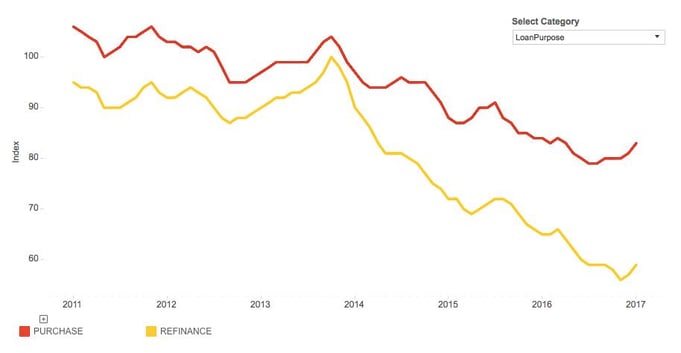

We’ve posted the January First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 5.8 percent in January 2017 as compared with the previous month, and decreased 3.9 percent as compared to January 2016. The Defect Index is down 28.4 percent from the high point of risk in October 2013.

“In real estate, location matters. In defect, misrepresentation and fraud risk, loan purpose matters.”

“This month, the Loan Application Defect Index continued the upward trend that started in December 2016. The overall index increase is largely the result of waning refinance activity in the mortgage market,” said Mark Fleming, chief economist at First American. “Defect, misrepresentation and fraud risk is significantly lower on refinance transactions, so the increased risk of misrepresentation and fraud is due to the increasing share of higher risk purchase transactions within the mortgage market.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.