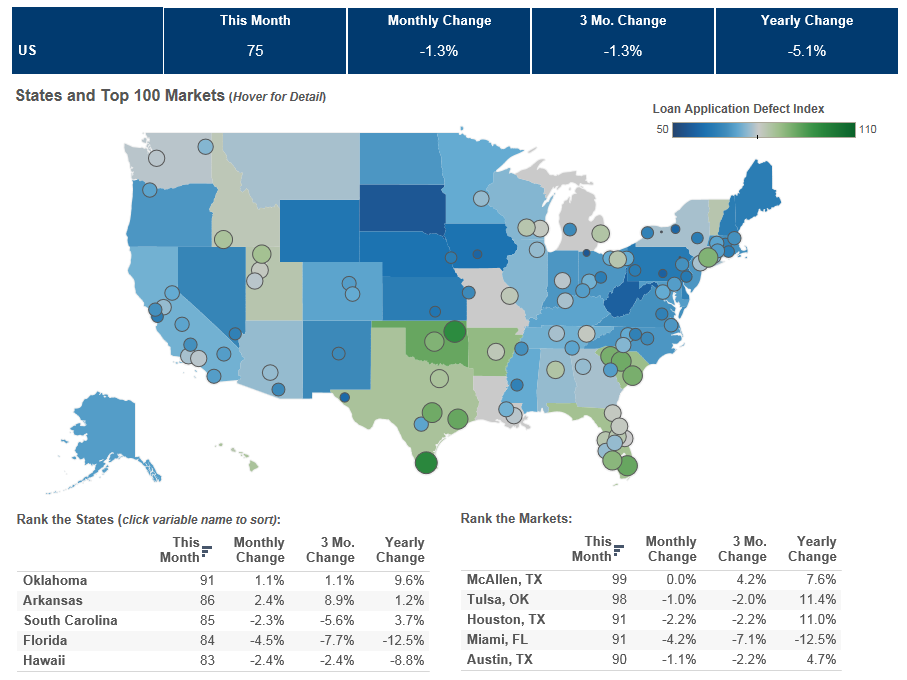

We’ve posted the April First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.3 percent in April as compared with March and decreased by 5.1 percent as compared with April 2015. The Defect Index is down 26.5 percent from the high point of risk in October 2013.

“The Detroit of old is fast disappearing and being replaced by a market with one of the fastest improving loan application, misrepresentation and fraud risk profiles in the country.”

This month, the analysis of the index examines defect risk in two markets that are generally perceived as very different, San Francisco and Detroit. San Francisco is a consistently lower risk metropolitan area, while Detroit has recently had higher levels of risk. However, in the most recent year, Detroit has significantly closed that gap. While San Francisco’s misrepresentation and fraud risk has declined 6.8 percent from a year ago, Detroit’s risk level has fallen an impressive 25.5 percent.

“Local economic conditions have an important influence on misrepresentation and fraud risk,” said Mark Fleming, chief economist at First American. “Economic conditions can change, and in the case of Detroit, for the better. The Detroit of old is fast disappearing and being replaced by a market with one of the fastest improving loan application, misrepresentation and fraud risk profiles in the country.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.