It’s that time of year again…yes, it’s tax season, which are due this year on April 15th (unless you file for an extension)!

Key Takeaways

- It’s important to know where you fall in the current tax.

- Recent standard deduction increases may make it easier for you to file your taxes in the future.

- With 401(K) contribution limit increases in 2024, it’s important for you to plan today to maximize your retirement savings and potential tax savings.

- The increase in Health Savings Account (HSA) contributions will allow you to save more money for qualified medical expenses.

- Child tax credits may help you reduce your taxable income.

Benjamin Franklin once said, “Nothing in life is certain except death and taxes.”

It’s important you know all the changes to tax law each year because it impacts your money. Every year the IRS (Internal Revenue Service) announces changes to the tax brackets, which usually occurs around the same time the federal government makes changes to social security payments.

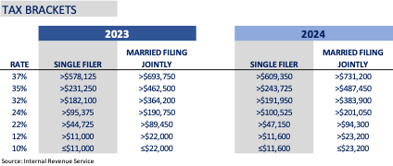

Figure 1 – Tax Brackets

Looking at tax year 2023 (Figure 1), one of the biggest changes we saw was a slight shift in the tax brackets. There are still 7 tax rates, but the income ranges for each rate have widened and shifted higher to account for inflation and rising wages that we’ve seen recently. Within the 7 new taxable income brackets, the lowest tax rate is 10% at the bottom of the scale and goes all the way up to 37% for the highest earners.

Looking at tax year 2023 (Figure 1), one of the biggest changes we saw was a slight shift in the tax brackets. There are still 7 tax rates, but the income ranges for each rate have widened and shifted higher to account for inflation and rising wages that we’ve seen recently. Within the 7 new taxable income brackets, the lowest tax rate is 10% at the bottom of the scale and goes all the way up to 37% for the highest earners.

In 2024, those brackets will increase and knowing how tax brackets work is key to understanding how your income will be taxed. Your top marginal tax rate, or what people commonly refer to as their tax bracket, is not the same thing as your effective tax rate. Being in the 24% bracket doesn’t mean you’re paying 24% of your taxable income in taxes. Instead, your income is taxed progressively through a series of marginal tax rates, up to 24%.

Knowing your top marginal rate may be helpful in estimating how much tax you may owe on any additional income you make (i.e., bonuses, capital gains, lottery winnings, etc.). Any additional income may put you into a higher tax bracket and you’ll still be taxed according to the same progressive system of rates and brackets; however, you’ll just top out in a higher bracket.

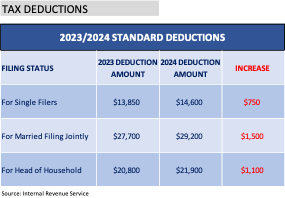

Standard deductions (Figure 2) reflect the new increases for 2023 and 2024.

Figure 2 – Tax Deductions

The standard deductions for tax year 2023 are $13,850 for single filers, $27,700 for married couples, and $20,800 for single heads of households. Additional increases to the standard deductions for tax year 2024 will increase yet again.

The standard deductions for tax year 2023 are $13,850 for single filers, $27,700 for married couples, and $20,800 for single heads of households. Additional increases to the standard deductions for tax year 2024 will increase yet again.

For example, in 2024 a married couple filing jointly will come close to $30,000 for a standard deduction. The higher standard deductions and the new tax bracket next year may provide a compelling reason for you to take the standard deductions rather than itemize your taxes (Figure 3).

Figure 3 – Itemized Deductions

401K Contribution

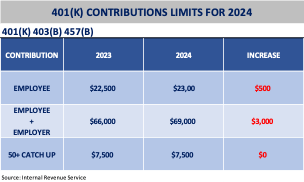

When it comes to contributions to 401K, IRA, etc., there’s a saying, “Start early and start small.” For many investors interested in maximizing their retirement savings with the added benefit of tax savings, the IRS has also adjusted contribution limits that impact your retirement savings (Figure 4).

Figure 4 – 401K Contribution Limits for 2024

Many of you can start planning your 2024 contributions this year! Employee 401(K) contribution limits will be maxed out at $23,000 and that number goes up to $69,000 for the combined employee and employer contributions. If you’re 50 or older, you’re eligible for an additional $7,500 in catch-up contributions.

Many of you can start planning your 2024 contributions this year! Employee 401(K) contribution limits will be maxed out at $23,000 and that number goes up to $69,000 for the combined employee and employer contributions. If you’re 50 or older, you’re eligible for an additional $7,500 in catch-up contributions.

Roth 401(K) (2023 & 2024) have the same pretax limits as traditional 401(K) plans. The simple benefit of a Roth 401(K) allows investors to make contributions with after-tax money; so there’s no tax break like a traditional 401(K). In exchange, any money that is withdrawn in retirement will be tax-free.

