First American’s proprietary Real House Price Index (RHPI) looks at June 2016 data and includes analysis from First American Chief Economist Mark Fleming explaining the influence of foreign monetary stimulus on U.S. mortgage rates and its impact on consumer house-buying power.

“Counter to the conventional wisdom that housing is becoming less affordable in most markets, many house-hunters reaped the benefit of improving affordability in June.”

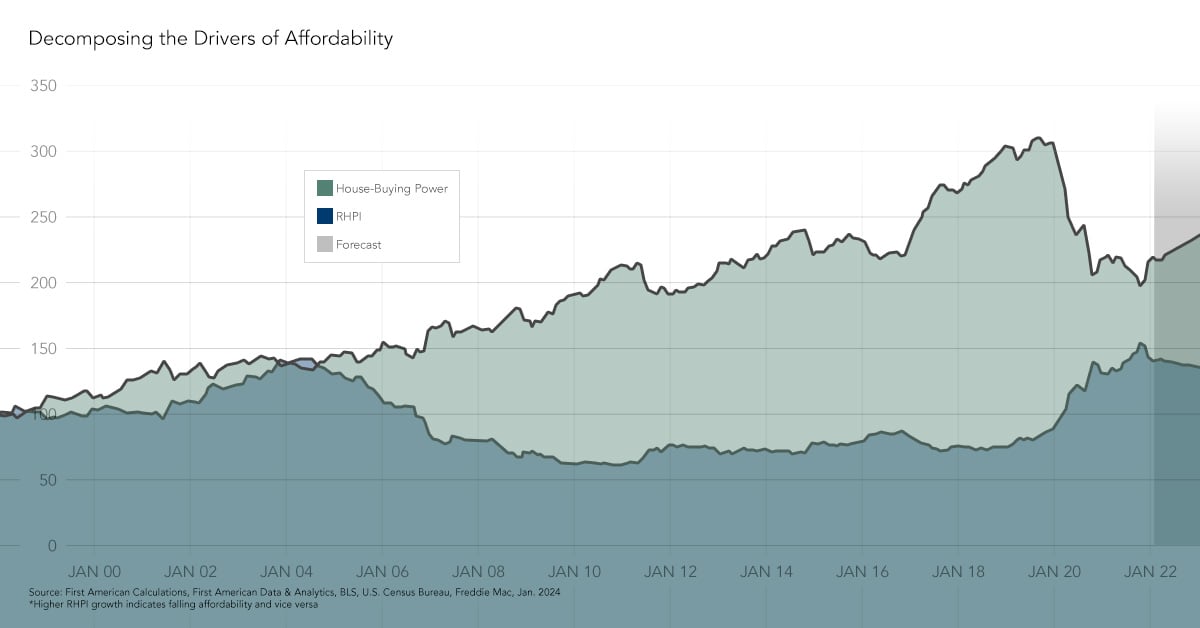

“The monetary policy in parts of Europe and Asia continues to drive investors to the relatively higher returns of U.S. Treasury bonds. The benefit to the average American consumer? Historically low mortgage rates and surging house-buying power, contributing to gains in affordability that many people overlook,” said Mark Fleming, chief economist at First American. “Counter to the conventional wisdom that housing is becoming less affordable in most markets, many house-hunters reaped the benefit of improving affordability in June.”

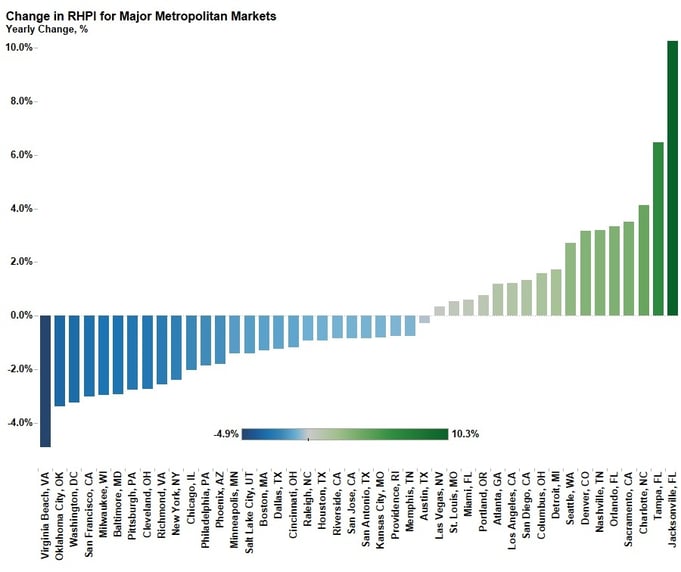

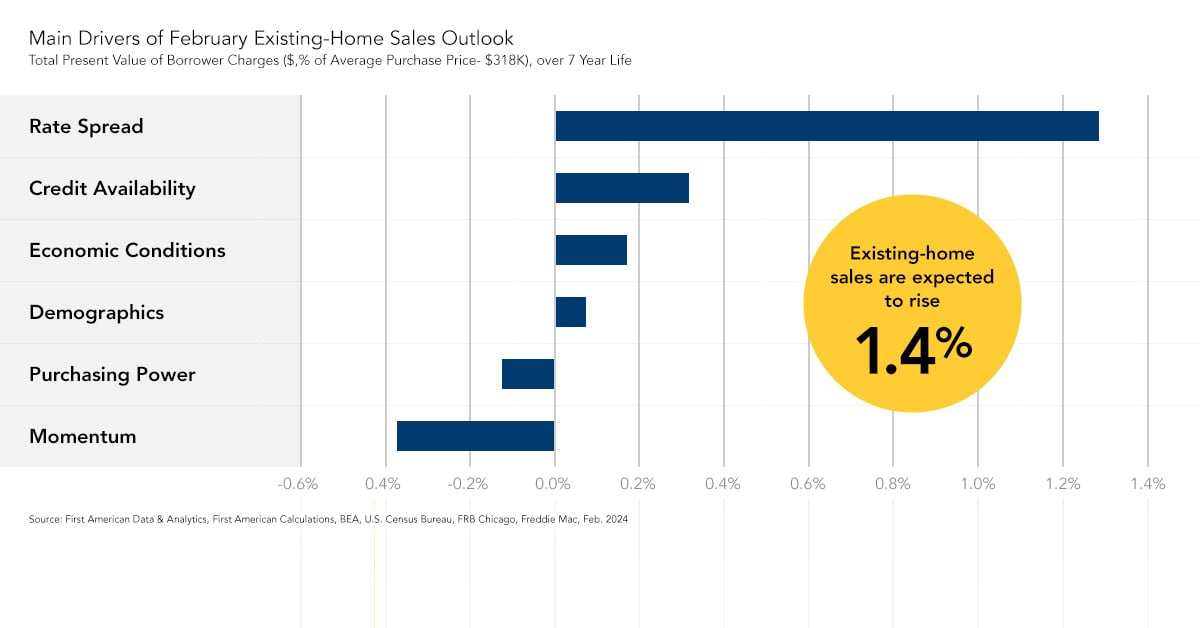

The RHPI offers an alternative view of the change over time of house prices at the national, state and metropolitan area level. It measures the price changes of single-family properties throughout the U.S. adjusted for the impact of income and interest rate changes on consumer house-buying power. Because the RHPI adjusts for house-buying power, it is also a measure of housing affordability.

For Mark’s full analysis on affordability, the top five states and markets with the greatest increases and decreases in real house prices, and more, please visit the Real House Price Index.

The RHPI will be updated monthly with new data, so look for the next edition of the RHPI on September 19.