Why the Labor Market May Recover Faster than Previous Recessions

By

Odeta Kushi on May 6, 2020

The coronavirus pandemic continues to significantly impact the domestic and global economy. Weekly unemployment claims in April have broken records and consumer confidence has declined with the worsening economic conditions. More than 18 percent of the labor force has claimed unemployment in the past six weeks. Less than two months ago, the ...

Read More ›

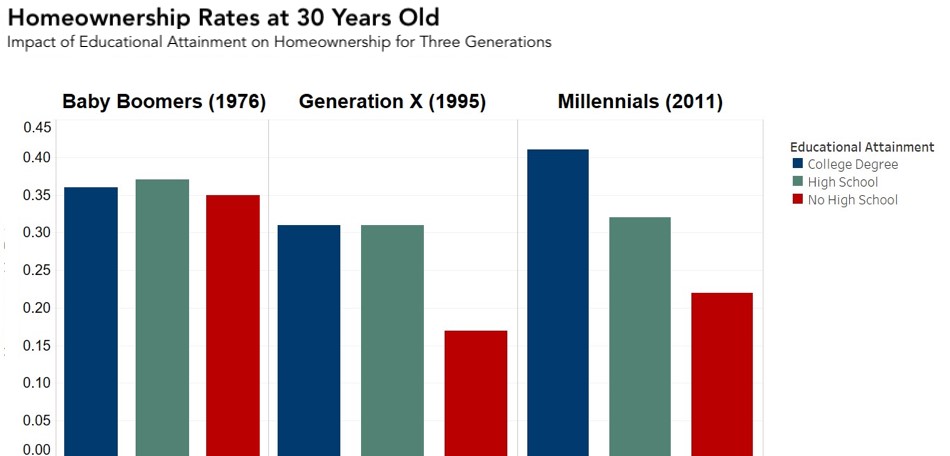

Why Education is the Best Investment for Homeownership

By

Mark Fleming on September 7, 2018

Whether students are beginning middle school or their last year of college, back-to-school season is here. Although many students may grimace when they hear “back to school,” they won’t regret pursuing a higher education as adults as they compete for well-paying jobs and one day, hopefully, buy a home.

Read More ›

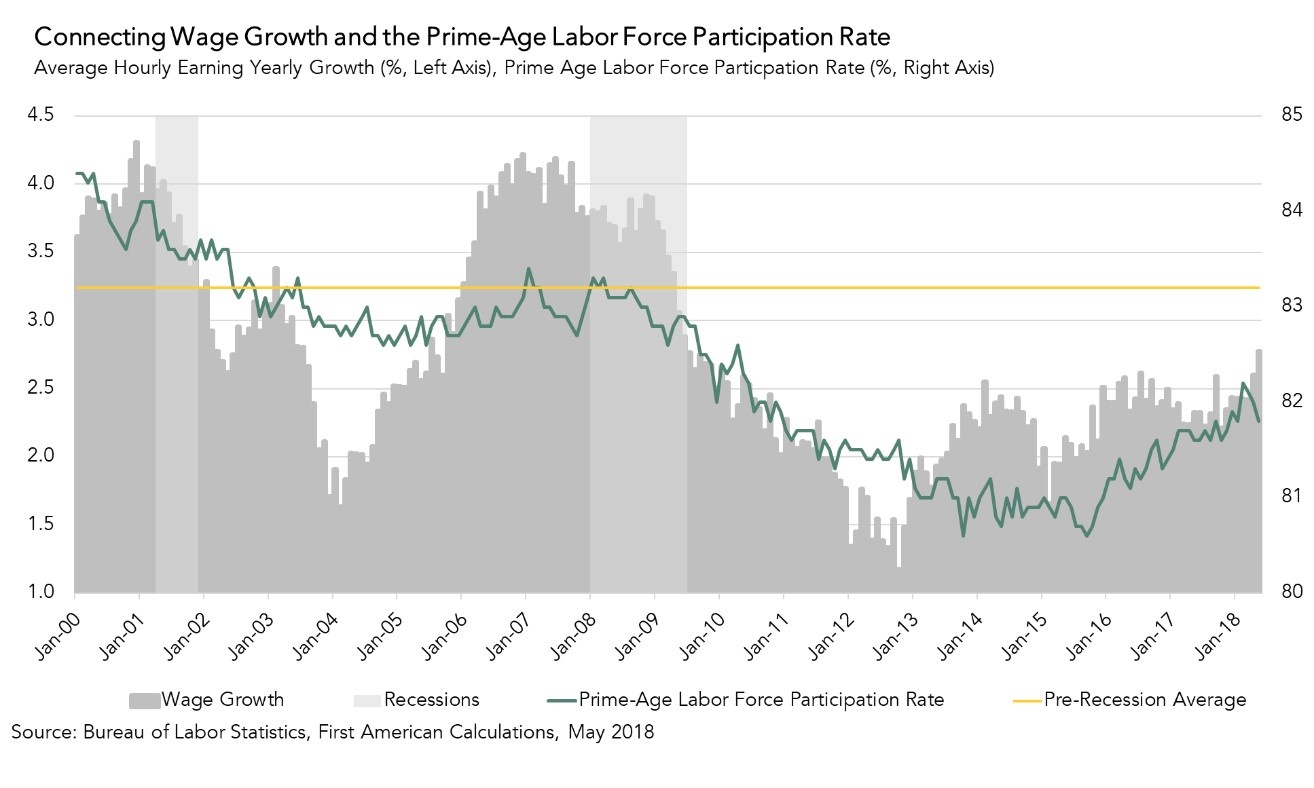

What Does the Prime-Age Labor Force Participation Rate Mean to Your Paycheck?

