Mortgage technology is one of the most important components of the real estate transaction’s digital transformation. Since real estate professionals and title and settlement providers work closely with lenders to facilitate transactions, staying close to and investing in mortgage technology provides insight into how each may need to evolve to serve customers better in the future. Through our venture arm, Parker89, and other efforts, First American is playing a key role in supporting the digitization and modernization of the mortgage process.

Given the elevated interest rate environment and recent cooling of the venture capital market, there may be skepticism about new mortgage technology companies at this time. We believe, however, that mortgage technology startups with strong growth metrics and experienced teams will continue to find traction. The problems these companies are solving are systemic in the mortgage process, versus cyclical, and therefore are pertinent no matter the macroeconomic picture. Furthermore, as lender profit margins shrink in the current environment, we expect there to be added focus from lenders on finding ways to create differentiation and operational efficiency, which is where these new technology companies are focusing their efforts.

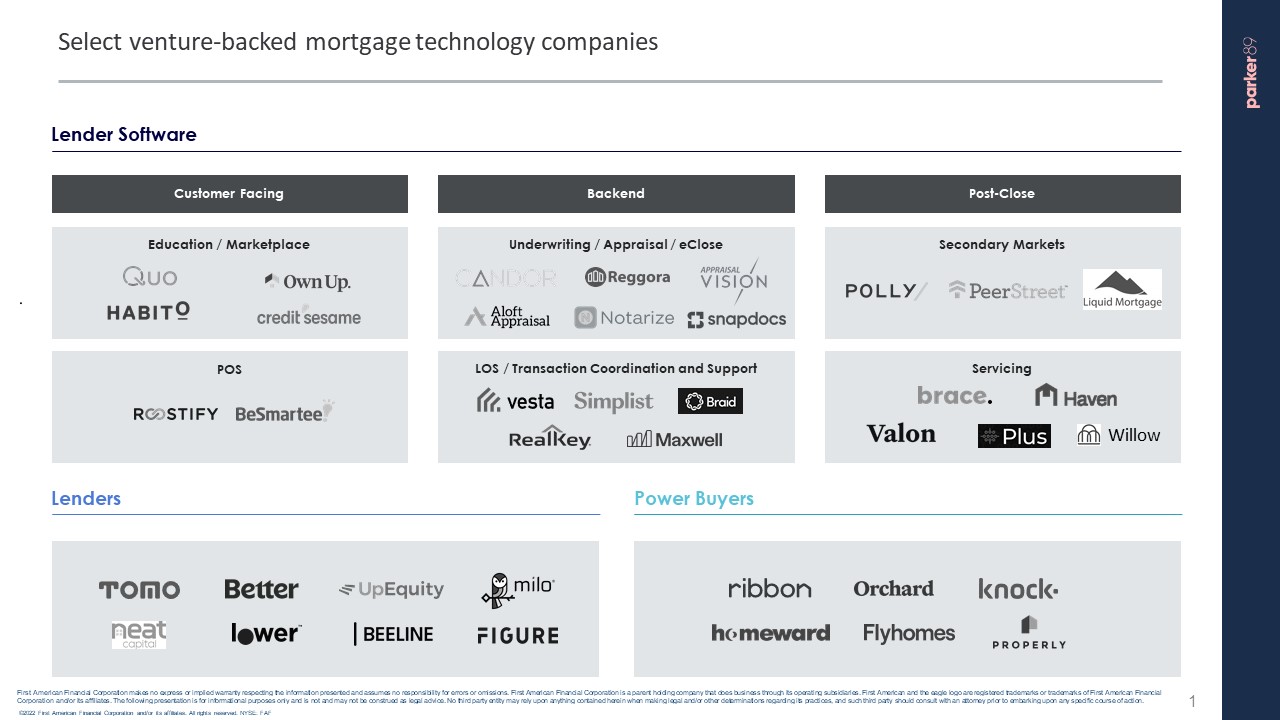

We think about the mortgage technology space as being composed of the following three categories: mortgage software used to enable originations, tech-driven mortgage originators, and “power buyers.”

Mortgage Software

The mortgage software space can itself be broken down into three areas: (1) point of sale (POS) and lead generation or other technologies that sit at the top of the customer acquisition funnel; (2) back-end enabling infrastructure; and (3) capital markets and servicing.

In the POS category, the top of the customer acquisition funnel has been the lowest hanging fruit for innovation and, as a result, the space has largely been saturated by a number of early movers. We haven’t seen many new mortgage startups with truly innovative technology enter this space recently.

