Sales Activity Driven by the Five Ds Amid Persistent Market Headwinds

By

Odeta Kushi on April 10, 2024

Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales based on the historical relationship between sales, demographic trends, house-buying power, and the prevailing financial and economic conditions. Based on our nowcast, we expect March existing-home sales to rise 1.7 percent compared with February, but remain approximately 16 ...

Read More ›

Interest Rates Federal Reserve Mortgage Rates Existing-Home Sales

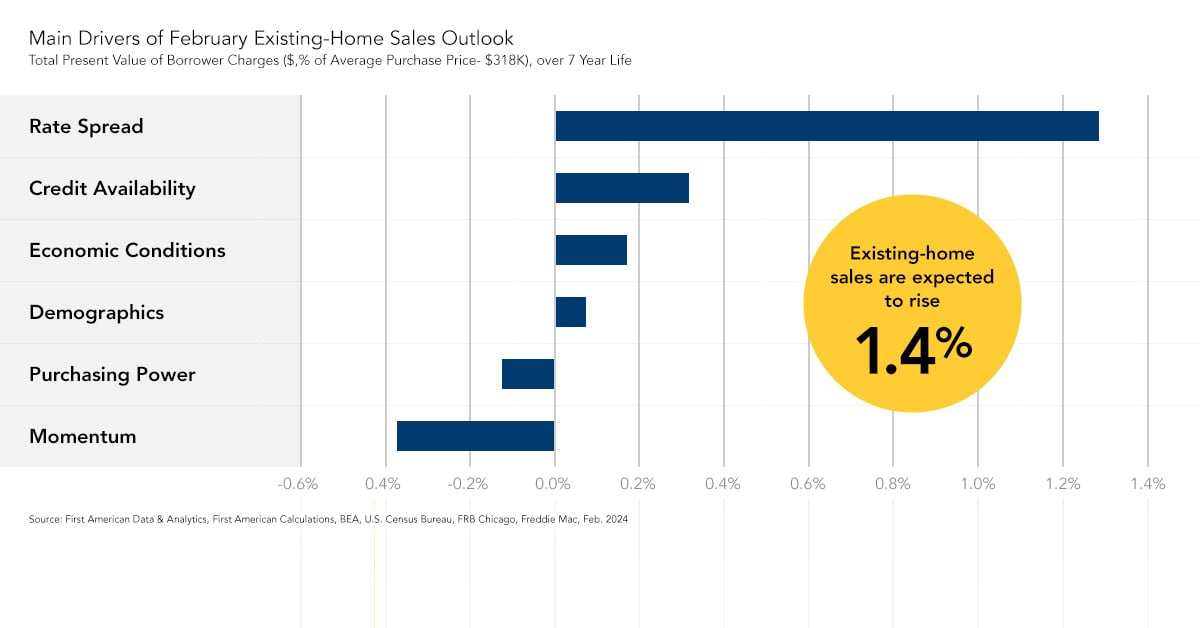

New Existing-Home Sales Outlook Report Projects February Uptick in Sales, Despite Rising Mortgage Rates

By

Mark Fleming on March 13, 2024

On average, nearly 40 percent of all existing-home sales in a year occur during the spring home-buying season between April and June. The warming weather and the end of the academic school year make for a more optimal time to move and fuel the seasonal increase in housing market activity. In the spring of 2023, home sales were lackluster. Housing ...

Read More ›

Interest Rates Federal Reserve Potential Home Sales Mortgage Rates

The Good, the Bad and the Maybe Ahead of Spring Home Buying

By

Mark Fleming on March 19, 2021

In February 2021, housing market potential increased to its highest level since 2007, despite the largest month-over-month jump in mortgage rates since October 2019. Housing market potential rose 1.3 percent in February relative to the previous month, and 12.2 percent year-over-year. While rising average tenure length was the largest drag on ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

Is the Economy Stuck in Neutral?

By

Odeta Kushi on February 3, 2021

When determining where to set the federal funds rate, the Federal Reserve studies a multitude of models and analyses, including the neutral rate of interest. The neutral “what” you ask? The neutral rate of interest is the short-term interest rate that would prevail when the economy is at full employment and stable inflation. The Fed may choose to ...

