First American Chief Economist Mark Fleming was interviewed on CNBC yesterday and discussed the impact of rising interest rates on affordability and home-buying demand.

“When the rates rose last week, the mortgage market had already priced that in because they were expecting it. We’re seeing demand effectively being pulled forward. People are buying homes now because they expect future rate increases.”

Interview Transcription

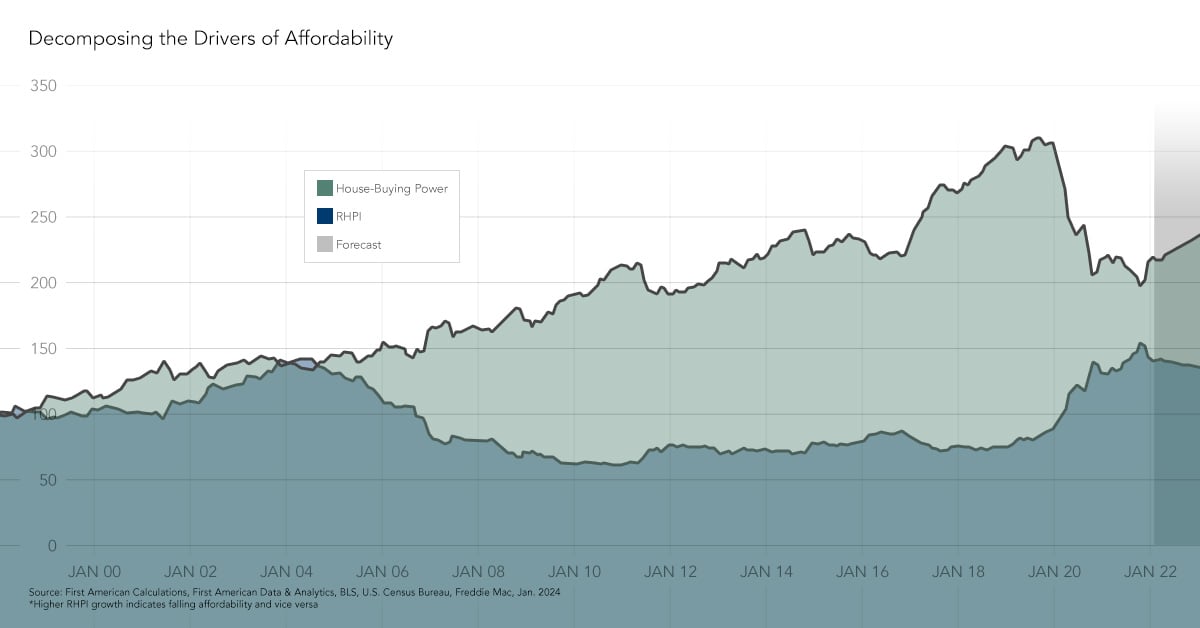

Mark: No, it’s not going to kill the bond market, I mean the mortgage market. I think mortgage rates moving up to 5 percent will reduce purchasing power for consumers about $20,000 for a typical homebuyer, but we actually saw that when the rates rose last week, the mortgage market had sort of already priced that in. They were already expecting it and we are seeing demand effectively being pulled forward. People are trying to buy homes now because they expect future rate increases. I was thinking as you were mentioning in that conversation just now, what would be just right for a mortgage rate? And 5 still seems low, maybe 6 is sort of not-too-hot not-too-cold, but just right for a mortgage rate.

Brian: You think so? Because nobody buys a house, Mark, as you know better than I do, based on the price. They buy the house based on the monthly payment. As rates go up, if prices don’t come down, the monthly payment just simply gets more expensive. Mark: Well you have to remember one of the reasons why rates are going up is because the economy is doing well, and wages are rising, and so your income is going up and that’s countering or offsetting the increased expense of mortgage rates. It’s not necessarily the case that it becomes a priori, sort of more expensive. The reason this is happening, the reason we are normalizing our price of money is because the economy is doing well.

Brian: You nailed it. That is the ultimate, key trillion-dollar question: will wages go up enough to mitigate the raise in interest rates that affect so many aspects, not just housing, in our lives.

Mark: Right. It’s a tug-of-war between the two, to see what, ultimately, the net effect becomes.

Brian: And what’s going to be the outcome according to First American and Mark Fleming?

Mark: I think people are still going to buy homes. House price appreciation will cool down, but people are going to want to buy homes not because the mortgage rate has gone to 5 and a half percent, they buy homes because they want that lifestyle of being a homeowner.

Brian: But you combine that with this salt reduction, the deduction of the reduction for mortgage interest. It’s kind of a double whammy.

Mark: Yeah, you have to remember: I don’t know about you but when I was buying my first home, was I worrying about the tax implications in the decision to buy? Not so much. I made the decision to buy and then I figured out how much I could afford. I think those who are potential first-time home buyers, that calculation happens in that two-step process. You are not going to not buy because someone has taken away a deduction from you a year ago.