Global events and uncertainty, such as the conflict between the U.S. and Iran, clearly impacts geopolitical relations, but also impacts the U.S. economy, and more specifically, the U.S. housing market. How? Against a backdrop of uncertainty, investors worldwide look for a safe place to put their money. U.S. bonds, backed by the full faith and credit of the U.S. government, are widely considered the safest investments in the world. When global investors sense increased uncertainty, there is a “flight to safety” in U.S. Treasury bonds, which causes their price to go up, and their yield to go down – U.S. home buyers benefit from this dynamic.

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

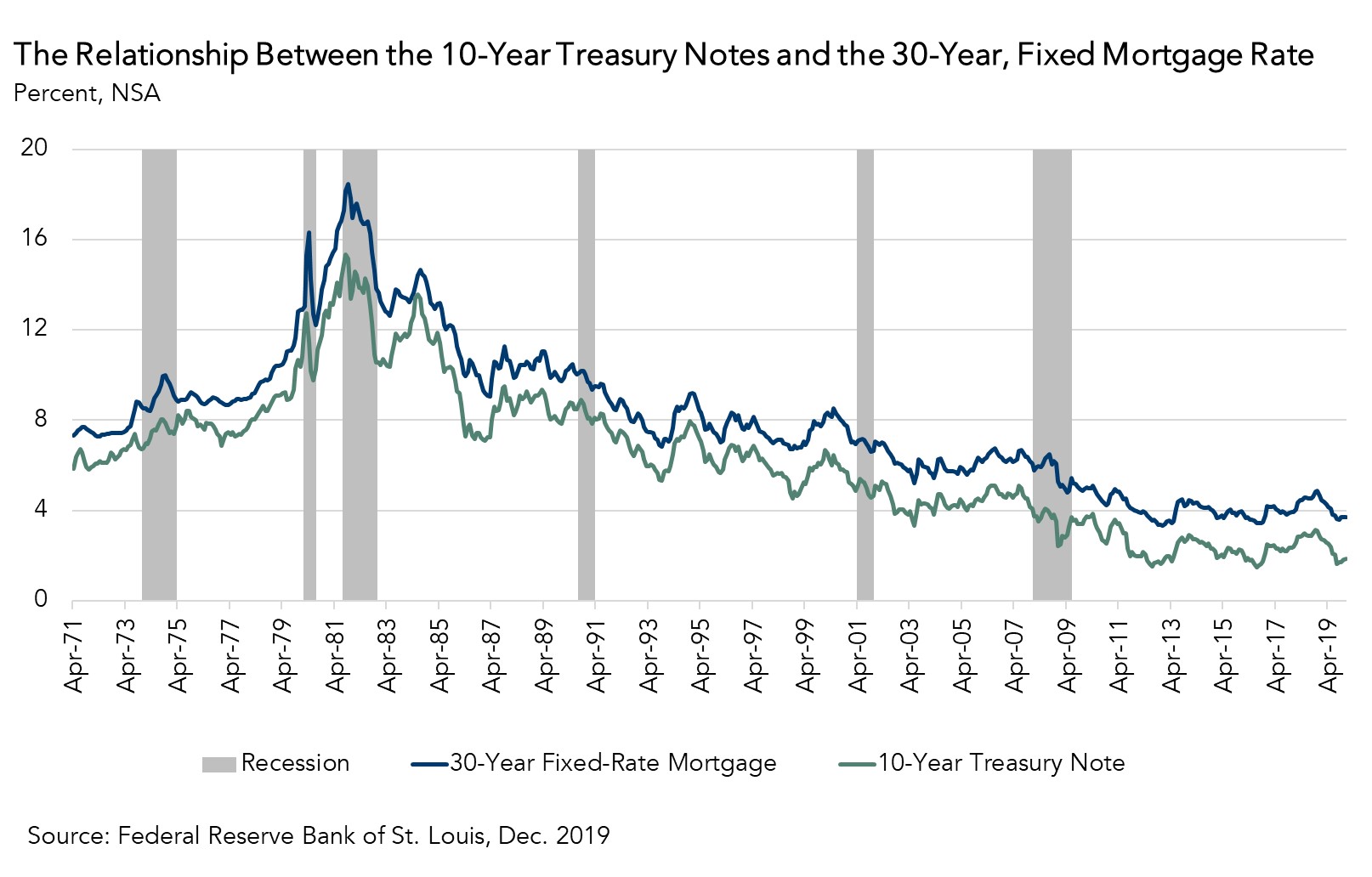

The popular 30-year, fixed-rate mortgage closely follows the 10-year Treasury bond. In fact, as shown in the chart below, since the end of the recession, the 30-year, fixed-rate mortgage has on average remained 1.7 percentage points higher than the 10-year Treasury bond yield. If that trend remains consistent, and the 10-year Treasury yield dips to 1.5 percent because of increased uncertainty and a global “flight to safety”, then the 30-year, fixed-rate mortgage rate could dip as low as 3.2 percent. The 30-year, fixed-rate mortgage fell to its lowest level in a month in response to the decline in the 10-year treasury yield on the morning after the U.S. airstrike in Iran.

