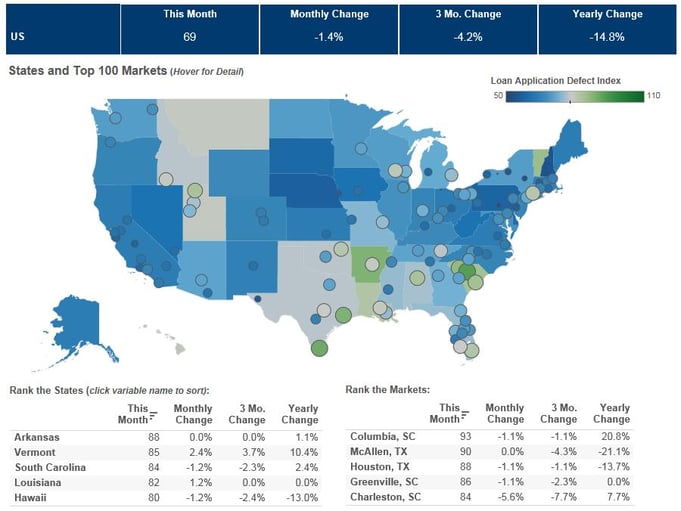

We’ve posted the September First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.4 percent in September as compared with August and decreased by 14.8 percent as compared to September 2015. The Defect Index is down 32.3 percent from the high point of risk in October 2013.

“Defect, fraud and misrepresentation risk is falling practically everywhere in the country, and falling to very low levels in some markets.”

“Defect, fraud and misrepresentation risk is falling practically everywhere in the country, and falling to very low levels in some markets,” said Mark Fleming, chief economist at First American. “The widespread implementation of data- and technology-enabled loan manufacturing processes is benefiting consumers across the country. The mortgage finance industry continues to improve, producing loans with fewer defects and producing those loans right the first time.”

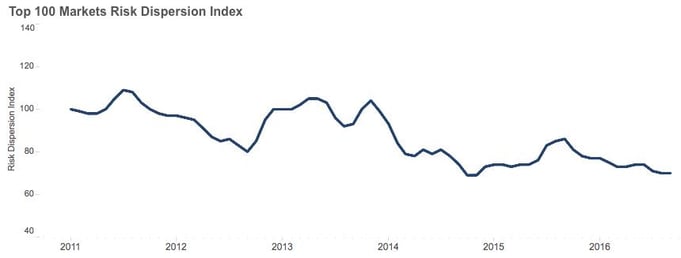

“The defect risk levels across different markets are becoming more homogenous because the benefits of more robust and data-driven loan production processes apply equally from market to market,” said Fleming. The dispersion, or amount of difference in defect risk across markets, has declined 18.6 percent over the past year.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.