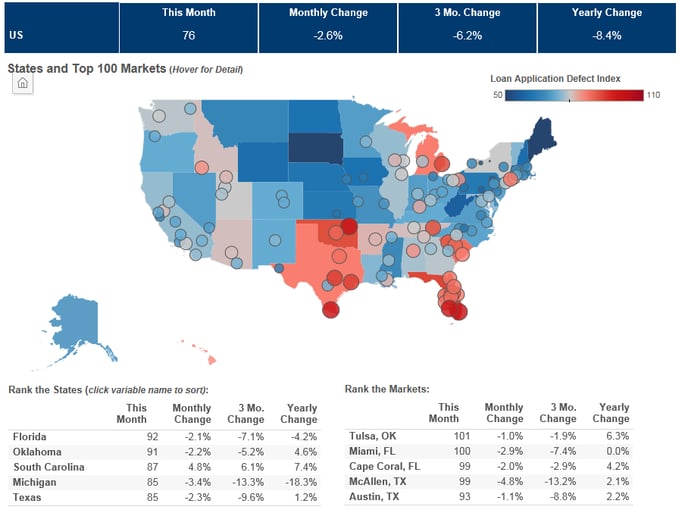

We’ve posted the December First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. Overall, the index fell 2.6 percent in December as compared with November and decreased by 8.4 percent as compared with December 2014.

“Iowans may be up very late next week caucusing, but this is one state that doesn’t keep me awake at night worrying about mortgage fraud risk.”

With the Iowa caucus, opening this year’s presidential election process, less than a week away, the team took a close look at the state of defect, fraud and misrepresentation risk in the state. Iowa defect and misrepresentation risk has declined by almost nine percent in the past year and has one of the lowest levels of risk among all 50 states. Misrepresentation and fraud risk has declined 23 percent from Iowa’s high point in September 2014. Among the largest 100 markets in the country, Des Moines is the fifth least risky market, only Syracuse, N.Y.; Rochester, N.Y.; Harrisburg, Pa. and Greensboro, S.C. are less risky.

"The presidential campaign goes into full swing next week with the opening caucus in Iowa. The state’s level of defect and misrepresentation risk is one of the lowest in the country, making Des Moines one of the least risky major markets," said Mark Fleming, Chief Economist at First American. "Iowans may be up very late next week caucusing, but this is one state that doesn’t keep me awake at night worrying about mortgage fraud risk."

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.