Read More ›

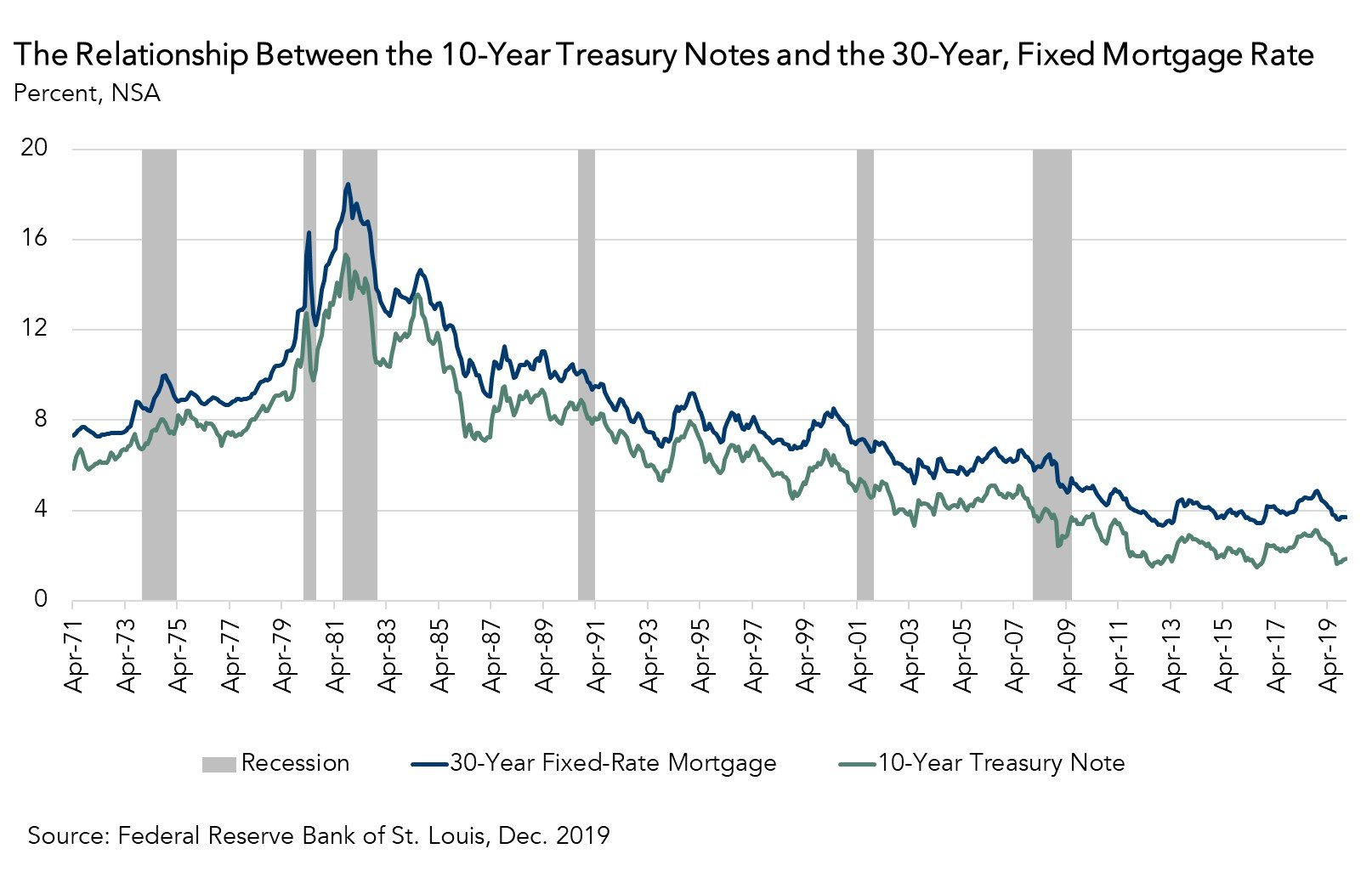

Are Negative Mortgage Rates on the Horizon?