Looking Back

There are several examples of political events causing significant changes to the 10-year Treasury bond and, consequently, of the 30-year, fixed mortgage rate. The second-largest shift in the 30-year fixed mortgage rate since the end of the Great Recession occurred following the 2016 presidential election. In the week after the election, the mortgage rate increased from 3.57 on November 10 to 3.94 on November 17. A few months earlier, in the weeks following the “Brexit” vote on June 23, 2016 in the United Kingdom, the U.S. Treasury bond yield declined by 0.29 percentage points and produced a 0.15 percentage point decline in the mortgage rate. More recently, the decline in mortgage rates since the beginning of 2019 has been partly due to uncertainty around the outcome of U.S.-China trade relations, including the largest single-week decline in the mortgage rate (0.22 percentage points) since the end of the Great Recession in March 2019.

Amid Uncertainty, Housing Benefits

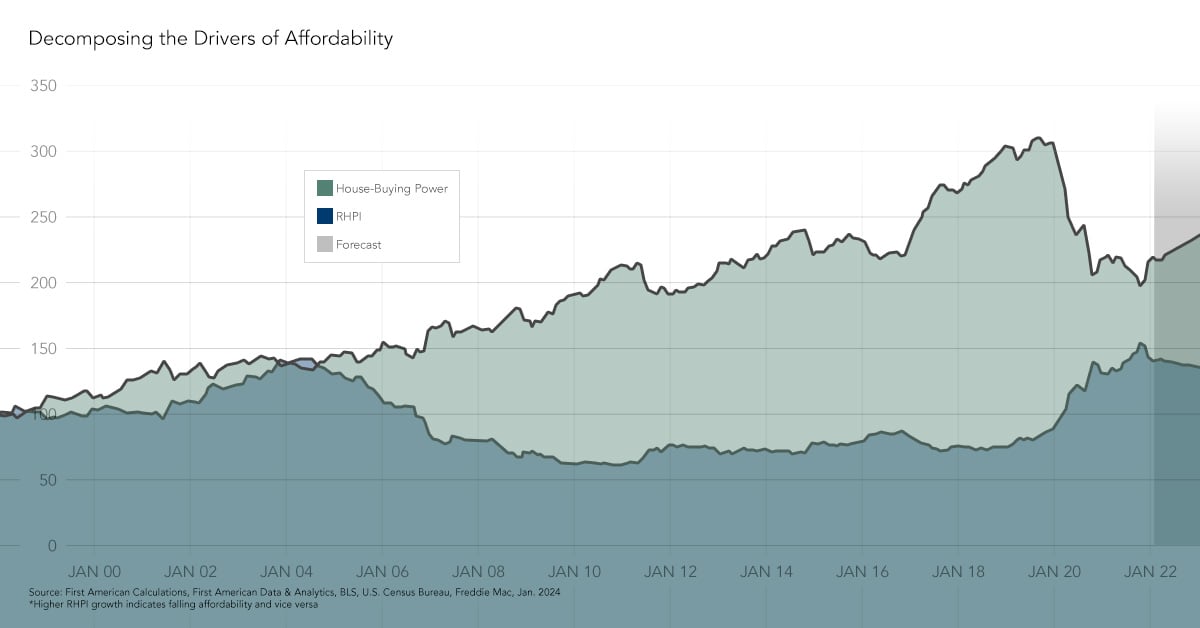

While global uncertainty can reduce domestic consumer confidence in their own economic future and cause potential home buyers to hesitate before purchasing the largest durable consumer good of their lifetime, a home, there is a benefit too. In our Real House Price Index for the month of October, the 10-year Treasury yield was 1.7 percent and the 30-year, fixed mortgage rate was 3.7 percent. With an average national household income of approximately $66,400, consumer house-buying power, the combination of one’s income and the prevailing mortgage rate, was $418,200. Even a small change in the 10-year Treasury due to increased uncertainty, let’s say a slight drop to 1.6 percent, would imply a 30-year, fixed mortgage rate as low as 3.3 percent. Assuming no change in household income, that would mean a house-buying power gain of $21,000, a five percent increase. Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.