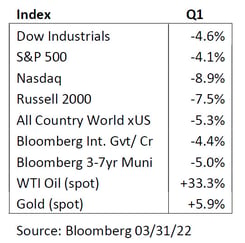

Following a solid 2021 performance, equity markets struggled in the first quarter of 2022. The three major averages were negative for the first quarter, with the NASDAQ turning in the worst performance. Although markets rallied in the quarter’s final two weeks, the major averages had their first negative quarter since 2020. Equity market leadership had a late-cycle defensive tone in the quarter. Only two sectors produced positive returns. The Energy sector dominated, up nearly 40%, driven by the surge in the price per barrel of oil, while utilities provided investors with defense, increasing 4.8%. On the other hand, Financials fell 1.5%, led by the pro-cyclical banking industry, despite the tailwind of higher interest rates.

Investor sentiment has been impacted by high inflation, supply-chain imbalances, Russia’s invasion of Ukraine, and the beginning of a rate hiking cycle from the Federal Reserve. Investors are increasingly concerned that growth may soon slow and are eyeing a flattening U.S. Treasury yield curve. The curve, as measured by the difference between the 10-year less the 2-year Treasury note yield, narrowed to its lowest level since 2019 and briefly inverted. While an inverted yield curve has preceded all recessions, not all yield curve inversions have presaged a recession.

Thus, capital markets have entered the second quarter faced with a variety of headwinds. Fears of stagflation and recession are stoking investor anxieties which were fueled by the plunge in ISM new orders and surge in ISM prices paid. The Consumer Price Index, which measures a wide range of goods and services, climbed at the fastest pace in 40 years and topped estimates due to rising food and energy costs. In early March, U.S. consumer sentiment deteriorated more than expected and reached its lowest level in 11 years on inflation worries. Oil prices surged over $100 for the first time since 2014 as both West Texas Intermediate and Brent moved higher on supply disruptions and sanction concerns related to the Russian invasion of Ukraine.

Entering 2022, positive earnings per share revisions helped to support elevated market valuations. Year-to-date earnings expectations have continued along the same positive path as estimates have risen about 7% over the past several months relative to the historical average of a 4% decline in expectations. However, increasing prospects for slower domestic and global growth paired with higher commodity prices pose a risk to earnings and margins.

As discussed in our 2022 outlook, several headwinds temper our expectations for capital market performance this year. Since the pandemic’s start, markets have been supported by extraordinary fiscal and monetary stimulus programs that served to offset the economic shock. Today’s environment is quite the opposite, with inflation being the primary near-term risk to capital markets. The Fed is behind the curve on inflation and is positioning to remove accommodation rapidly through rate hikes and balance sheet contraction. Removing accommodation will likely increase financing costs, tighten financial conditions, and slow economic growth. There is also a risk that Fed policy tightening overshoots and sends the economy into recession.

Despite the headwinds, our base-case outlook calls for moderate market upside based on better than expected earnings growth, balanced with easing supply shocks and normalizing consumer spending habits. Record corporate cash flow and strong fundamentals should continue to drive capital investment, inventory restocking, and shareholder return activity. Therefore, we are mindful of changing policy conditions as risks of higher inflation and slower growth have increased, leading to a broader set of possible macroeconomic outcomes.

Investment implications are many, given the greater dispersion of economic and inflation outcomes. At a minimum, we expect markets to increase in volatility. Anticipated volatility in market conditions will necessitate greater flexibility through portfolio rebalancing and positioning. Portfolio construction will need to balance the risk of current inflationary concerns and cyclical economic pressures with the shifts in fiscal and monetary policy response. Financial conditions will be a crucial barometer through the course of the year. We continue to favor high-grade corporate credit exposures within fixed income given continued, although slowing, economic growth. Within credit, the current narrow risk premium in the high yield category could be an underappreciated risk, given the potential for economic growth to slow during the year. Client cash flow needs to continue to guide fixed income portfolio duration positioning with an anchoring towards neutral to the benchmark. Our global equity portfolio remains overweight large-cap domestic stocks relative to international. We see late-cycle dynamics in the market favoring large-cap and high-quality style factors, and as a result, we are underweight small-caps. Within our large-cap stock allocation, we prefer companies with strong pricing power or expense pass-throughs and lower labor intensity to mitigate the risks of a persistent inflationary environment. The portfolio is also tilted towards consumer services companies likely to benefit from further reopening.

|

Jason Nerio Vice President, Director of Investment Research and Strategy First American Trust |

Jason Nerio is the Director of Investment Research and Strategy at First American Trust. Mr. Nerio has more than 20 years of investment research experience. He is responsible for formulating investment strategy and serves as a leading member of the investment committee which monitors and manages the firm’s allocation strategies for over $1 billion in client assets.

|

Scott Dudgeon, CFA Director, Equity Research First American Trust |

Scott Dudgeon is the Director of Equity Research at First American Trust. Mr. Dudgeon is a Chartered Financial Analyst (CFA) and has more than 25 years of investment research experience. He also serves as a leading member of the investment committee and has a proven track record for outperforming the markets for our clients. He has been with The First American Family of Companies for 16 years.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.