Given the strong likelihood of rising mortgage rates in 2018, many savvy real estate market observers are curious how rising rates may impact demand, especially among millennial first-time home buyers. As part of our quarterly First American Real Estate Sentiment Index (RESI), we recently surveyed title insurance agents and real estate professionals across the nation for their perspective on how sensitive they thought first-time home buyers were to rising mortgage rates and at what rate they would withdraw from the market.

"Continued positive economic news and confidence that buyers will remain undeterred, even if rates exceed 5.5 percent, bode well for the real estate market in 2018."

Rising Rates and the First-Time Home Buyer

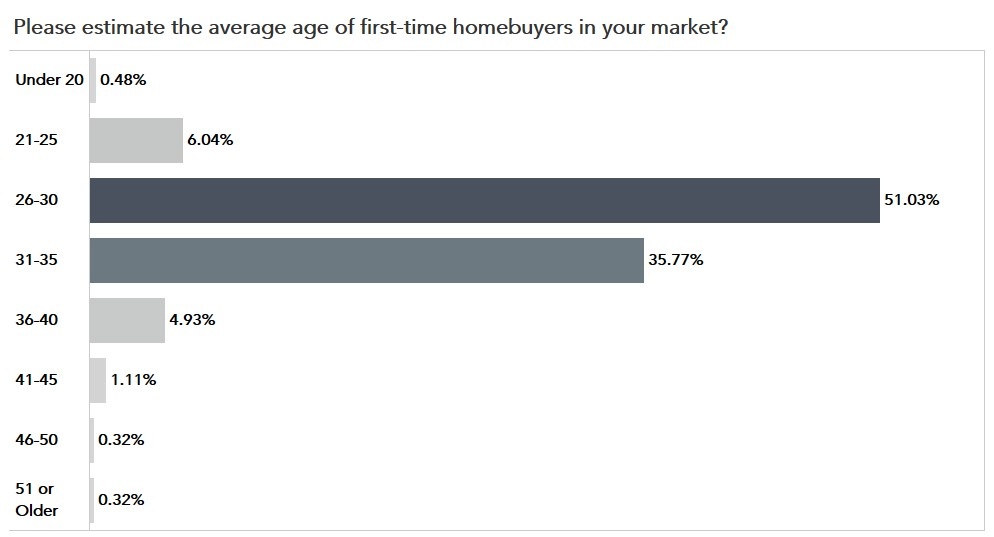

According to the title agents and real estate professionals surveyed, nearly 87 percent of first-time home buyers were in the prime home-buying age of 26-35, which corresponds with the millennial generation.

On a national level, the title agents and real estate professionals surveyed believe that mortgage rates would need to hit 5.6 percent, 1.0 percentage point above the current rate, before first-time home buyers withdraw from the market. We asked the same question in the first quarter of 2017, and title agents and real estate professionals cited 5.4 percent as the mortgage rate at which first-time home buyers would withdraw from the market.

The increase in the perceived mortgage rate tipping point for first-time home buyer demand indicates that survey respondents may see more runway in the current housing market. This may indicate they realize that the housing market is more resilient to mortgage rate increases than they thought a year ago.

Even though the Fed is widely expected to raise the Federal Funds rate multiple times this year, most forecasts suggest mortgage rates will just reach 5 percent. Based on our second quarter RESI results, purchase market demand should not be materially impacted by any modest increase in mortgage rates.

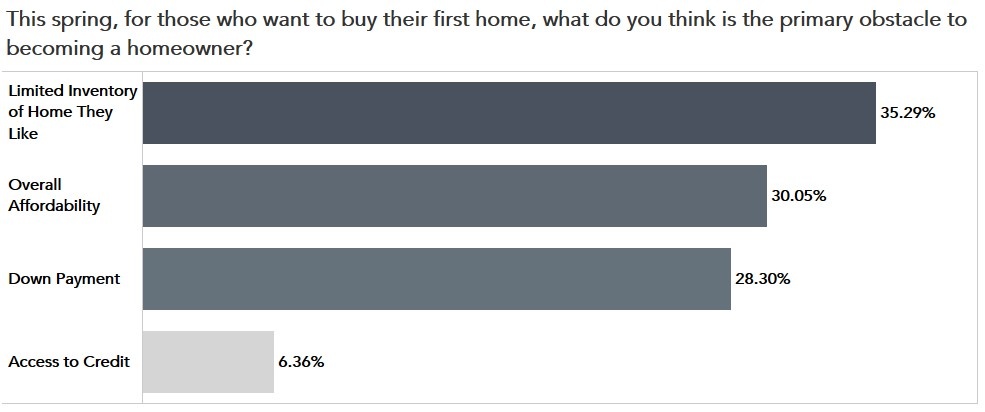

The No. 1 Obstacle to Home Buyers: Limited Supply

However, while rising interest rates may not deter first-time home buyers, lack of inventory might. When asked what the primary obstacle to becoming a homeowner was, 35.3 percent of title agents and real estate professionals responded with limited inventory of homes they like. The second most cited obstacle was overall affordability (30.1 percent), followed by down payment (28.3 percent). The housing market is facing its greatest supply shortage in 60 years of record keeping, according to the Federal Reserve Bank of Kansas City. The ongoing housing supply shortage will make it difficult for first-time buyers to find a home to buy, even when they are financially ready.

“Title agents and real estate professionals do not believe increasing mortgage rates will have a significant impact on the housing market in 2018. Continued positive economic news and confidence that buyers will remain undeterred, even if rates exceed 5.5 percent, bode well for the real estate market in 2018,” said Fleming. “However, more than a third of title agents and real estate professionals see limited supply as the primary obstacle to first-time home buyers.”

Purchase Market Outlook Remains Positive

Title agents and real estate professionals maintained an overall positive outlook for the purchase market, though the outlook for purchase sales growth was slightly less positive year over year. However, as might be expected, the outlook for growth in refinance transactions declined.

The title agents and real estate professionals surveyed expect residential house prices to increase by 4.2 percent in the next year. This is up 0.7 percentage points from last quarter, and 0.1 from the previous year. The expectation for further price appreciation is not surprising, given the market dynamics at play in the housing market today that are preventing more existing homeowners from selling their homes and potentially alleviating some of the supply shortage.

For Mark’s full analysis of the second quarter RESI, the top five states for residential transaction growth and price growth outlook, and more, please visit the Real Estate Sentiment Index.

Look for the next edition of the RESI in September 2018.