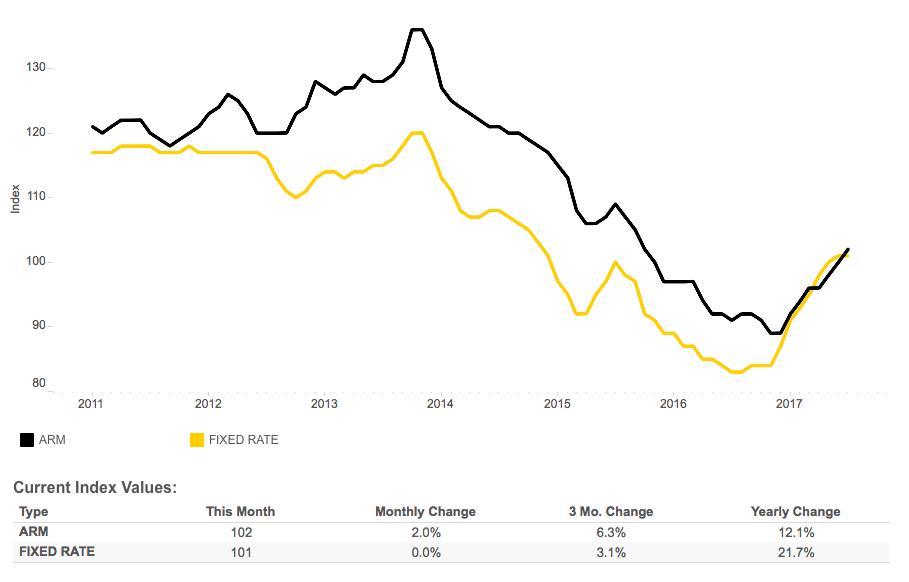

We’ve posted the July First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index remained the same in July 2017 as compared with the previous month, and increased 20.0 percent as compared to July 2016. The Defect Index is down 17.6 percent from the high point of risk in October 2013.

“Rates may rise and adjustable-rate mortgages may be more attractive, but the Fed’s actions won’t impact loan defect risk.”

“An adjustable-rate mortgage can be a good alternative to a fixed-rate mortgage in a rising rate environment, but they have historically had more fraud and misrepresentation risk,” said Mark Fleming, chief economist at First American. “Yet, this year the risk gap has closed. Rates may rise and adjustable-rate mortgages may be more attractive, but the Fed’s actions won’t impact loan defect risk.”

For the list of high risk markets with the fastest growing defect risk, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.