If you are someone who’s been thinking about a Roth conversation, meaning converting money in a traditional 401(K) or traditional IRA to a Roth 401(K) or Roth IRA, next year might be a good time to do this, because with the new tax rates combined with recent fluctuations in stock prices, it may mean that you can convert from a traditional IRA to a Roth IRA that could be taxed potentially at a lower rate.

A conversion for tax year 2024 might be particularly helpful if you expect your tax rate to be higher in future years.

We recommend consulting with your tax advisor before making the decision of a Roth conversion. Under the Tax Cuts and Jobs Act of 2017, you can no longer “recharacterize” or undo a Roth conversion. Once you convert, there’s no going back.

HSA Contributions

Contribution limits to HSAs (Health Savings Accounts) have been adjusted to reflect inflation as well (Figure 5).

Figure 5 – HSA Contributions Limits for 2024

HSAs allow you to put money away tax-free and the investments have the potential to grow tax-free. In addition, withdrawals for qualified medical expenses are tax-free. To be eligible for an HSA, you must be enrolled in a high-deductible health plan. (Just to be clear, we’re talking about federal taxes, contributions, investment earnings, and distributions that may or may not be subject to state taxation.) If you haven’t already contributed to an HSA in 2023, you have until April 15, 2024, to do so.

HSAs allow you to put money away tax-free and the investments have the potential to grow tax-free. In addition, withdrawals for qualified medical expenses are tax-free. To be eligible for an HSA, you must be enrolled in a high-deductible health plan. (Just to be clear, we’re talking about federal taxes, contributions, investment earnings, and distributions that may or may not be subject to state taxation.) If you haven’t already contributed to an HSA in 2023, you have until April 15, 2024, to do so.

Contribution limits in 2024 have increased from 2023. They are now $4,150 for self only, $8,300 for family coverage and if you’re 55 and older you can also put in $1,000 more. For many families, these catch-up contributions are a nice perk.

Be mindful of catch-up contribution rules. For example, if both spouses are covered by a family high deductible health plan and share a HSA, they’re eligible for one catch-up contribution of $1,000. If one of them is 55 or older, and not enrolled in Medicare, however, and they each want to make a catch-up contribution, they can do so, but they must do so in separate HSAs, resulting in a $10,300 limit.

Child Tax Credit

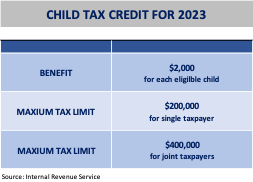

Child tax credits for parents and grandparents may qualify if they claim a child/grandchild as a dependent (Figure 6).

Figure 6 – Child Tax Credit for 2023

The IRS definition of qualifying children for a tax credit is broad enough to include stepchildren, foster children, siblings, grandchildren, and even nieces and nephews. The tax credit is factored in after you’ve calculated your taxes and may potentially reduce the amount of taxes you owe.

The IRS definition of qualifying children for a tax credit is broad enough to include stepchildren, foster children, siblings, grandchildren, and even nieces and nephews. The tax credit is factored in after you’ve calculated your taxes and may potentially reduce the amount of taxes you owe.

This year the child tax credit is $2,000 per child under the age of 17, who’s under your care. For example, if you owe $2,000 in federal income tax and qualify for a child tax credit worth $2,000, your tax bill could be wiped out.

To get the maximum $2,000 child tax credit your 2023 modified adjusted gross income or AGI can be up to $200,000 if you file individually or $400,000 if you file taxes jointly with your spouse. Otherwise, there’s a phaseout where you aren’t getting the full tax credit.

There’s also the additional child tax credit, the refundable portion of the child tax credit, the maximum refund is $1,600 per qualifying child*.

This information should not be perceived as tax advice and we recommend that you consult with your tax advisor. If you're looking to preserve your wealth for generations to come, please get in touch with one of our advisors today: 877.908.7878.

*The legislation, the Tax Relief for American Families and Workers Act of 2024, has already passed the House and would expand the child tax credit by boosting the maximum refundable amount per child over the next three years. Still pending Senate approval, the new rules would increase the maximum refundable amount from $1,600 per child. For the tax year 2023, it would increase to $1,800; for the tax year 2024, to $1,900; and for the tax year 2025, to $2,000.

Author:

|

Michael Serrano Vice President, Portfolio Manager First American Trust |

Michael has been in the financial services industry for 30 plus years and brings more than 18 years of experience in investment and portfolio management to his role as Vice President and Portfolio Manager.

The following article is for informational purposes only and is not and may not be construed as legal and/or investment advice. Investments contain risks, no third-party entity may rely upon anything contained herein when making legal and/or investment determinations regarding its practices, and such third party should consult with an attorney and/or an investment professional prior to embarking upon any specific course of action.

Past performance is no guarantee of future results. Individual account performance will vary. Not FDIC insured. No Bank guarantee. May lose value.