By

Mark Fleming on June 2, 2018

The Bureau of Labor Statistics’ employment situation report for May signals good news for the housing market, as the unemployment rate hits an 18-year low, and hourly wages continue to increase.

Read More ›

Why the Ability-to-Repay Rules are Like a Steering Wheel Lock

By

Mark Fleming on May 30, 2018

In January of 2013, the mortgage industry witnessed the birth of a new income-underwriting era. The Consumer Finance Protection Bureau (CFPB) published new requirements for mortgage lenders to carefully assess a consumer’s ability to repay their mortgage loan. The new standards were dubbed the “ability-to-repay” rules and were set to take effect ...

Read More ›

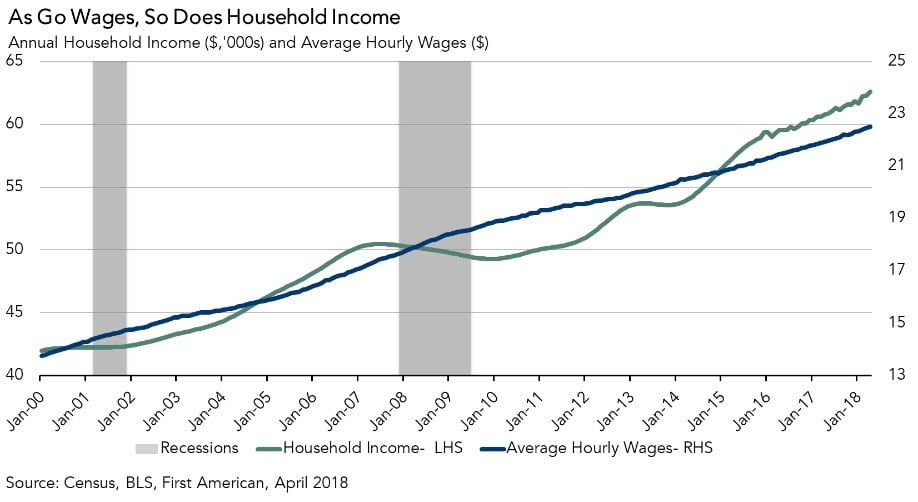

The Link Between Wage Growth and House-Buying Power

By

Mark Fleming on May 5, 2018

Yesterday, the Bureau of Labor Statistics released the employment situation report for April. Here are the highlights. Total non-farm payroll jobs increased by 164,000 in April. In fact, total non-farm payroll jobs have now increased every month since October 2010. Since that date, the U.S. economy has added more than 17.5 million jobs. The ...

Read More ›

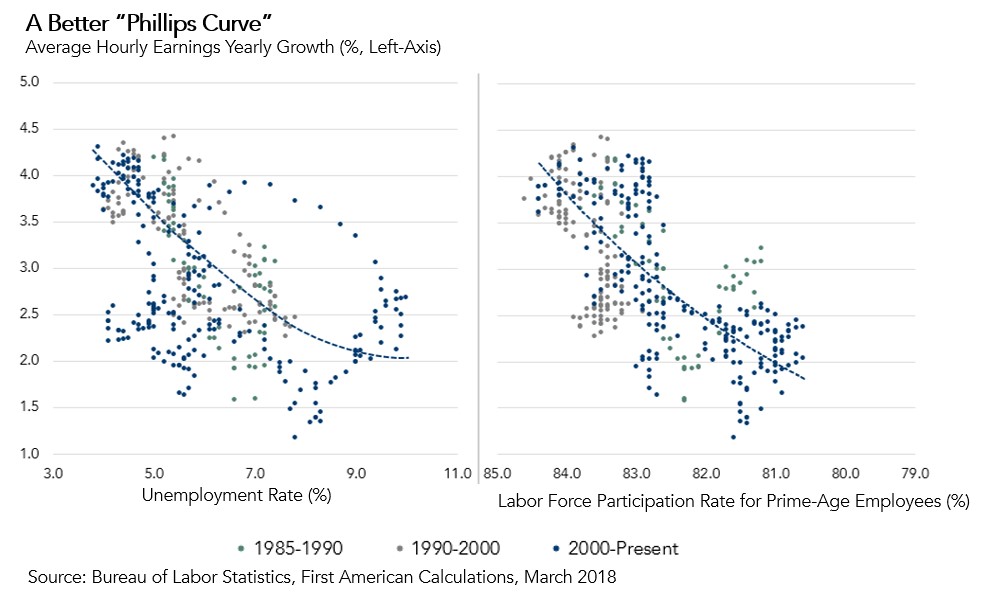

Will Wage Growth Continue -- One Number May Tell the Story

By

Mark Fleming on April 6, 2018

Today, the Bureau of Labor Statistics released the employment situation report for March. Here are the headlines. Total non-farm payroll jobs increased by 103,000 in March. Total non-farm payroll jobs have increased every month since October 2010. Since that date, the U.S. economy has added more than 17.5 million jobs. The unemployment rate ...

Read More ›