By

Odeta Kushi on March 18, 2020

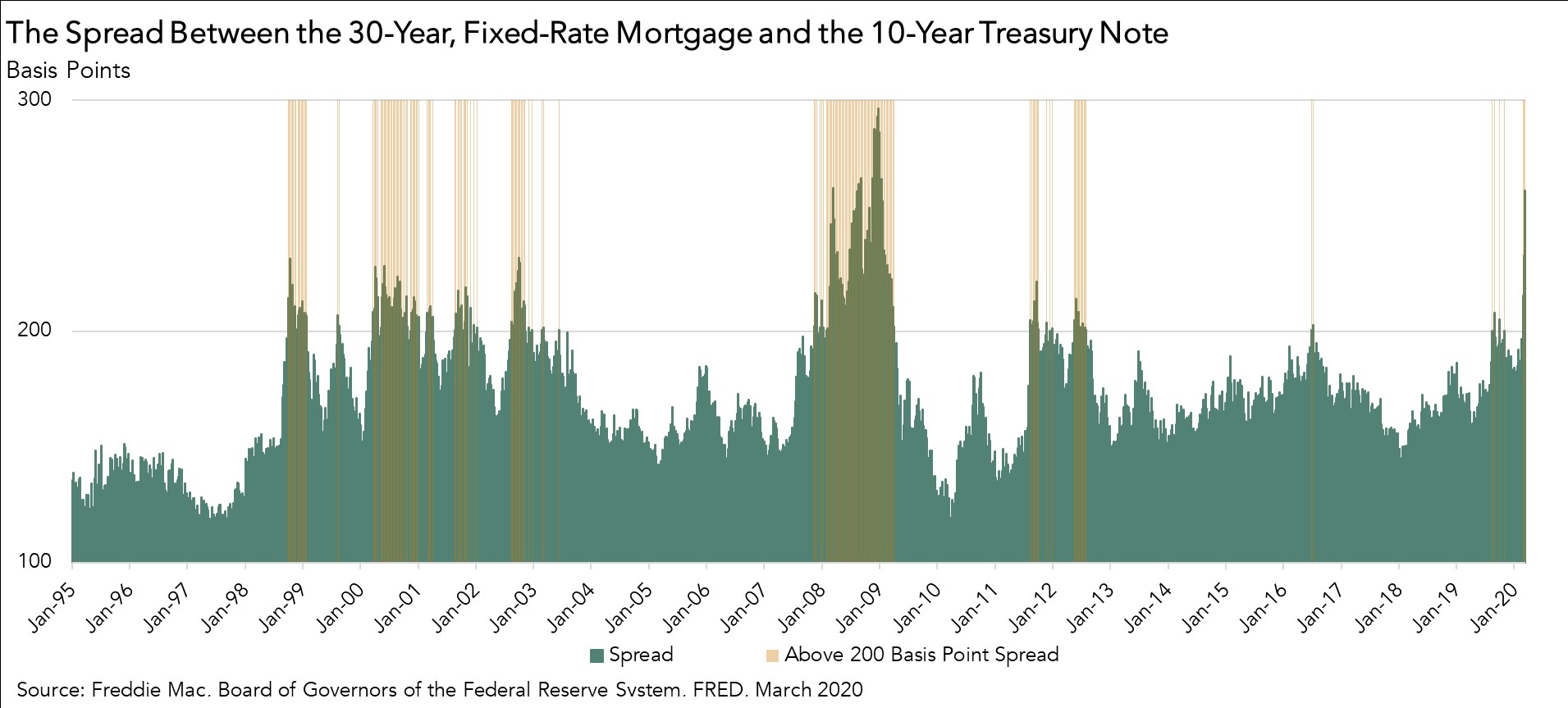

Given both emergency rate cuts of the Federal Reserve and the recent economic uncertainty due to the spread of the Coronavirus, the 10-year Treasury yield dropped to its lowest level in 150 years, according to Nobel Laureate Robert Shiller. For added perspective, that takes us back to the time of Ulysses S. Grant’s presidency. The 10-year Treasury ...

Read More ›

What Global Uncertainty Means for the Housing Market

By

Mark Fleming on January 10, 2020

Global events and uncertainty, such as the conflict between the U.S. and Iran, clearly impacts geopolitical relations, but also impacts the U.S. economy, and more specifically, the U.S. housing market. How? Against a backdrop of uncertainty, investors worldwide look for a safe place to put their money. U.S. bonds, backed by the full faith and ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Affordability