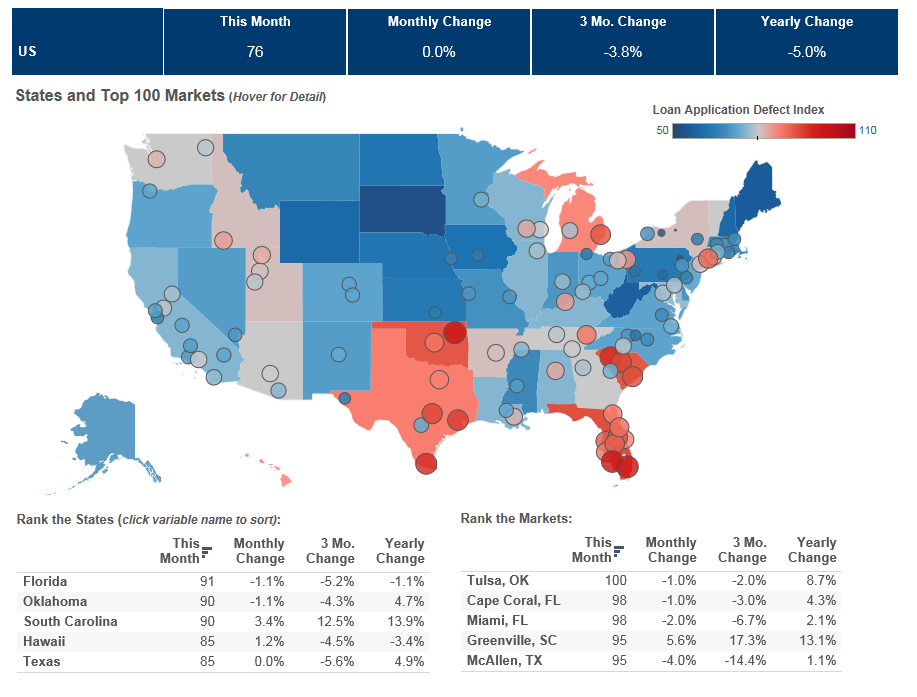

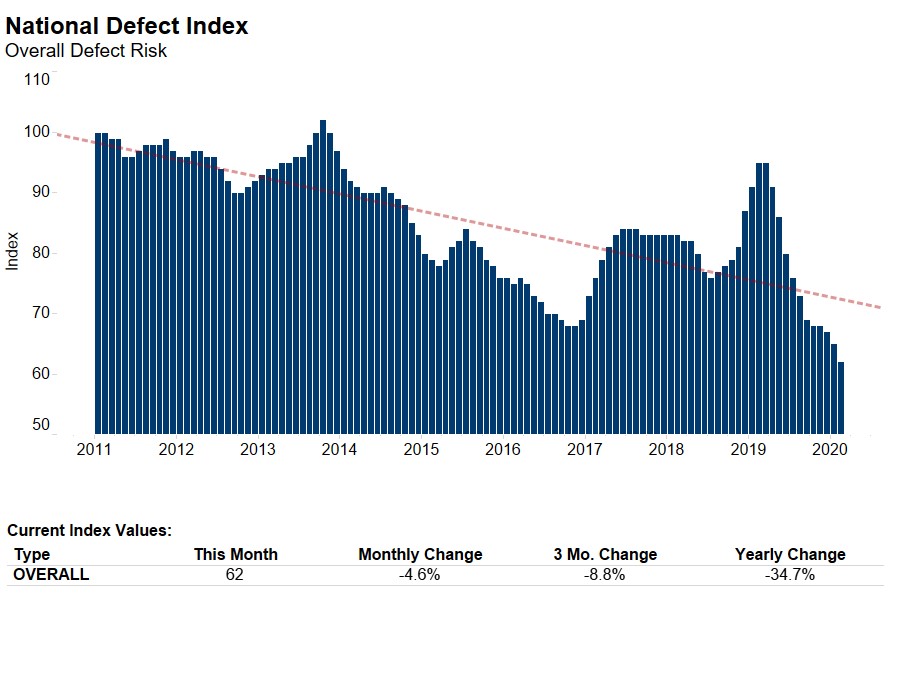

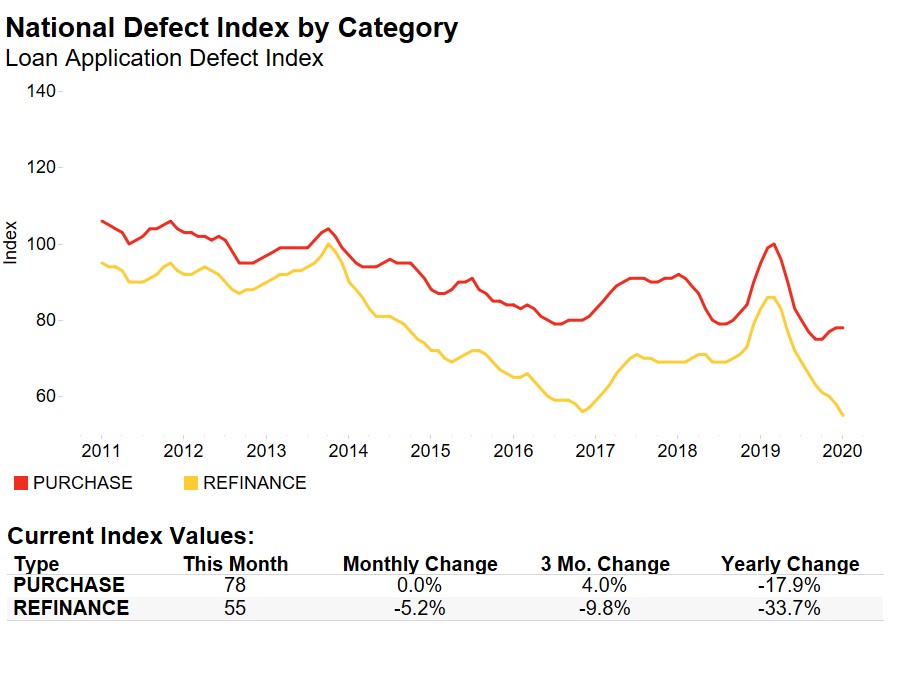

We’ve posted the January First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The index remained unchanged in January as compared with December and decreased by 5.0 percent as compared with January 2015. The Defect Index has fallen 3.8 percent over the last three months, and January was the sixth consecutive month without an increase in defect and misrepresentation risk. The index remains at its lowest point since its inception.

As Super Tuesday fast approaches on March 1, and with its likely important implications for the summer conventions of both the Democrats and Republicans, we consider the state of defect, fraud and misrepresentation risk in the major Super Tuesday states.

"Even though defect and fraud risk in loan applications is declining overall in Super Tuesday states, rising misrepresentation and fraud risk in key states like Texas only serve to remind us of the importance of safeguarding the mortgage market against fraud to protect the American Dream for those who could benefit most."

