We’ve posted the February First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications.

“Increased share of higher risk purchase transactions and the potential for more adjustable rate mortgages amid the expected strong spring market means mortgage lenders should remain watchful for defect and fraud risk.”

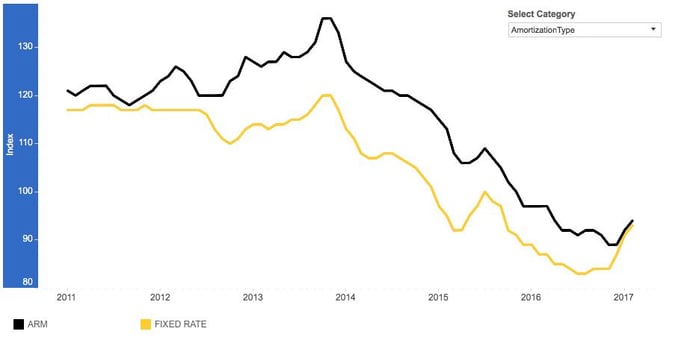

The Defect Index increased 4.1 percent in February 2017 as compared with the previous month, and increased 1.3 percent as compared to February 2016. The Defect Index is down 25.5 percent from the high point of risk in October 2013.

“This month, the Loan Application Defect Index surged higher as rising mortgage rates continue to put downward pressure on lower risk mortgage refinance activity. The March rate increase by the Federal Open Market Committee and strong economic performance will continue to pressure rates upward,” said Mark Fleming, chief economist at First American. “As the spring home buying season gets underway in earnest, the volume of higher risk purchase applications will grow and further increase loan application defect and fraud risk.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.