Back-end enabling infrastructure includes loan origination software (LOS), underwriting, appraisal, and eClosing. This is a more challenging space to build upon and innovate within because of the complex workflows, well-entrenched incumbents, high cost and difficulty of switching providers, and heavier regulatory and compliance requirements.

However, innovation is needed in these areas and the opportunity is significant. As venture capital dollars flowing into the mortgage software space have grown, we’ve seen that the most promising companies are those led by founders who have come from other mortgage technology companies and possess deep expertise in both mortgage and technology. That may explain why venture activity in back-end infrastructure has increased in the past couple of years, as more knowledgeable mortgage investors pair with strong founders who have the requisite experience. Parker89 has invested in Notarize, which offers remote online notarization and recently funded Vesta in this space. Vesta has built a new, open LOS, which functions as a system of record and workflow tool, saving significant time for processers, underwriters and closers.

At the so-called “end” of the mortgage value chain, Parker89 recently funded Polly, which has built modern capital markets software, including pricing, hedging and best execution analysis tools.

Servicing however, which is a $12 trillion market, may be the most challenging area in mortgage from an innovation perspective. We have yet to see a new venture-backed tech company in this space gain significant traction. However, we’re witnessing more and more innovation here and some novel go-to-market approaches (e.g., loss mitigation, interim servicing, full-stack servicing, etc.). Although these new servicing technology players will likely continue to grow their adoption over the long term, they will be slower to scale given high switching costs, compliance requirements, and long sales cycles. ServiceMac, which is a sub-servicer that’s part of the First American family of companies, gives us strong insight into this market and its latest trends.

Ultimately, innovation in the mortgage software space is critical to improving the customer experience across the board, and it will help small- and medium-sized originators enjoy the efficiencies that larger originators realize from their scale and custom-built software.

“The problems these companies are solving are systemic in the mortgage process, versus cyclical, and therefore are pertinent no matter the macroeconomic picture. Furthermore, as lender profit margins shrink in the current environment, we expect there to be added focus from lenders on finding ways to create differentiation and operational efficiency, which is where these new technology companies are focusing their efforts.”

Tech-enabled Mortgage Originators

Tech-enabled mortgage originators saw significant venture capital investment activity from 2019 through 2021. These startups were heavily focused on innovating in the refinance arena because of the tremendous growth in refinance transactions in 2020 and 2021, and because refinance loans are operationally easier to originate and don’t require the involvement of real estate agents in the transaction. However, many of these companies have been challenged with the precipitous drop in refinance volume in 2022.

Parker89 recently invested in Tomo, a startup company with a lot of promise in the tech-enabled mortgage space. Unlike the refinance-driven originators, Tomo is focused purely on purchase mortgage transactions. They rely heavily on product differentiation and are building relationships with real estate agents, which we view as a more sustainable, long-term customer acquisition strategy. Our investment in Tomo reflects our belief that creating consistency and predictability in the purchase lending process through the use of technology will drive a noticeably better experience for real estate professionals and home buyers alike.

Power Buyers

Venture-backed companies offering “power buyer” solutions have garnered a significant amount of attention and funding over the past couple of years. As multiple-offer bidding wars have become increasingly common in competitive real estate markets, home buyers using traditional mortgages have found it difficult to compete against cash offers. In addition, sellers who are also buying (dual trackers), have challenges lining up their new home mortgage before completing the sale of their existing home and the payoff of their existing home mortgage.

Power buyer companies help home buyers facing these problems. These companies enable buyers to use a traditional mortgage to make cash offers on homes, which are backed by innovative financing methods. They also help dual trackers coordinate the timing between the sale of their existing home and the purchase of a new one.

Given the broad applicability of power-buying products and varying approaches of companies in the space, there could be multiple winners. As such, Parker89 has made multiple investments. Knock and Orchard both offer power buyer services via their lending arms (although Orchard’s is linked through its W-2 brokerage model), and Ribbon uses innovative debt financing and their industry network to enable real estate agents and lenders to offer power buying to consumers via the lender of their choice.

Even as transaction volume declines with rising interest rates, cash offers enable bidders to win with lower offers, so we expect demand for these products to remain strong.

Despite the current transition in the housing market, the trend toward a more digital real estate transaction will continue to build momentum in the months and years ahead. Forward-thinking real estate professionals and title and settlement providers will recognize the opportunity to work with lenders to continually enhance the real estate transaction and make sustained, long-term investments in innovations that drive the industry’s future.