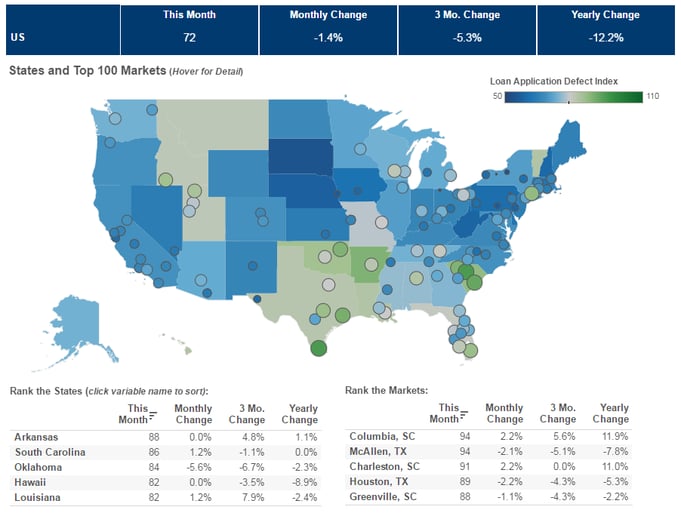

We’ve posted the June First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.4 percent in June as compared with May and decreased by 12.2 percent as compared with June 2015. The Defect Index is down 29.4 percent from the high point of risk in October 2013.

“We expect the declining loan application defect risk trend to continue into July, as the impacts of ‘Brexit’ and global uncertainty keep rates low, triggering an increase in the volume of lower risk refinance loan applications.”

The Defect Index has fallen 5.3 percent over the last three months. The index has been reaching new lows this year, continuing its long-term trend. Since its inception, the Defect Index has been consistently trending lower, apart from the increases in risk in 2013 and early 2015.

“There are two factors driving the long-term decline in the Defect Index, the impact of improvements to the systems and production standards mitigating risk throughout the lending industry, and the continued strength of refinance application activity due to low mortgage rates, said Mark Fleming, chief economist at First American. “We expect the declining loan application defect risk trend to continue into July, as the impacts of ‘Brexit’ and global uncertainty keep rates low, triggering an increase in the volume of lower risk refinance loan applications.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.