and industrial loans, which was already slowing credit growth.

High inflation continues to erode consumer purchasing power and is pressuring corporate profit margins. However, progress is being made as the inflation rate continues to moderate. The February PCE deflator fell to 5% from a year ago after peaking slightly under 7% in June 2022. Further support for easing price pressures is seen in manufacturing supply chain pricing, significant drops in commodity prices from a year ago, waning pricing on rents, and moderating, though still elevated, wage gains. It is important to see further progress on the inflation front as the Fed seeks evidence that it is winning its bout with inflation. This balancing act by the Fed has historically not favored soft economic landings, and thus there is a risk that the Fed overshoots its tightening efforts.

Looking forward, we expect market volatility until there is increasing evidence that inflation is reined in without significant economic repercussions. In this environment, slowing growth and sticky inflation dynamics weaken the corporate profit outlook and consequently increase market volatility. For 2023, revenue and earnings have been trending down since the beginning of the year. Consensus expectations for revenue and earnings at the end of the first quarter are +2.0% and +1.5%, respectively. At the beginning of this year, 2023 revenue growth was expected to be +3.2%, with earnings growth of +4.6%. The current outlook for corporate profits carries increased downside risks without a change in monetary policy, and consequently, a more conservative investment posture is generally prudent.

Increasingly volatile market conditions will require portfolio flexibility through rebalancing and positioning. Portfolio construction will need to balance the risk of slowing growth and moderating inflation with the potential for shifts in monetary policy. We believe financial conditions metrics are crucial barometers for measuring risk in the financial system, and thus will monitor them closely and adjust portfolios accordingly. We currently favor high-grade corporate credit and government bonds within fixed income given slowing economic growth and view below investment-grade credit as expensive, given that spreads do not adequately reflect recession risks. Client cash flow needs should guide fixed income portfolio duration positioning with an anchoring towards neutral relative to the benchmark. Our global equity portfolio remains overweight large-cap domestic stocks relative to international stocks. However, the U.S. Dollar may be shifting to a more sustained downward bias as changing relative economic growth, inflation, and monetary policy dynamics begin to favor foreign markets. Foreign stocks are trading at historical discounts to U.S. stocks, and a sustained downward decline in the Dollar would create strong tailwinds for international investing. Prospects for Asian markets are likely to improve as China moves away from the Zero-COVID policy to reopen its economy, extending regional benefits to neighboring economies. Continental European economies have deftly negotiated an energy shortage leading to better-than-feared growth and inflation, though geopolitical tail risks remain. In U.S. markets, we see late-cycle dynamics and favor high-quality style factors, stable growth, and a selective mix of cyclical value. Within our large-cap stock allocation, we prefer companies with pricing power or expense pass-throughs and lower labor intensity to mitigate the risks of a persistent inflationary environment. The portfolio is also tilted to companies geared toward capital investment for future growth and companies well-positioned for the energy transition.

Written By:

|

Jason Nerio Vice President, Director of Investment Research and Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.