Last week, I posted an analysis of the GSE Conforming loan limit and my expectation for how it might change in 2016. I based the analysis on my interpretation of the Housing and Economic Recovery Act of 2008 (HERA). Specifically, Section 1124 of the law, which states, “If the change in the house price index during the most recent 12-month or 4 quarter period ending before the time of determining such annual adjustment is a decrease, then no adjustment shall be made for the next year, and the next adjustment shall take into account prior declines in the house price index, so that any adjustment shall reflect the net change in the house price index since the last adjustment.”

“The FHFA interpretation of HERA describes a specific starting point for the process of taking into account prior declines in the house price index and reflecting the net change.”

Since publishing my analysis, I have identified the specific interpretation used by the FHFA here. The FHFA interpretation of HERA describes a specific starting point for the process of taking into account prior declines in the house price index and reflecting the net change. Based on this interpretation of HERA and the “expanded-data” FHFA house price index, year-over-year appreciation of approximately 9.6 percent between the third quarter of 2014 to the third quarter of this year would be required to surpass the price level in the third quarter of 2007, which was used to set the current loan limit of $417,000. Given the amount of growth from the third quarter of 2014 to the second quarter of 2015, house prices would have had to increase an additional 4.9 percent between July and September this year. That is very unlikely. Therefore, based on the FHFA interpretation, I believe loan limits will remain the same in 2016. However, if prices continue to rise, as expected in 2016, the likelihood of the loan limit increasing in 2017 is quite high.

My graduate school advisor warned of the perils of forecasting. Never forecast an amount and a time, she would say. I am revising my initial forecast for the conforming loan limit, based on more specific information from the FHFA on their interpretation of HERA. No change for 2016, but a change is likely for 2017. By how much, I cannot yet say.

The original post is provided below.

Since the financial crisis began, any conversation about housing policy has inevitably included a discussion of GSE reform. The Protecting American Taxpayers and Homeowners (PATH) Act, Johnson/Crapo reform bill and Administrative reform have all been discussed. Yet, one of the least discussed and most important features of the GSE relationship to the housing market is the conforming loan limit that restricts GSE lending based on the loan amount. The Federal Housing Finance Agency (FHFA) sets the loan limit for the upcoming year in late November. This year, the announcement is likely to be more important than in most recent years because it will likely be the first time in almost a decade that the conforming loan limit will be increased.

The Housing and Economic Recovery Act of 2008 (HERA) established the current formula for the calculation of loan limits to be administered by the FHFA. Under the HERA formula loan limits can only adjust upward with house price appreciation based on an index chosen by the FHFA. In other words, the GSE conforming loan limit can rise with house price inflation, but cannot fall in the event of any house price depreciation. This means that GSE market coverage effectively expands in times of stress (when prices are falling), and is inflation-adjusted in times of rising house prices.

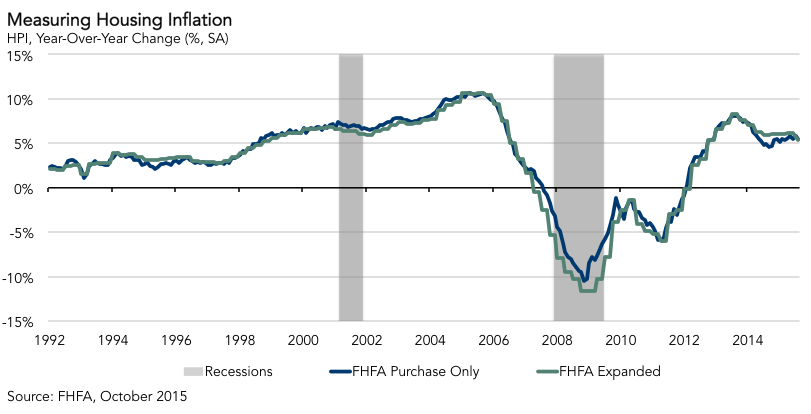

Since 2008, FHFA has been using their standard FHFA purchase-only house price index that uses only GSE data. Keep in mind that the GSEs are only allowed to securitize loans at or below the conforming limit, so the data from the GSE’s doesn’t reflect all of the transactions in the market. Economists call this a sample selection bias. Earlier this year, the FHFA proposed changing the index they use to calculate the conforming loan limit to a broader “expanded-data” index that includes public record sale transactions, as well as GSE data in an effort to address sample selection bias. The industry overwhelming supported the proposed index switch. A better assessment of price changes can only unambiguously improve the important task of inflation-adjusting the GSEs’ allowable market coverage.

The conforming loan limit has been $417,000 since 2006 and, as prices fell dramatically in many markets throughout the country, has remained at this limit ever since. In the figure, one can see that the distinction of index is realistically much less important than the simple fact that house price inflation has been consistent since 2012. In fact, prices have recovered so much that, based on either of these indices, all that was lost has finally been regained this year. In other words, it is time to inflation-adjust the conforming loan limit upward.

Using the proposed “expanded-data” FHFA house price index, year-over-year appreciation from the third quarter of 2014 to the third quarter of this year of approximately 2 percent would have been sufficient to surpass the price level used to set the current loan limit of $417,000. We estimate that the index will likely report a 5.5 percent increase year-over-year in the third quarter. Based on the HERA mandated formula, the conforming loan limit will increase almost 3 percent to a new overall limit of $429,000.

While the debate continues about reducing the role and market share of the GSEs in the housing market, my expectation is that we will increase the market share of the GSE with an inflation-adjustment to the loan limit of almost 3 percent next year. Without the inflation-adjustment, over time the market share would decline without any further legislative action required. Has the housing market recovered? Having to adjust the FHFA loan limit for inflation is one very strong sign that it has.