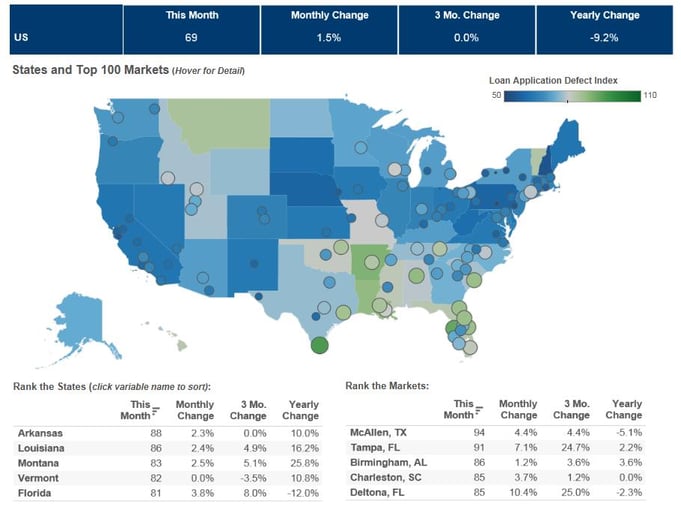

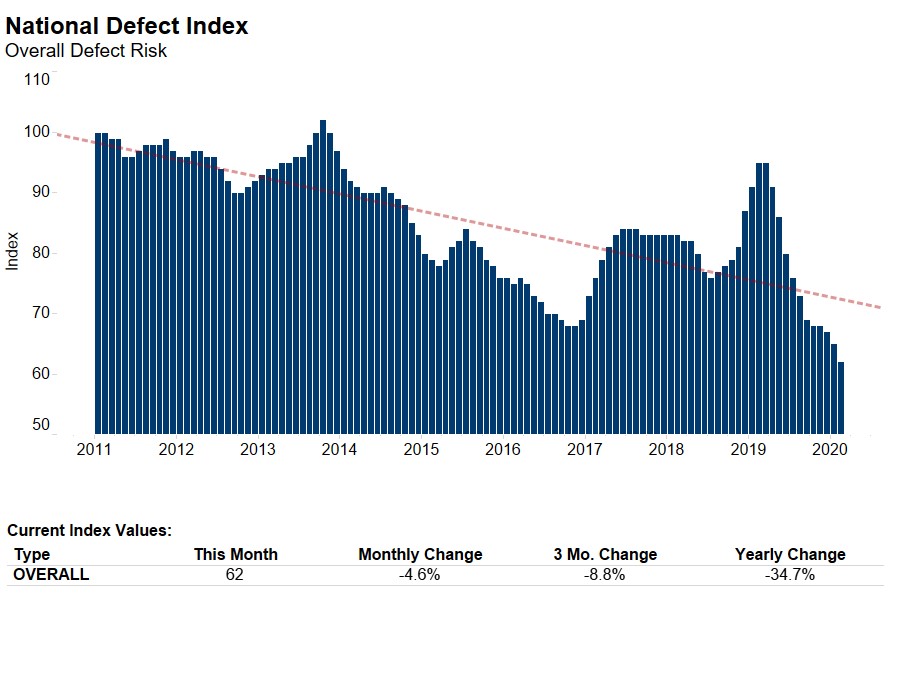

We’ve posted the December First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 1.5 percent in December 2016 as compared with November 2016 and decreased by 9.2 percent as compared to December 2015. The Defect Index is down 32.4 percent from the high point of risk in October 2013.

