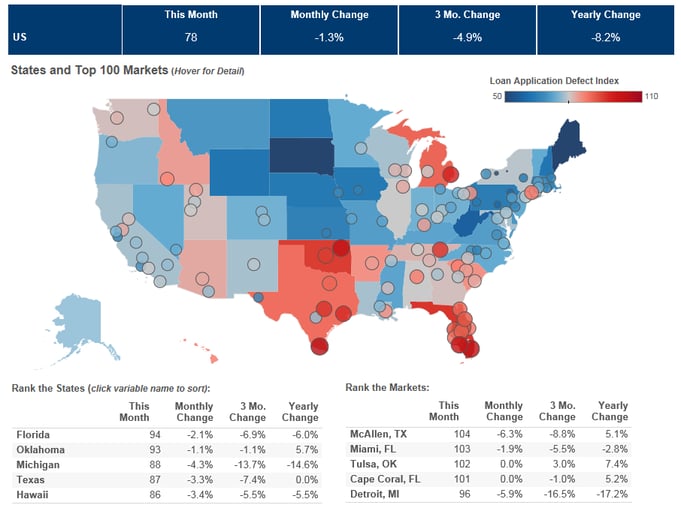

We've posted the November First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. Overall, the index fell 1.3 percent in November as compared with October and decreased by 8.2 percent as compared with November 2014.

"Multi-unit investment properties jump out as significantly more prone to loan application defect risk than other occupancy or property types."

"While fraudulent and misrepresentative loan applications are continuing to decline, a few large markets remain at risk. In particular, the concentration of risk in Florida is a concern. All the major metropolitan areas in Florida are above the national average, and Miami ranks second among the top 100 markets nationally," said Mark Fleming, chief economist at First American. "Luckily, while the risk of loan defects in Florida is significantly higher than the national average, the risk is following the same downward trend as the national average. In fact, fraud and misrepresentation risk is down 7 percent over the last three months."

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.