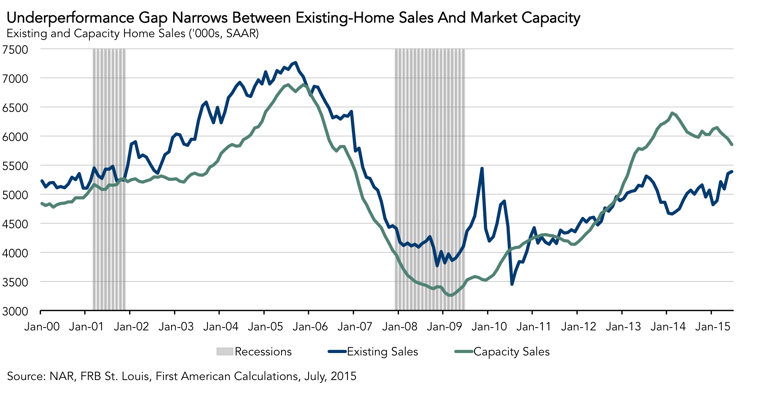

Housing market improving as underperformance gap between existing-home sales and market capacity shrinks.

First American’s proprietary Existing-Home Sales Capacity (EHS-C) model provides a gauge on whether existing-homes sales are under capacity or over capacity based on current market fundamentals. For the month of June, the EHS-C rate decreased by 1.7 percent compared to May and by 3.6 percent compared to a year ago. The seasonally adjusted, annualized rate (SAAR) of existing-home sales capacity is up 79.3 percent from the low point of sales reached in February 2009*.

The EHS-C seasonally adjusted, annual rate of sales decreased by 102,000 in June. The strengthening labor market, as indicated by the decline in the unemployment rate from 5.5 percent in May to 5.3 percent in June, provided upward momentum to capacity sales. The increase in mortgage rates and further slow-down in house price appreciation sufficiently countered the upward momentum with the net effect of a month over month decline.

EHS-C is down 547,000 (SAAR) from the most recent peak in February 2014.The gap between market capacity and actual existing-home sales continues to improve. The current underperformance gap is 461,000 existing-home sales at a seasonally adjusted annual rate, significantly reduced compared to the sales capacity gap of 1.7 million existing-home sales in February 2014.

The increasing pace of actual home sales and the decreasing pace of growth in the market’s capacity for existing-home sales continue to reduce the underperformance gap in the market. Based on our model, the market capacity for existing-home sales currently reflects the influence of slower price appreciation and modestly increased rates, although global uncertainty has added some volatility in recent weeks.

Early forecaster estimates for June existing-homes sales predict an increase to 5.45 million seasonally adjusted at an annual rate. This would be an increase of 1.9 percent over May and a further indication that, while market capacity is declining, the conditions that are causing the underperformance gap are moderating. The levels of negative and insufficient equity are declining as reported here and here.

Encouraged by rising prices, more existing-home owners are able to bring their homes to market with sufficient equity to pay the sale transaction costs and fund a down payment on another home. Unlocking the pent-up supply typically generates two transactions in the market, helping to further boost actual existing-home sales.

First-time homebuyers are also returning to the market in larger numbers, possibly jumping in because they expect mortgage rates to rise in the near future or because rising rents are increasing the relative affordability of homeownership.

In a world where “normal” is hard to define, the housing market for existing homes continues to improve and, most importantly, actual levels of sales activity are getting closer to the capacity level supported by current market fundamentals.

Next EHS-C release: August 19, 2015 for July EHS-C

*Previous EHS-C releases referred to November 2011 as the low point of sales. The model used to generate existing-home sales capacity has been enhanced to more accurately reflect the dynamic relationships between sales, prices, interest rates, and the user-cost of housing, resulting in a model that more accurately reflects past conditions.

About Existing-Home Sales Capacity

First American’s proprietary Existing-Home Sales Capacity (EHS-C) model provides a gauge on whether existing-homes sales are under capacity or over capacity based on current market circumstances. The EHS-C rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and coops, are outperforming or underperforming based on current market fundamentals. The seasonally adjusted annualized EHS-C estimates the historical relationship between existing-home sales and the U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of existing-home sales above the level of the EHS-C indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of existing-home sales below the level of the EHS-C indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the capacity rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent EHS-C estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The EHS-C will be published prior to National Association of Realtors Existing-Home Sales report each month.