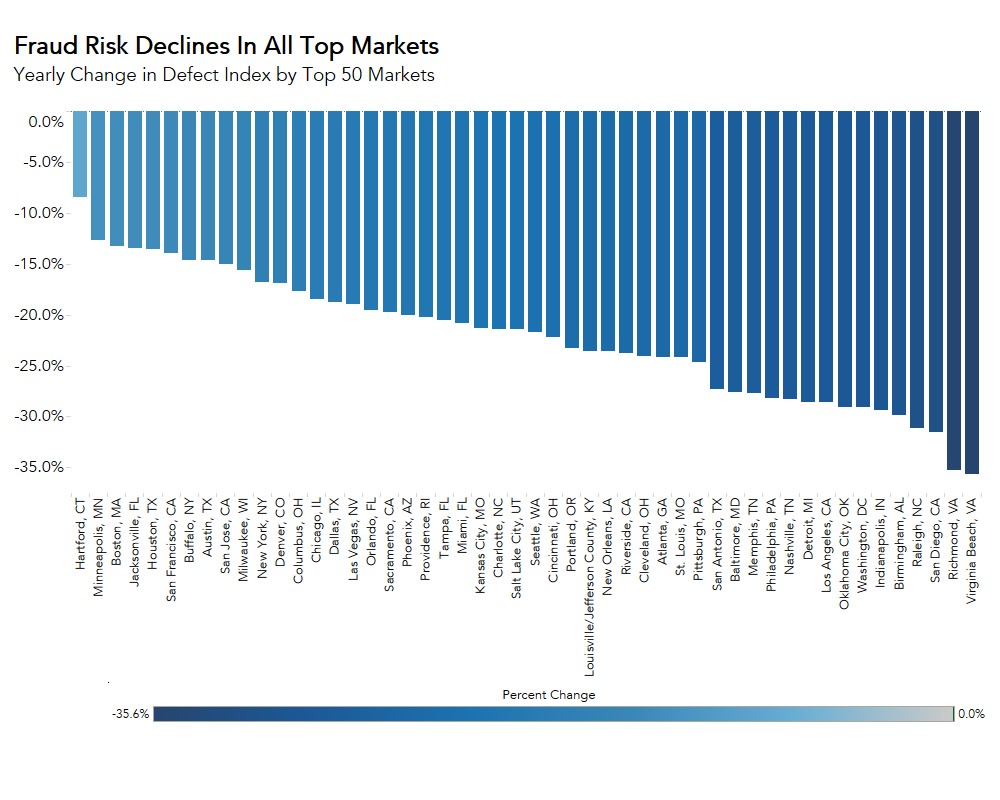

“Risk is always relative. Even the highest risk markets today are well below the risk levels of many markets in 2011.”

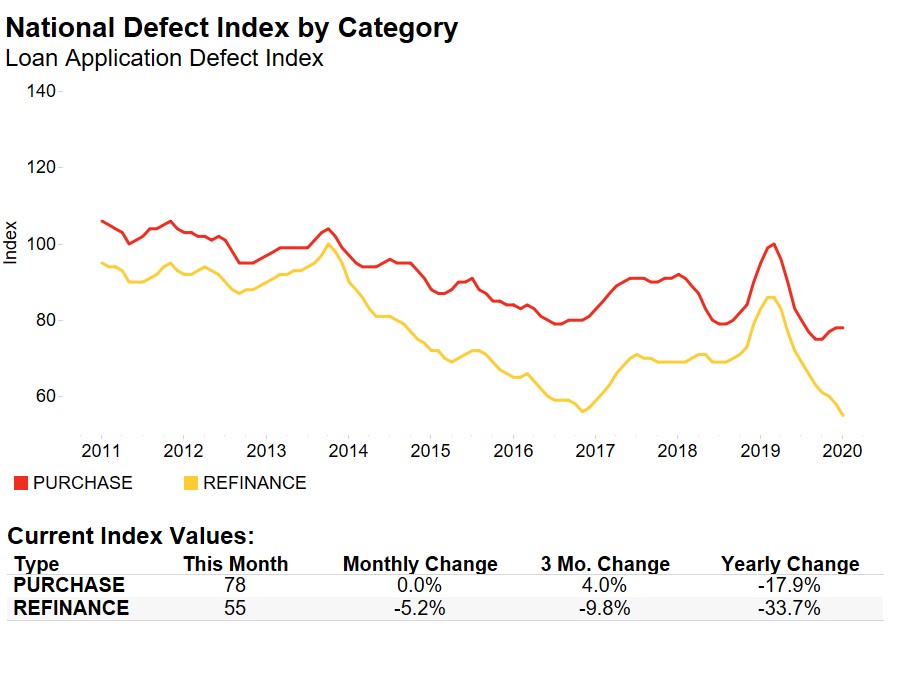

"This month, the Loan Application Defect Index moved modestly higher on increases in risk for purchase and refinance applications, in combination with the continuing shift toward a purchase-dominated market,” said Mark Fleming, chief economist at First American. “One month’s change doesn’t necessarily signal a trend, but it bears watching to see if defect risk rises again next month. However, the prospect of rising loan application defect risk may be countered in 2017 by the market’s continued adoption of validation tools early in the loan application process, which create more certainty in application data.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.