Only three of the 14 Super Tuesday states have increasing year-over-year defect risk – Texas, Oklahoma and Virginia – with risk increases of 4.9 percent, 4.7 percent, and 2.9 percent respectively. Yet, even though defect risk is increasing in Texas and Virginia and these states have large populations relative to most of the other Super Tuesday states, in aggregate defect and fraud risk in Super Tuesday states is declining on a year-over-year basis.

"While housing and homeownership have received little attention on the campaign trail, it is critically important to wealth creation, particularly for the majority of lower- and middle-class Americans," said Mark Fleming, chief economist at First American. "Even though defect and fraud risk in loan applications is declining overall in Super Tuesday states, rising misrepresentation and fraud risk in key states like Texas only serve to remind us of the importance of safeguarding the mortgage market against fraud to protect the American Dream for those who could benefit most."

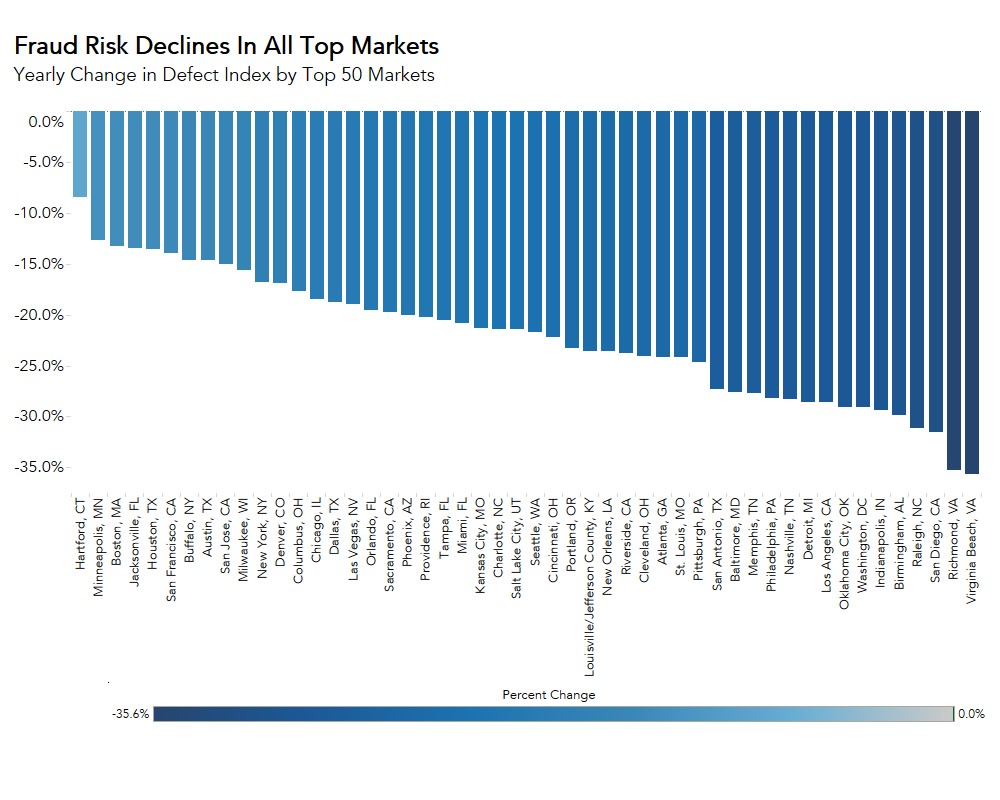

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.